Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Carter Inc. has gathered the following budgeting information for next year and has asked you to prepare their master budget. a. b. C. d.

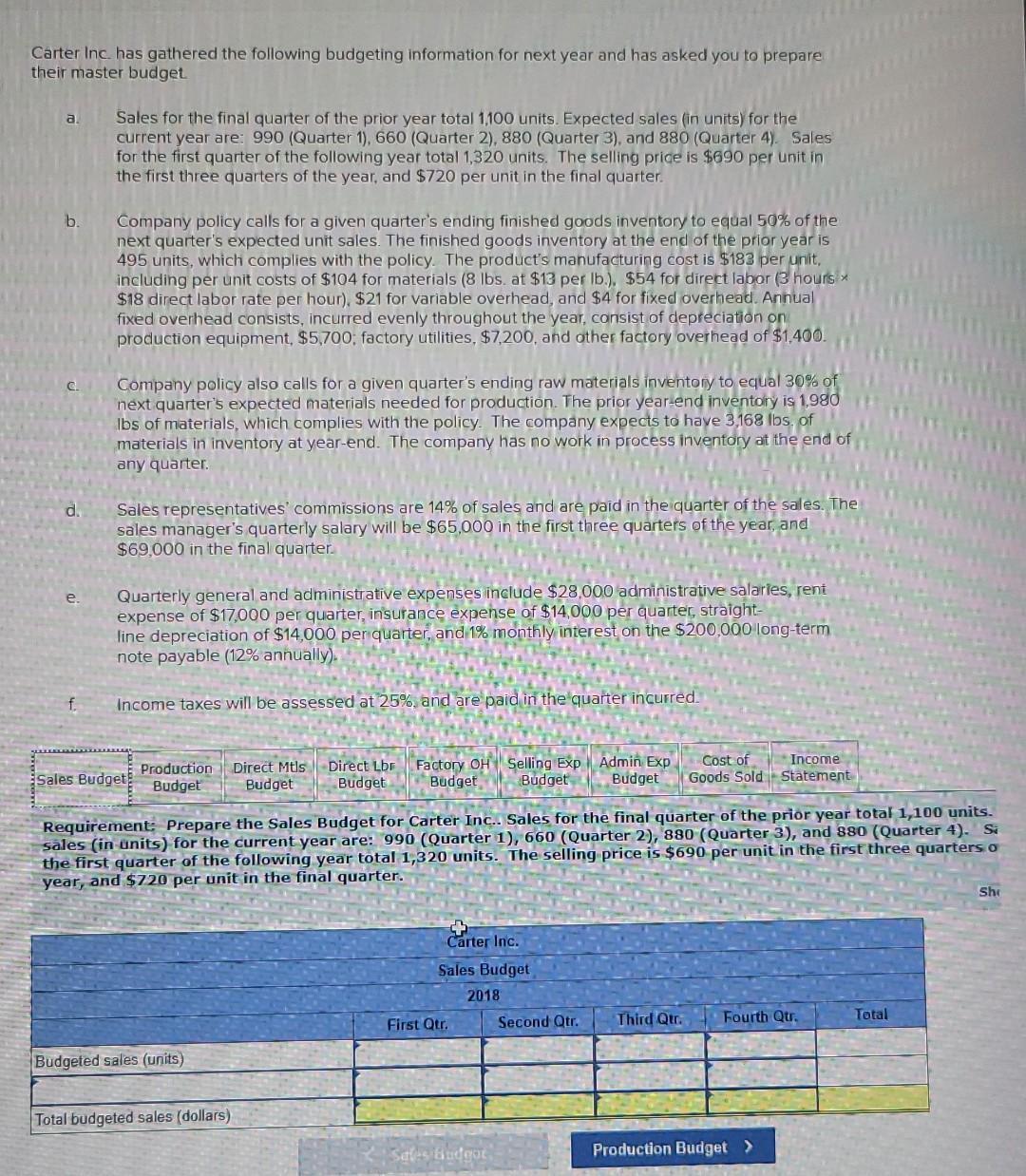

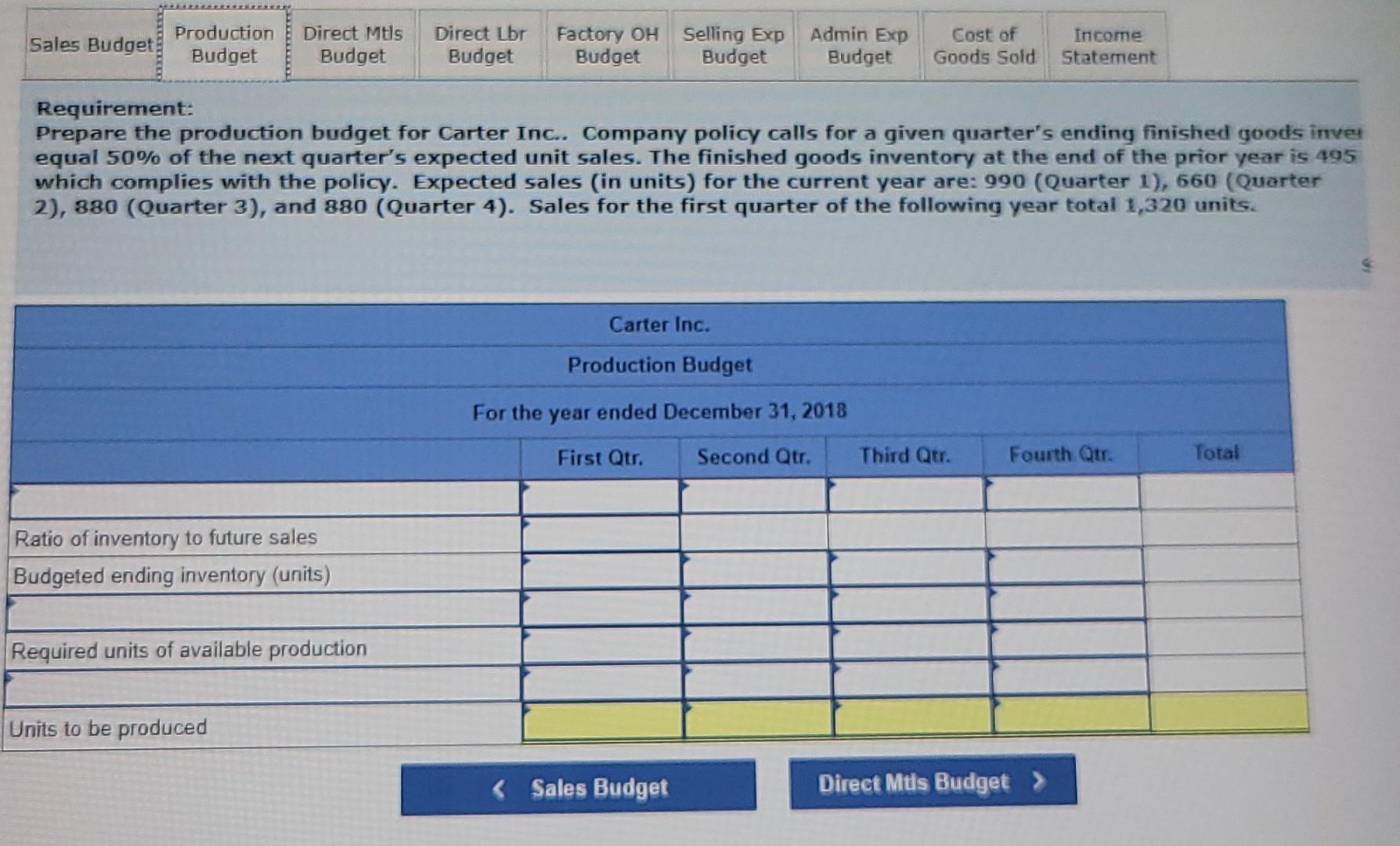

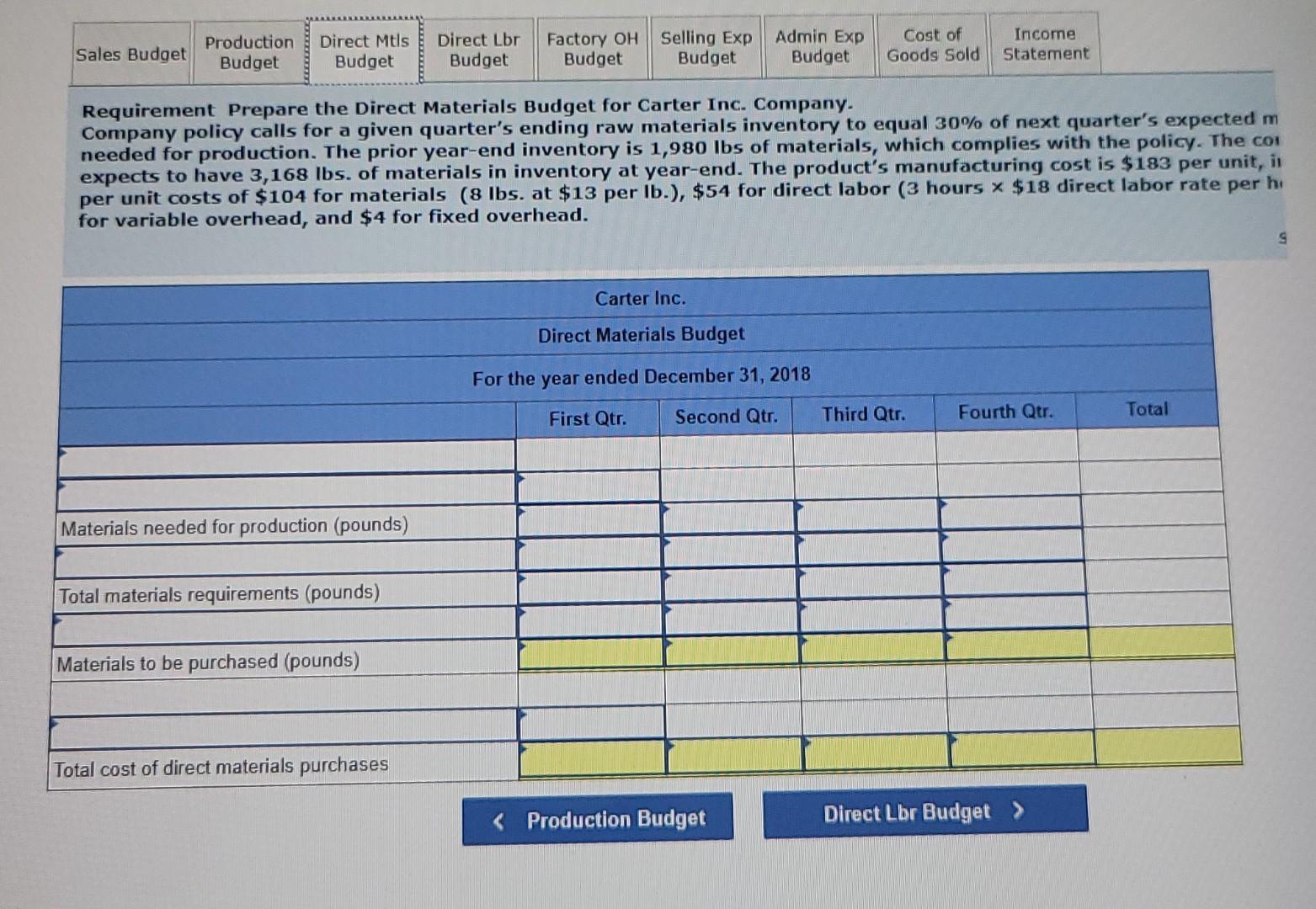

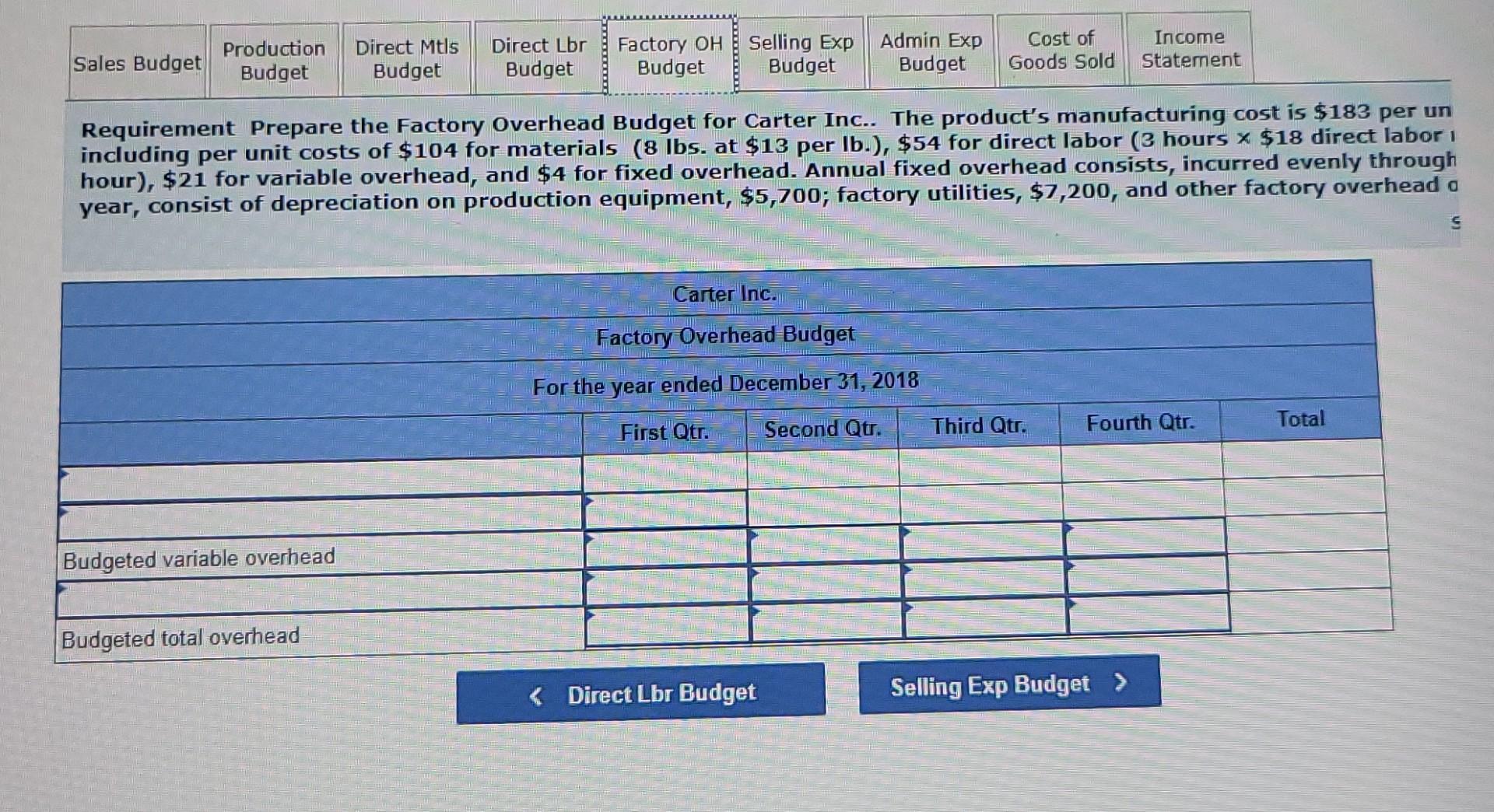

Carter Inc. has gathered the following budgeting information for next year and has asked you to prepare their master budget. a. b. C. d. e. f. Sales for the final quarter of the prior year total 1,100 units. Expected sales (in units) for the current year are: 990 (Quarter 1), 660 (Quarter 2), 880 (Quarter 3), and 880 (Quarter 4). Sales for the first quarter of the following year total 1,320 units. The selling price is $690 per unit in the first three quarters of the year, and $720 per unit in the final quarter. Company policy calls for a given quarter's ending finished goods inventory to equal 50% of the next quarter's expected unit sales. The finished goods inventory at the end of the prior year is 495 units, which complies with the policy. The product's manufacturing cost is $183 per unit, including per unit costs of $104 for materials (8 lbs. at $13 per lb.), $54 for direct labor (3 hours * $18 direct labor rate per hour), $21 for variable overhead, and $4 for fixed overhead. Annual