Question

Casado and Associates Bookkeeping Services- Process one complete accounting cycle Mariana Casado has bookkeeping business that provides bookkeeping services for small and medium businesses in

Casado and Associates Bookkeeping Services- Process one complete accounting cycle

Mariana Casado has bookkeeping business that provides bookkeeping services for small and medium businesses in the south Puget Sound area. In addition to managing and working in her business, she also hires two employees: another accountant (YOU) and an office manager.

The business rents a big office in a strip mall in Lakewood. They hire out a cleaning service to keep the office clean, and they pay rent for their office space. They depreciate all office equipment and furniture. This business used the Allowance for Doubtful Accounts method to manage their receivables.

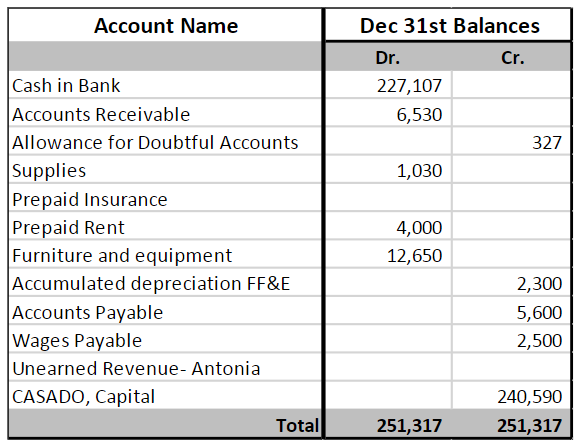

This business is a sole proprietorship. The post-closing trial balance for the bookkeeping business is as follows on December 31st, 2020:

As the accountant hired by Ms. Casado, you need keep the books for the bookkeeping business. You will do that by performing the following tasks:

- Journalize all January 2021 transactions

- Post the transactions to the general ledger accounts

- Prepare the Trial Balance for January 2021 on the worksheet

- Record the following end of the month adjustments:

| Adjusting Entries |

| Adjust the supplies account. An end of the period count (January 31st) shows the business has $3,650 of supplies on hand |

| Record the adjustment for insurance expense for the month of January |

| Record the rent expense for January in the amount of $4,000 |

| Record the furniture and depreciation expense for January in the amount of $250 |

| Write off A/R in the amount of $2,400 (allowance method) |

| Replenish The Allowance for doubtful accounts, so its balance is $3,000 |

| Accrued 3,600 in wages January |

- Journalize and post the closing entries

- Complete all columns of the worksheet provided for this project

- Prepare the Income Statement for the month of January

- Prepare the Statement of Owners equity for the month of January

- Prepare the Balance Sheet for the month of January

- Prepare a post-closing trial balance

January Transactions

| January day | Transaction |

| 4 | Purchased a 1-year insurance policy for $6,240 with check# 234 |

| 4 | Purchased supplies for $5,600. Issued check # 235 |

| 6 | Collected $3,800 on account from credit customers |

| 7 | Returned damaged supplies in the amount of $530 |

| 8 | Sold 6-months bookkeeping services for $32,600 to Antonia's Diner. Of this amount, the client paid $10,000 with check# 598, and CASADO issued credit for the remainder. Work has not yet been performed. |

| 9 | CASADO performed bookkeeping services to Antonia's Diner in the amount of $12,000 |

| 11 | Bought radio slots from KIRO to advertise services locally, on account, for 2,780 |

| 12 | Prepared a batch of 1099s for a construction client. The service cost $4,900, of which $2,000 was paid by the customer with a check (#1002), and the remainder was put on account |

| 12 | Collected $7,300 on account from credit customers |

| 14 | Issued check# 236 to pay for the office cleaning in the amount of $1,050 |

| 15 | Received a monthly telephone bill for $340 |

| 18 | Sold bookkeeping services for $3,050, of which $2,000 was immediately collected. |

| 19 | Purchased Supplies for $4,300 with check# 237 |

| 20 | Collected $3,000 on account from credit customers |

| 20 | Sold $13,560 in tax prep services that will be concluded in January. On account. |

| 21 | Purchased newspaper space for advertising on account for $2,500 |

| 22 | Collected $3,600 on account |

| 22 | Purchased supplies for $490. Received an invoice. |

| 25 | Issued check# 238 to pay for utilities in the amount of $890 |

| 26 | Sold tax preparation services for $2,600, of which everything has been collected. |

| 26 | Purchased one additional computer for $380 on account |

| 27 | Prepared a batch of 1099s for a bakery chain client. Services were provided for $6,400 on account |

| 27 | Issued check# 238 to pay for supplies in the amount of $ 350 |

| 28 | Collected $8,900 from clients on account |

| 28 | Issued check #238 to pay for maintenance services for January $680 |

| 29 | Issued checks #239 and #240 to cover payroll. These checks total $10,600 |

| 29 | Issued check# 241 for an owner's withdraw in the amount if $10,000 |

| 29 | Purchased a new set of office furniture for $1,350 on credit. |

| 29 | Expensed one month of insurance |

| 29 | Paid bills in the amount of $4,360 using check#242 |

| 29 | Sold services for $3,600, of which $1,500 was paid. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started