Answered step by step

Verified Expert Solution

Question

1 Approved Answer

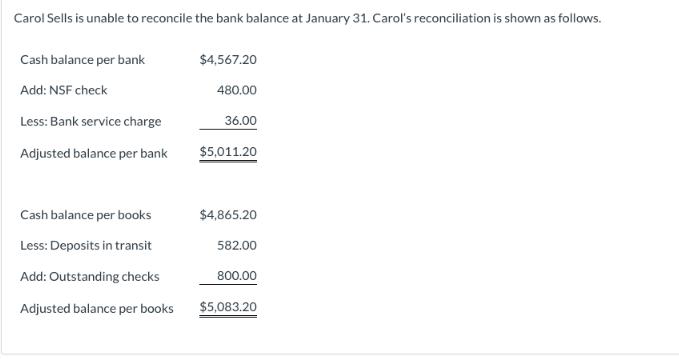

Carol Sells is unable to reconcile the bank balance at January 31. Carol's reconciliation is shown as follows. Cash balance per bank Add: NSF

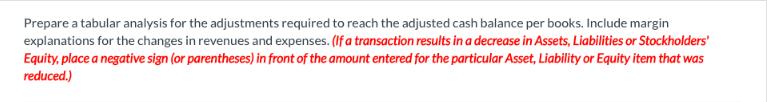

Carol Sells is unable to reconcile the bank balance at January 31. Carol's reconciliation is shown as follows. Cash balance per bank Add: NSF check Less: Bank service charge Adjusted balance per bank Cash balance per books Less: Deposits in transit Add: Outstanding checks Adjusted balance per books $4,567.20 480.00 36.00 $5,011.20 $4,865.20 582.00 800.00 $5,083.20 Prepare a tabular analysis for the adjustments required to reach the adjusted cash balance per books. Include margin explanations for the changes in revenues and expenses. (If a transaction results in a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Carol Sells Bank Reconciliation Jan31 Bank sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started