fixed overhead consists, incurred evenly throughout the year, consist of depreciation on production equipment, $5,700; factory utilities, $7,200, and other factory overhead of $1,400. Company policy also calls for a given quarter's ending raw materials inventory to equal 30% of next quarter's expected materials needed for production. The prior year-end inventory is 1,980 lbs of materials, which complies with the policy. The company expects to have 3,168 lbs. of materials in inventory at year-end. The company has no work in process inventory at the end any quarter. Sales representatives' commissions are 14% of sales and are paid in the quarter of the sales. The sales manager's quarterly salary will be $65,000 in the first three quarters of the year, and $69,000 in the final quarter. Quarterly general and administrative expenses include $28,000 administrative salaries, rent expense of $17,000 per quarter, insurance expense of $14,000 per quarter, straight- line depreciation of $14,000 per quarter, and 1% monthly interest on the $200,000 long-term note payable (12% annually). Income taxes will be assessed at 25%, and are paid in the quarter incurred. Sales Budget Production Direct Mtls Direct Lbr Factory OH Selling Exp Admin Exp Budget Budget Budget Budget Budget Budget Requirement: Prepare the Sales Budget for Carter Inc.. Sales for the final quarter of the prior year total 1,100 units. sales (in units) for the current year are: 990 (Quarter 1), 660 (Quarter 2), 880 (Quarter 3), and 880 (Quarter 4). St the first quarter of the following year total 1,320 units. The selling price is $690 per unit in the first three quarters o year, and $720 per unit in the final quarter. Budgeted sales (units) Total budgeted sales (dollars) Carter Inc. Sales Budget 2018 First Qtr. Safes Budgot Second Qtr. Cost of Income Goods Sold Statement Third Qtr. Fourth Qtr. Production Budget > Total Sho Sales Budget Production Direct Mtls Budget Budget Ratio of inventory to future sales Budgeted ending inventory (units) Required units of available production Direct Lbr Budget Units to be produced Factory OH Budget Selling Exp Budget Requirement: Prepare the production budget for Carter Inc.. Company policy calls for a given quarter's ending finished goods inver equal 50% of the next quarter's expected unit sales. The finished goods inventory at the end of the prior year is 495 which complies with the policy. Expected sales (in units) for the current year are: 990 (Quarter 1), 660 (Quarter 2), 880 (Quarter 3), and 880 (Quarter 4). Sales for the first quarter of the following year total 1,320 units. Admin Exp Budget < Sales Budget Carter Inc. Production Budget For the year ended December 31, 2018 