Answered step by step

Verified Expert Solution

Question

1 Approved Answer

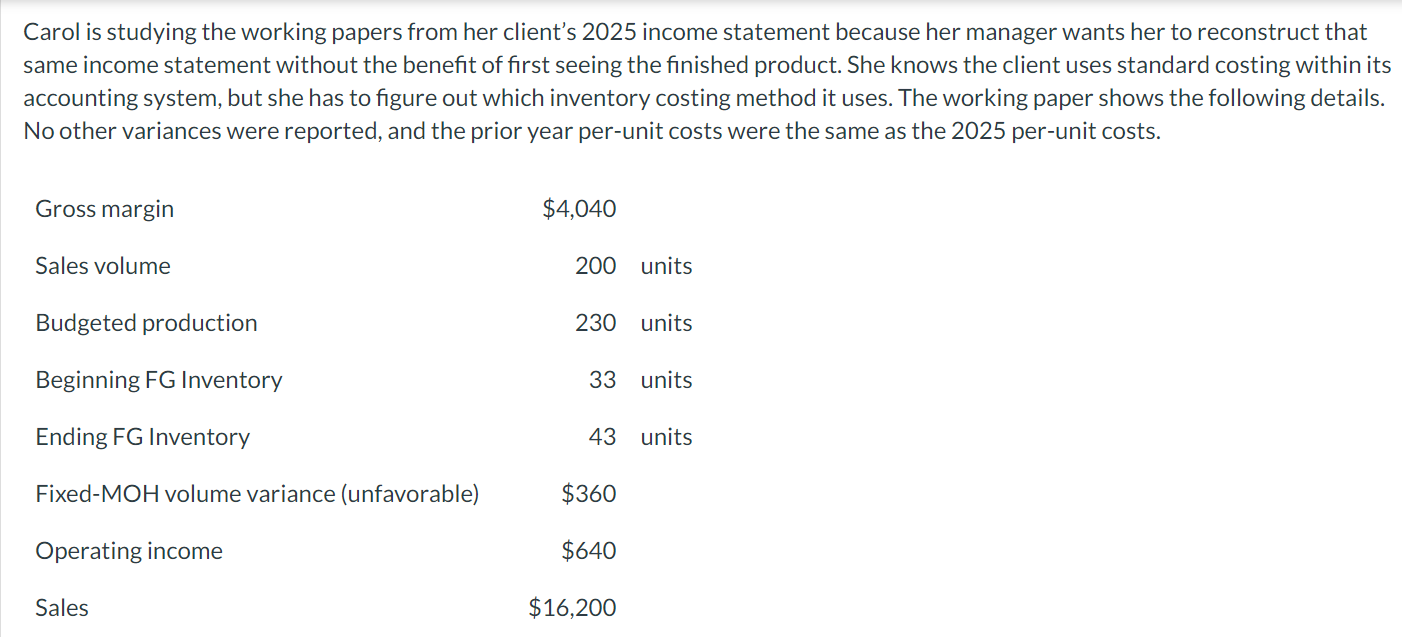

Carol is studying the working papers from her client's 2025 income statement because her manager wants her to reconstruct that same income statement without

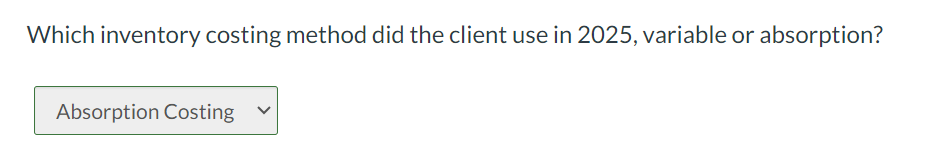

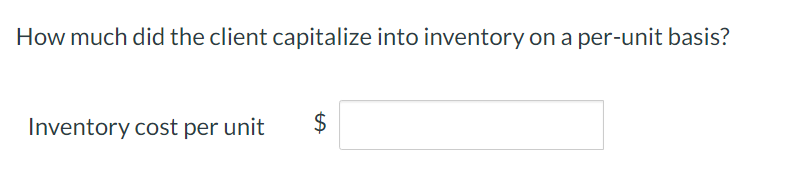

Carol is studying the working papers from her client's 2025 income statement because her manager wants her to reconstruct that same income statement without the benefit of first seeing the finished product. She knows the client uses standard costing within its accounting system, but she has to figure out which inventory costing method it uses. The working paper shows the following details. No other variances were reported, and the prior year per-unit costs were the same as the 2025 per-unit costs. Gross margin Sales volume Budgeted production Beginning FG Inventory Ending FG Inventory Fixed-MOH volume variance (unfavorable) Operating income Sales $4,040 200 units 230 units 33 units 43 units $360 $640 $16,200 Which inventory costing method did the client use in 2025, variable or absorption? Absorption Costing How much did the client capitalize into inventory on a per-unit basis? Inventory cost per unit $ tA

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Identifying the Inventory Costing Method Based on the information provided we can identify the clien...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started