Question

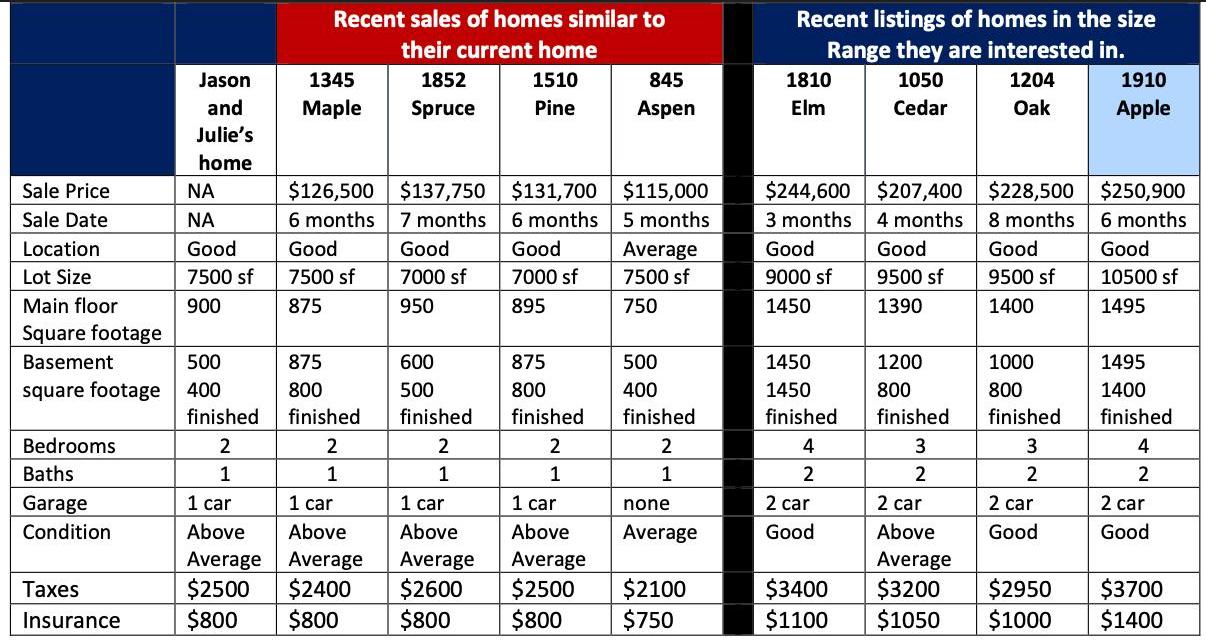

Jason and Julie live in a small bungalow style home that has 900 square feet with a one car garage and a 500 square foot

Jason and Julie live in a small bungalow style home that has 900 square feet with a one car garage and a 500 square foot basement. Their current home has two bedrooms living room, kitchen and bath on the main floor with a bath and laundry in the basement. They purchased their home 6 years ago for $80,000 and took out a 25-year 80% loan to value mortgage at 5.5%. Julie just informed Jason that she is expecting their second child in seven months. With the new addition Jason and Julie would like to find a bigger home. They would like a three-to-four-bedroom home with two baths on the main floor, a finished basement with a bath, laundry, extra bedroom and a two-car garage. The homes they have found that meet their room requirements and have 1100 to 1400 square feet on the main floor and finished basement. Over the past 6 years homes sales have increased on average 8% per year and interest rates have gone down from 5.5 % to 4%.

Questions

What is your estimated value of their current home today using the information in the grid above? Support your decision

Does the value you found in the sales grid match the estimated increase in home sales of 8% per year compounded annually? Explain why or why not.

How much did they put down on their current loan?

Assuming taxes of $2500 and insurance of $800 per year what would their current payment be?

What is the MOST they should list their home for? Is your recommendation at or above the estimated market value you determined in #2 above? Explain in some detail.

They have contacted a real estate broker to list their home for sale. The broker charges 6% of the selling price. What is the net amount they might have after paying the broker’s commission and payoff their existing loan? (Assuming the home sells for the asking price)

If the net amount they should receive represents the funds available for a down payment on a new home, what is the maximum they could put down on a new home?

If these funds represent a 20% down payment, what is the maximum home they can afford in total dollars?

Which of the homes listed in the sales grid would you recommend for Jason and Julie? Why, explain in a narrative statement of approximately 750 words.

Do they have funds available to buy any of the homes listed in the grid? Does your recommendation require them to put all of their funds down? Explain.

What would their payment be on the new home?

Sale Price Sale Date Location Lot Size Main floor Square footage Basement square footage Bedrooms Baths Garage Condition Taxes Insurance Jason and Julie's home Good 7500 sf 900 500 400 Recent sales of homes similar to their current home 1345 Maple $126,500 6 months Good 7500 sf 875 875 800 1852 Spruce finished 2 1 $137,750 7 months Good 7000 sf 950 600 500 1510 Pine finished 2 1 $131,700 6 months Good 7000 sf 895 finished 2 1 1 car 1 car 1 car 1 car Above Above Above Average Above Average Average Average $2500 $2400 $2600 $2500 $800 $800 $800 $800 875 800 finished 2 1 845 Aspen $115,000 5 months Average 7500 sf 750 500 400 finished 2 1 none Average $2100 $750 Recent listings of homes in the size Range they are interested in. 1050 Cedar 1810 Elm $244,600 3 months Good 9000 sf 1450 1450 1450 finished 4 2 2 car Good $207,400 4 months Good 9500 sf 1390 1200 800 finished 3 2 2 car Above Average $3400 $3200 $1100 $1050 1204 Oak $228,500 8 months Good 9500 sf 1400 1000 800 finished 3 2 2 car Good $2950 $1000 1910 Apple $250,900 6 months Good 10500 sf 1495 1495 1400 finished 4 2 2 car Good $3700 $1400

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 What is your estimated value of their current home today using the information in the grid above Support your decision Using the 8 annual increase the estimated value of their home today is Year 1 o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started