Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is

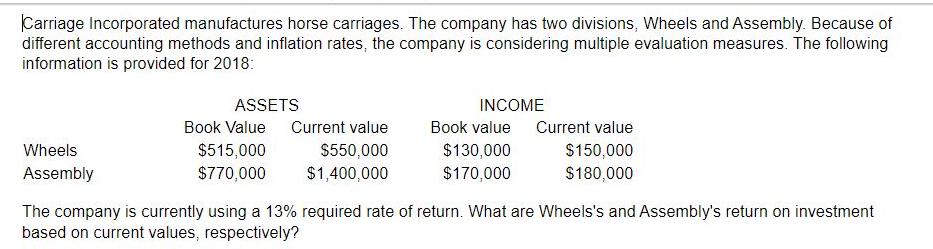

Carriage Incorporated manufactures horse carriages. The company has two divisions, Wheels and Assembly. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2018: Wheels Assembly ASSETS INCOME Book Value $515,000 $770,000 Current value $550,000 $1,400,000 Book value $130,000 $170,000 Current value $150,000 $180,000 The company is currently using a 13% required rate of return. What are Wheels's and Assembly's return on investment based on current values, respectively?

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the return on investment ROI based on current values for each division we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started