First Qtr. Second Qtr. Cost of Goods Sold Third Qtr. Income Statement Fourth Qtr. Direct Muis Budget > Total Sales Budget Production Budget Direct Mtls Budget Materials needed for production (pounds) Total materials requirements (pounds) Materials to be purchased (pounds) Direct Lbr Budget Total cost of direct materials purchases Factory OH Budget Selling Exp Budget Requirement Prepare the Direct Materials Budget for Carter Inc. Company. Company policy calls for a given quarter's ending raw materials inventory to equal 30% of next quarter's expected m needed for production. The prior year-end inventory is 1,980 lbs of materials, which complies with the policy. The co expects to have 3,168 lbs. of materials in inventory at year-end. The product's manufacturing cost is $183 per unit, in per unit costs of $104 for materials (8 lbs. at $13 per lb.), $54 for direct labor (3 hours x $18 direct labor rate per h for variable overhead, and $4 for fixed overhead. Admin Exp Budget Carter Inc. Direct Materials Budget For the year ended December 31, 2018 First Qtr. Second Qtr. Production Budget Cost of Goods Sold Income Statement Third Qtr. Fourth Qtr. Direct Lbr Budget > Total 9 Sales Budget Production Direct Mtls Budget Budget Total direct labor hours needed Direct Lbr Budget Total budgeted direct labor cost (dollars) Factory OH Budget Selling Exp