Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carol is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new pies

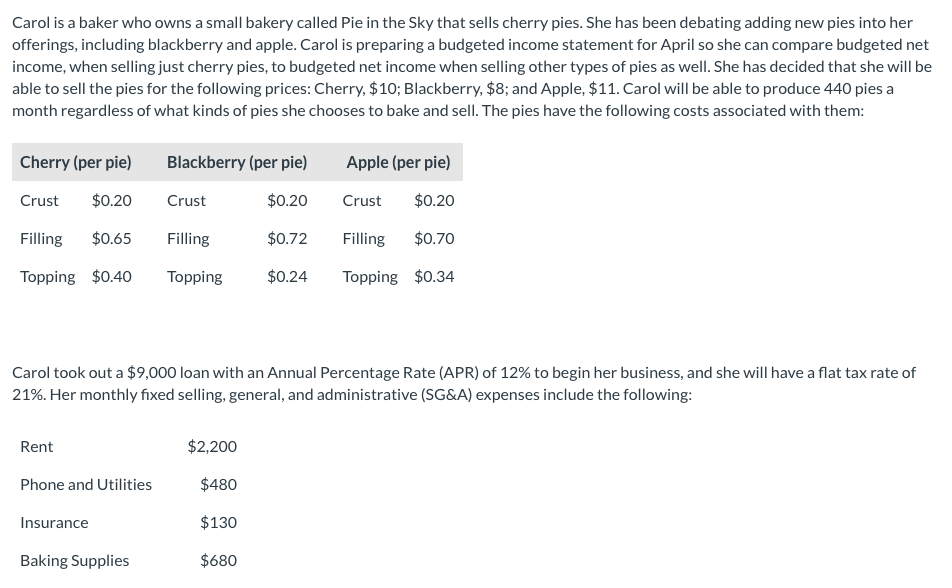

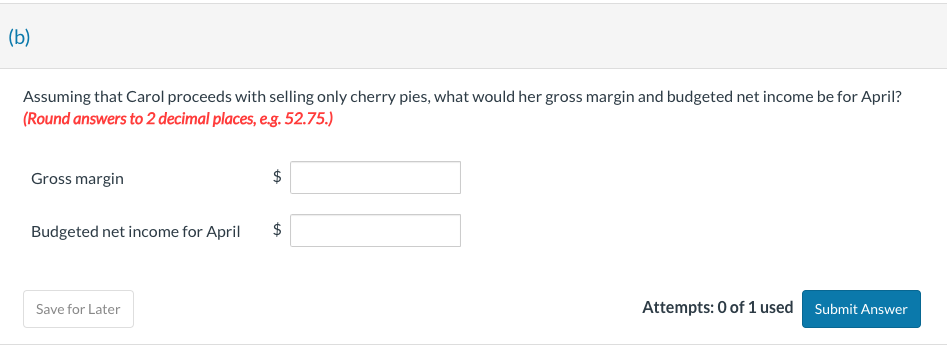

Carol is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new pies into her offerings, including blackberry and apple. Carol is preparing a budgeted income statement for April so she can compare budgeted net income, when selling just cherry pies, to budgeted net income when selling other types of pies as well. She has decided that she will be able to sell the pies for the following prices: Cherry, $10; Blackberry, $8; and Apple, $11. Carol will be able to produce 440 pies a month regardless of what kinds of pies she chooses to bake and sell. The pies have the following costs associated with them: Carol took out a $9,000 loan with an Annual Percentage Rate (APR) of 12% to begin her business, and she will have a flat tax rate of 21\%. Her monthly fixed selling, general, and administrative (SG\&A) expenses include the following: Assuming that Carol proceeds with selling only cherry pies, what would her gross margin and budgeted net income be for April? (Round answers to 2 decimal places, e.g. 52.75.) Gross margin $ Budgeted net income for April $ Attempts: 0 of 1 used

Carol is a baker who owns a small bakery called Pie in the Sky that sells cherry pies. She has been debating adding new pies into her offerings, including blackberry and apple. Carol is preparing a budgeted income statement for April so she can compare budgeted net income, when selling just cherry pies, to budgeted net income when selling other types of pies as well. She has decided that she will be able to sell the pies for the following prices: Cherry, $10; Blackberry, $8; and Apple, $11. Carol will be able to produce 440 pies a month regardless of what kinds of pies she chooses to bake and sell. The pies have the following costs associated with them: Carol took out a $9,000 loan with an Annual Percentage Rate (APR) of 12% to begin her business, and she will have a flat tax rate of 21\%. Her monthly fixed selling, general, and administrative (SG\&A) expenses include the following: Assuming that Carol proceeds with selling only cherry pies, what would her gross margin and budgeted net income be for April? (Round answers to 2 decimal places, e.g. 52.75.) Gross margin $ Budgeted net income for April $ Attempts: 0 of 1 used Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started