Question

Caroline is starting an art gallery business in part of a converted mill building. She sold her house, making 40,000 profit on the transaction, and

Caroline is starting an art gallery business in part of a converted mill building. She sold her house, making 40,000 profit on the transaction, and she is planning to put the money she has made into the new venture. 30,000 was used as a deposit on the purchase of her space in the mill, and she obtained a commercial mortgage of 118,000 for the remainder of the purchase price. The interest rate on the mortgage is 5.7 per cent and Caroline has negotiated a deal with the lender whereby she does not have to start paying off the capital sum until the third year of her business operation. The monthly interest only payments are 561.

Caroline will stage one exhibition each month, and her plans for the first three months of her business are as follows:

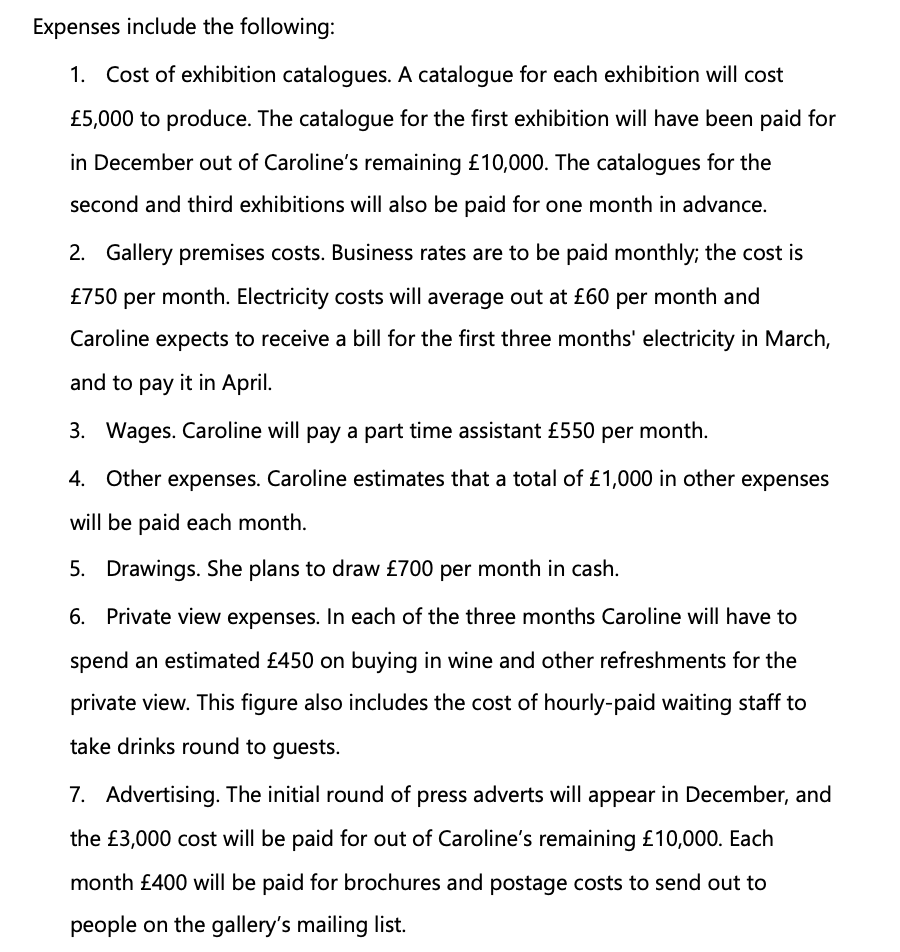

January exhibition of prints by major European artists of the 20th century. Caroline expects to sell about 50 per cent of the exhibits, which would produce total sales of 52,000, the cash received immediately. 36,000 of this would be payable to the owner of the prints in February.

February exhibition of the work of five sculptors. Working, again, on the expectation that 50 per cent of the work will sell, total sales are likely to be 48,000. Caroline will retain one third of this sum; the balance will be paid to the artists in March.

March exhibition by renowned artist, Pasha Quigley. Pasha rarely exhibits his work and it is a major coup for Caroline to have his paintings on show. Caroline expects to sell 85,000 of work, of which she will retain commission of 20,000. The 85,000 will be received from purchasers within the month of March, and Pasha will be paid in April.

The bank balance at 1 January 20X4 will be 2,000 after advertising and catalogue costs have been paid for. The advertising and catalogue costs form part of Carolines start-up capital.

The gallery premises are to be depreciated over 25 years on the straight-line basis, with an assumption of nil residual value.

Prepare for Caroline:

- a budget cash flow statement for the three months of January, February and March 20X4

- a budget statement of profit or loss for the three months ending 31 March 20X4

- a budget statement of financial position at 31 March 20X4 and:

- briefly discuss whether or not you think Carolines business is going to be successful, identifying any areas where cash flow might be a problem.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started