Answered step by step

Verified Expert Solution

Question

1 Approved Answer

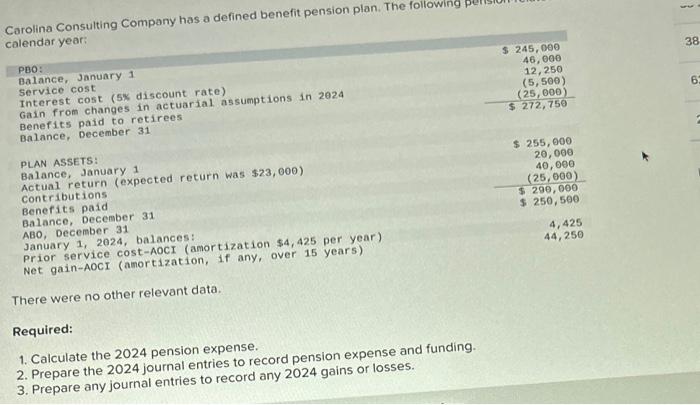

Carolina Consulting Company has a defined benefit pension plan. The following calendar year: PBO: Balance, January 1 Service cost Interest cost (5% discount rate) Gain

Carolina Consulting Company has a defined benefit pension plan. The following calendar year: PBO: Balance, January 1 Service cost Interest cost (5% discount rate) Gain from changes in actuarial assumptions in 2024 Benefits paid to retirees Balance, December 31 PLAN ASSETS: Balance, January 1 Actual return (expected return was $23,000) Contributions Benefits paid Balance, December 31 ABO, December 31 January 1, 2024, balances: Prior service cost-AOCI (amortization $4,425 per year) Net gain-AOCI (amortization, if any, over 15 years) There were no other relevant data. Required: 1. Calculate the 2024 pension expense. 2. Prepare the 2024 journal entries to record pension expense and funding. 3. Prepare any journal entries to record any 2024 gains or losses. $ 245,000 46,000 12,250 (5,500) (25,000) $ 272, 750 $ 255,000 20,000 40,000 (25,000) $ 290,000 $ 250,500 4,425 44,250 38 62 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started