Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carrington Company ( CC ) started its fourth year of operations with account balances shown in the accounting equation presented in Carrington Company ( CC

Carrington Company CC started its fourth year of operations with account balances shown in the accounting equation presented in Carrington Company CC started its fourth year of operations with account balances shown in the accounting equation presented in

Requirement a During Year the company experienced the following transactions.

CC acquired $ cash by issuing common stock.

CC received $ cash for providing services to customers.

CC paid $ cash for operating expenses.

CC paid an $ cash dividend to the owners.

CC paid $ cash to purchase land.

CC paid $ cash in a partial settlement of its note payable.

Required

a Record the events in an accounting equation. Record the amounts of revenue, expense, and dividends in the Retained Earnings

column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example.

b Identify each event as an asset source, use, or exchange transaction.

c Use the information in the accounting equation to prepare an income statement.

c Use the information in the accounting equation to prepare a statement of changes in stockholders' equity.

c Use the information in the accounting equation to prepare a balance sheet.

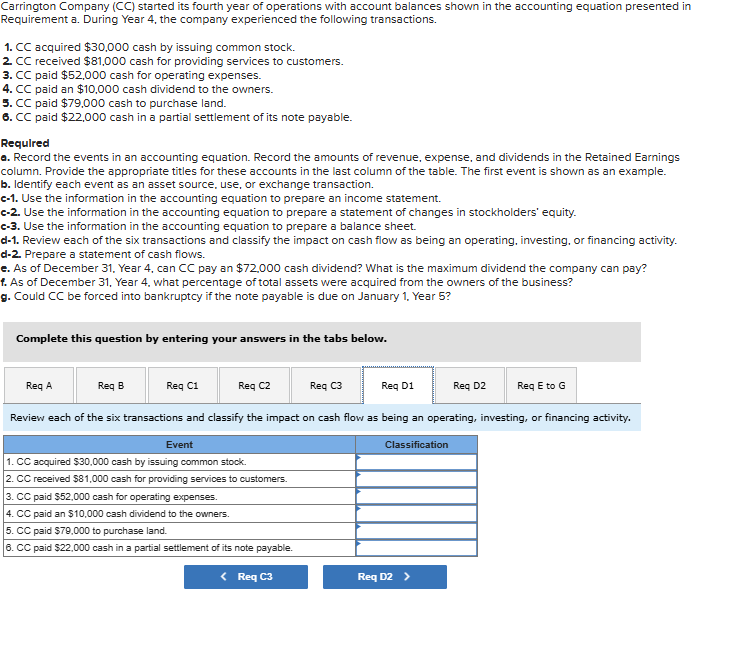

d Review each of the six transactions and classify the impact on cash flow as being an operating, investing. or financing activity.

d Prepare a statement of cash flows.

e As of December Year can CC pay an $ cash dividend? What is the maximum dividend the company can pay?

f As of December Year what percentage of total assets were acquired from the owhers of the business?

g Could CC be forced into bankruptcy if the note payable is due on January Year

Complete this question by entering your answers in the tabs below.

Requirement a During Year the company experienced the following transactions.

CC acquired $ cash by issuing common stock.

CC received $ cash for providing services to customers.

CC paid $ cash for operating expenses.

CC paid an $ cash dividend to the owners.

CC paid $ cash to purchase land.

CC paid $ cash in a partial settlement of its note payable.

Required

a Record the events in an accounting equation. Record the amounts of revenue, expense, and dividends in the Retained Earnings

column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example.

b Identify each event as an asset source, use, or exchange transaction.

c Use the information in the accounting equation to prepare an income statement.

c Use the information in the accounting equation to prepare a statement of changes in stockholders' equity.

c Use the information in the accounting equation to prepare a balance sheet.

d Review each of the six transactions and classify the impact on cash flow as being an operating. investing. or financing activity.

d Prepare a statement of cash flows.

e As of December Year can CC pay an $ cash dividend? What is the maximum dividend the company can pay?

f As of December Year what percentage of total assets were acquired from the owners of the business?

g Could CC be forced into bankruptcy if the note payable is due on January Year

Complete this question by entering your answers in the tabs below.

Req B

Req C

Req C

Req C

Req D

Req D

Req to

Review each of the six transactions and classify the impact on cash flow as being an operating, investing, or financing activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started