Budget Requirement Prepare the Direct Labor Budget for Carter Inc.. The product's manufacturing cost is $183 per unit, in unit costs of $104 for materials (8 lbs. at $13 per lb.), $54 for direct labor (3 hours x $18 direct labor rate per hour) variable overhead, and $4 for fixed overhead. Admin Exp Budget Carter Inc. Direct Labor Budget For the year ended December 31, 2018 First Qtr. Second Qtr. Total Sales Budget Production Budget Budgeted variable overhead Direct Mtls Budget Budgeted total overhead Direct Lbr Budget Factory OH Budget Selling Exp Budget Admin Exp Budget Requirement Prepare the Factory Overhead Budget for Carter Inc.. The product's manufacturing cost is $183 per un including per unit costs of $104 for materials (8 lbs. at $13 per lb.), $54 for direct labor (3 hours x $18 direct labori hour), $21 for variable overhead, and $4 for fixed overhead. Annual fixed overhead consists, incurred evenly through year, consist of depreciation on production equipment, $5,700; factory utilities, $7,200, and other factory overhead a S Carter Inc. Factory Overhead Budget For the year ended December 31, 2018 First Qtr. Second Qtr. Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

B Sales 1 Unit price 2 Total Budgeted Sales 1 x 2 Next Qtr sales Ratio of inventory to future sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started