Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Caroline Mathis, CPA is a sole practitioner, with two professional employees (a CPA with three years of experience and a new college graduate with

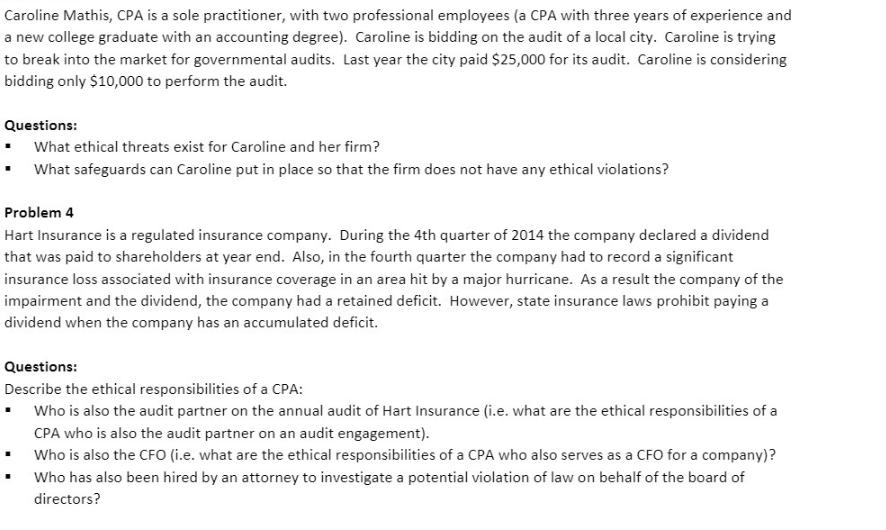

Caroline Mathis, CPA is a sole practitioner, with two professional employees (a CPA with three years of experience and a new college graduate with an accounting degree). Caroline is bidding on the audit of a local city. Caroline is trying to break into the market for governmental audits. Last year the city paid $25,000 for its audit. Caroline is considering bidding only $10,000 to perform the audit. Questions: What ethical threats exist for Caroline and her firm? What safeguards can Caroline put in place so that the firm does not have any ethical violations? Problem 4 Hart Insurance is a regulated insurance company. During the 4th quarter of 2014 the company declared a dividend that was paid to shareholders at year end. Also, in the fourth quarter the company had to record a significant insurance loss associated with insurance coverage in an area hit by a major hurricane. As a result the company of the impairment and the dividend, the company had a retained deficit. However, state insurance laws prohibit paying a dividend when the company has an accumulated deficit. Questions: Describe the ethical responsibilities of a CPA: Who is also the audit partner on the annual audit of Hart Insurance (i.e. what are the ethical responsibilities of a CPA who is also the audit partner on an audit engagement). Who is also the CFO (i.e. what are the ethical responsibilities of a CPA who also serves as a CFO for a company)? Who has also been hired by an attorney to investigate a potential violation of law on behalf of the board of directors?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

3 Ethical threats for Caroline and her firm 1 Selfinterest threat Caroline may have a financial interest in obtaining the audit engagement at any cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started