Answered step by step

Verified Expert Solution

Question

1 Approved Answer

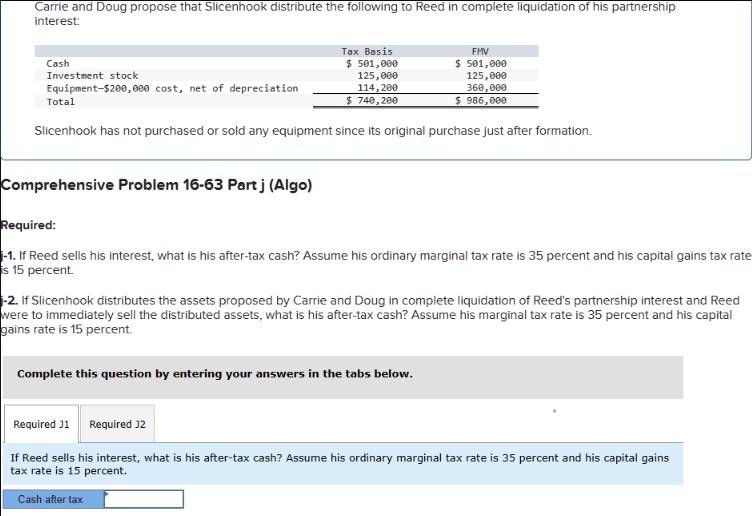

Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership interest: Cash Investment stock Tax Basis Equipment-$200,000

Carrie and Doug propose that Slicenhook distribute the following to Reed in complete liquidation of his partnership interest: Cash Investment stock Tax Basis Equipment-$200,000 cost, net of depreciation $ 501,000 125,000 114,200 FMV $ 501,000 125,000 360,000 $ 740,200 $ 986,000 Total Slicenhook has not purchased or sold any equipment since its original purchase just after formation. Comprehensive Problem 16-63 Part j (Algo) Required: -1. If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. -2. If Slicenhook distributes the assets proposed by Carrie and Doug in complete liquidation of Reed's partnership interest and Reed were to immediately sell the distributed assets, what is his after-tax cash? Assume his marginal tax rate is 35 percent and his capital gains rate is 15 percent. Complete this question by entering your answers in the tabs below. Required 31 Required J2 If Reed sells his interest, what is his after-tax cash? Assume his ordinary marginal tax rate is 35 percent and his capital gains tax rate is 15 percent. Cash after tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Reeds aftertax cash if he sells his interest we need to determine the tax implic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started