Answered step by step

Verified Expert Solution

Question

1 Approved Answer

carver incorporated purchased a building and the land on which the building is situated for a total cost of $978,900 cash. the land was appraised

carver incorporated purchased a building and the land on which the building is situated for a total cost of $978,900 cash. the land was appraised at $191,375 and the building at $934,360.

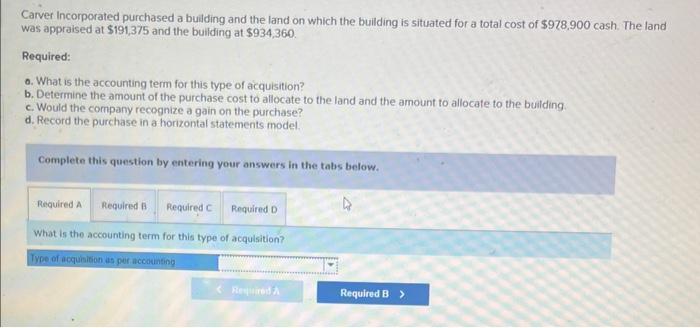

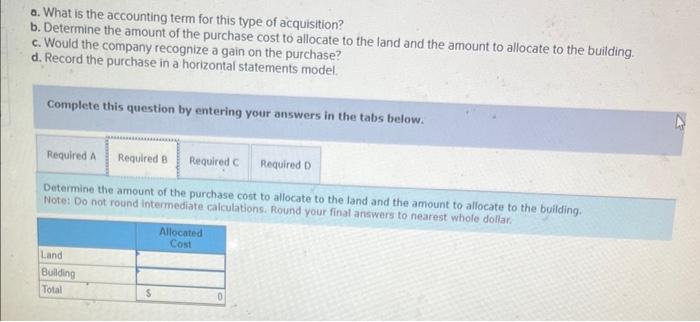

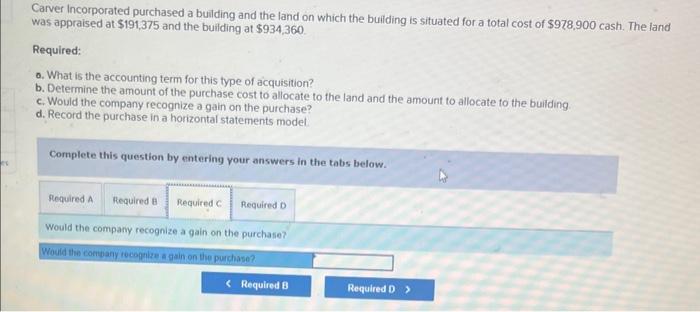

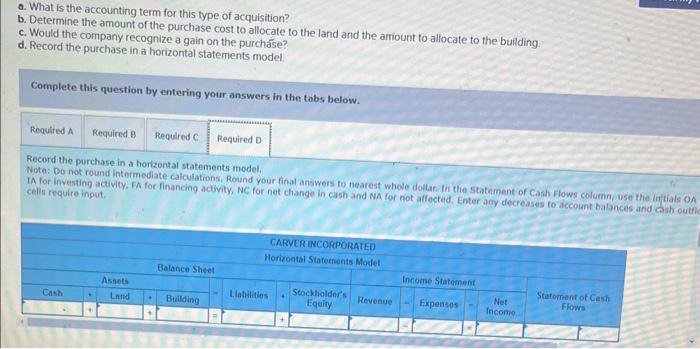

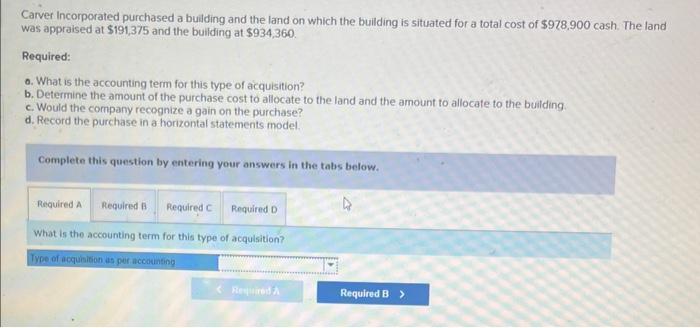

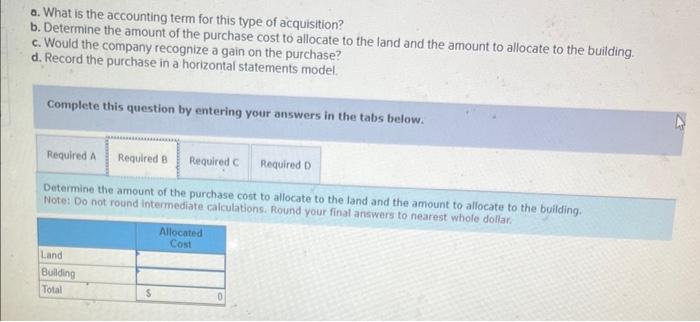

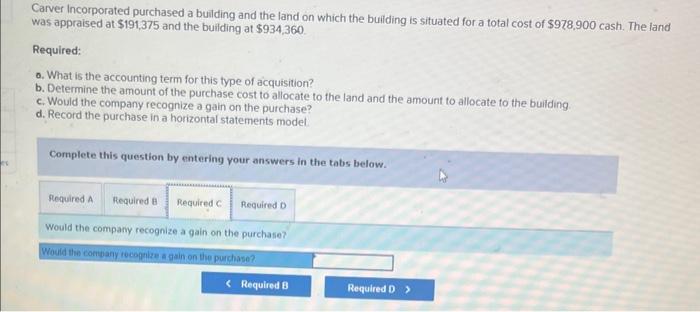

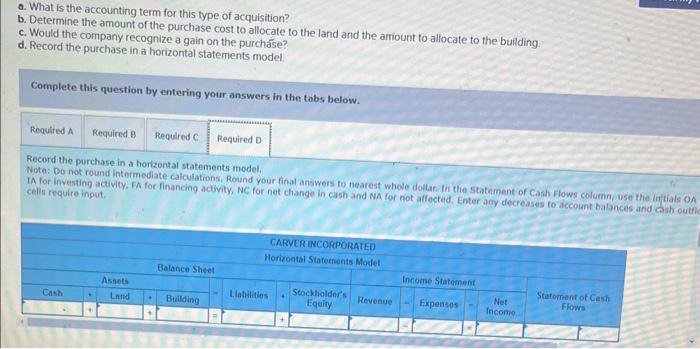

Carver Incorporated purchased a building and the land on which the building is situated for a total cost of $978,900cash. The land was appraised at $191,375 and the buliding at $934,360 Required: o. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model. Complete this question by entering your answers in the tabs below. What is the accounting term for this type of acquisition? o. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model. Complete this question by entering your answers in the tabs below. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. Note: Do not round intemediate calculations. Round your final answers to nearest whole dollar. Carver Incorporated purchased a building and the land on which the buifding is situated for a total cost of $978,900 cash. The land was appraised at $191,375 and the building at $934,360. Required: 0. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model Complete this question by entering your answers in the tabs below. Would the company recognize a gain on the purchase? o. What is the accounting term for this type of acquisition? b. Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. c. Would the company recognize a gain on the purchase? d. Record the purchase in a horizontal statements model Complete this question by entering your answers in the tabs below. Record the purchase in a horizontal statements model. Note: Bo not round intermediate calculations. Round your final answers to nearest whole dollar In the Statement of Cash Flows column, use the iritials on IA for Inverting activity, FA for finanding activity, NC for net change in cash and NA for not affected, Enter any decreases to account balances and cash outh

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started