Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A local firm issues two bond as follows: Bond A $5,000,000 par value with an 8% coupon rate. The yield-to-maturity on bonds at the

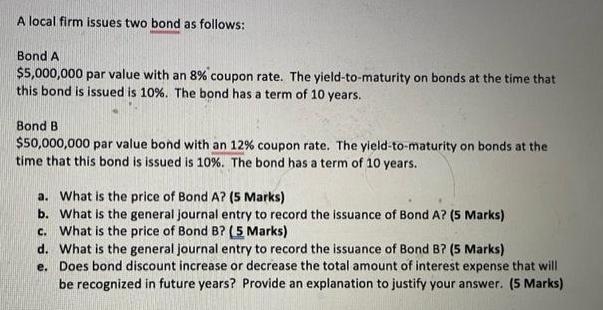

A local firm issues two bond as follows: Bond A $5,000,000 par value with an 8% coupon rate. The yield-to-maturity on bonds at the time that this bond is issued is 10%. The bond has a term of 10 years. Bond B $50,000,000 par value bond with an 12% coupon rate. The yield-to-maturity on bonds at the time that this bond is issued is 10%. The bond has a term of 10 years.. a. What is the price of Bond A? (5 Marks) b. What is the general journal entry to record the issuance of Bond A? (5 Marks) c. What is the price of Bond B? (5 Marks) d. What is the general journal entry to record the issuance of Bond B? (5 Marks) e. Does bond discount increase or decrease the total amount of interest expense that will be recognized in future years? Provide an explanation to justify your answer. (5 Marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of Bond A we need to use the present value formula Price of Bond A Coupon p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started