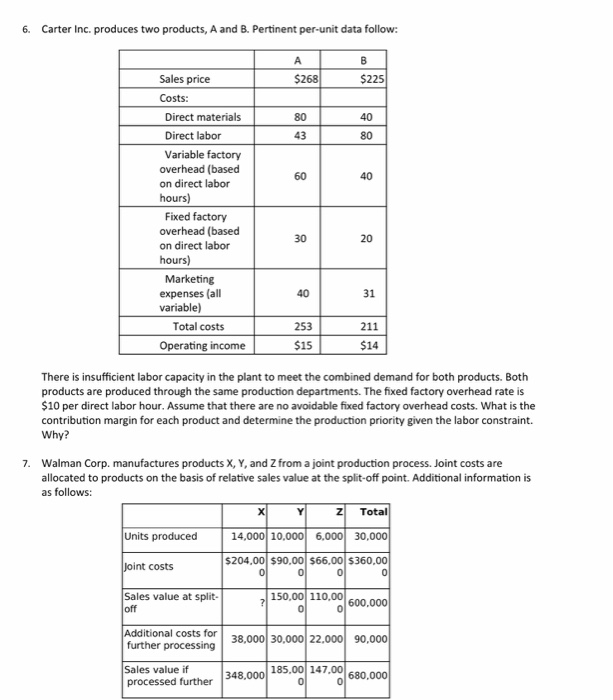

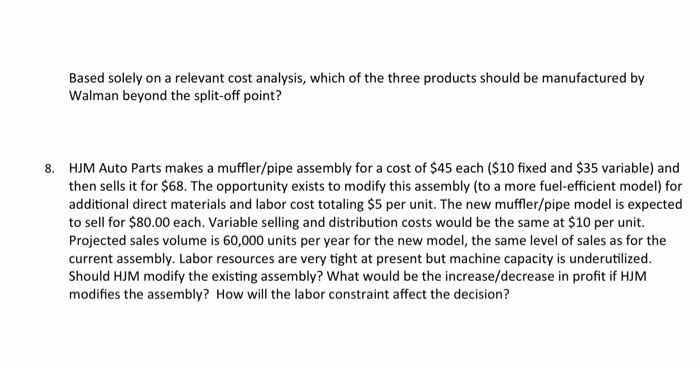

Carter Inc. produces two products, A and B. Pertinent per-unit data follow: 6. A Sales price $225 $268 Costs: Direct materials 80 40 Direct labor 43 80 Variable factory overhead (based on direct labor 60 hours) Fixed factory overhead (based on direct labor 30 20 hours) Marketing expenses (all variable) 40 31 Total costs 253 211 Operating income $15 $14 There is insufficient labor capacity in the plant to meet the combined demand for both products. Both products are produced through the same production departments. The fixed factory overhead rate is $10 per direct labor hour. Assume that there are no avoidable fixed factory overhead costs. What is the contribution margin for each product and determine the production priority given the labor constraint. Why? Walman Corp. manufactures products X, Y, and Z from a joint production process. Joint costs are 7. allocated to products on the basis of relative sales value at the split-off point. Additional information is as follows: Z Total Units produced 14,000| 10.000| 6,000| 30,000 $204,00 $90.00 $66.00 $360,00 Joint costs 0 0 0 Sales value at split- off 150,00 110,00 600.000 Additional costs for further processing 38,000| 30,000| 22.000| 90,000 Sales value if processed further 185,00 147.00 680,000 348,000 C 40 Based solely on a relevant cost analysis, which of the three products should be manufactured by Walman beyond the split-off point? HJM Auto Parts makes a muffler/pipe assembly for a cost of $45 each ($10 fixed and $35 variable) and then sells it for $68. The opportunity exists to modify this assembly (to a more fuel-efficient model) for additional direct materials and labor cost totaling $5 per unit. The new muffler/pipe model is expected to sell for $80.00 each. Variable selling and distribution costs would be the same at $10 per unit. Projected sales volume is 60,000 units per year for the new model, the same level of sales as for the current assembly. Labor resources are very tight at present but machine capacity is underutilized Should HJM modify the existing assembly? What would be the increase/decrease in profit if HJM modifies the assembly? How will the labor constraint affect the decision? 8