Cascade Mining Company expects its earnings and dividends to increase by 8 percent per year over the next 6 years and then to remain relatively constant thereafter. The firm currently (that is, as of year 0) pays a dividend of $4.5 per share. Determine the value of a share of Cascade stock to an investor with a 11 percent required rate of return. Use Table II to answer the question. Round your answer to the nearest cent.

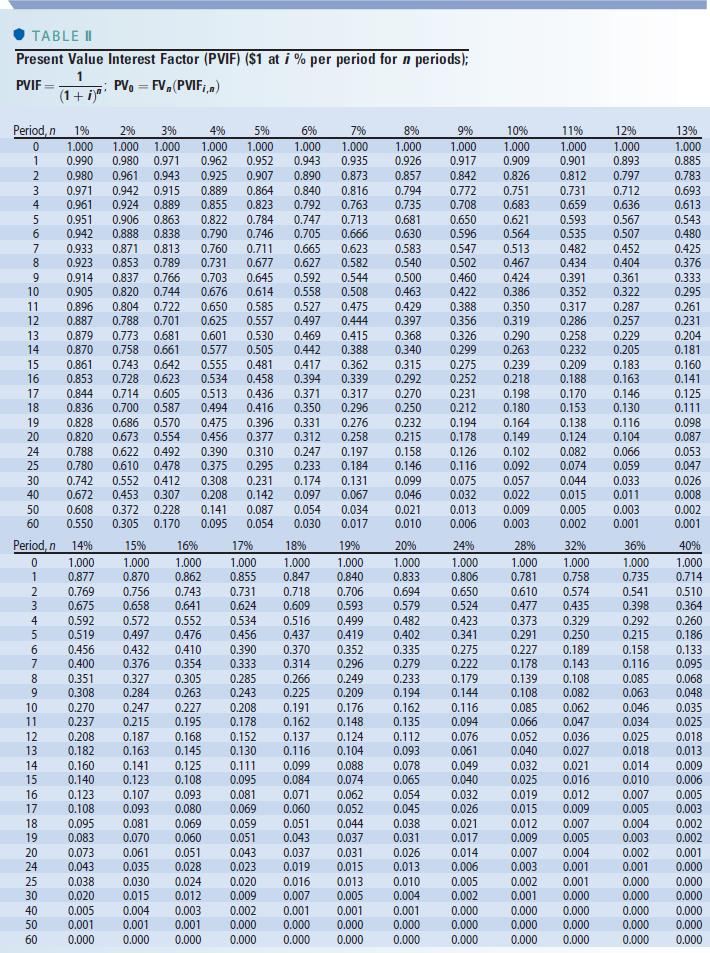

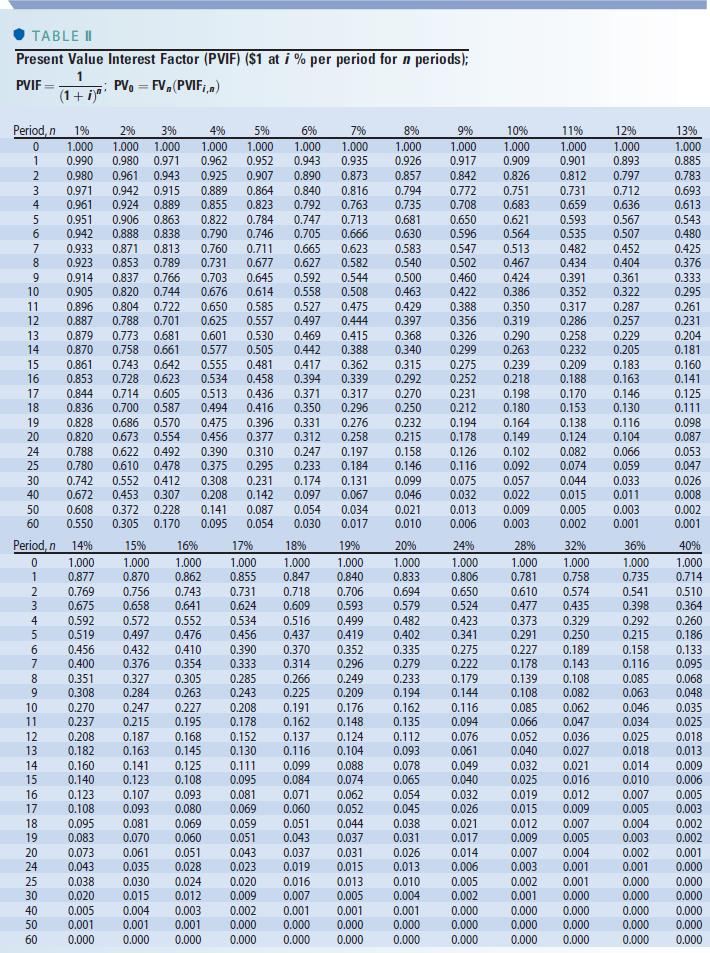

TABLE II Present Value Interest Factor (PVIF) ($1 at i % per period for n periods); PVIF PV = FV, (PVIF,.) (1 + i)" Period n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 24 25 30 40 50 60 1% 1.000 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.788 0.780 0.742 0.672 0.608 0.550 7% 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.184 0.131 0.067 0.034 0.017 9% 1.000 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.126 0.116 0.075 0.032 0.013 0.006 13% 1.000 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.047 0.026 0.008 0.002 0.001 2% 3% 4% 5% 6% 1.000 1.000 1.000 1.000 1.000 0.980 0.971 0.962 0.952 0.943 0.961 0.943 0.925 0.907 0.890 0.942 0.915 0.889 0.864 0.840 0.924 0.889 0.855 0.823 0.792 0.906 0.863 0.822 0.784 0.747 0.888 0.838 0.790 0.746 0.705 0.871 0.813 0.760 0.711 0.665 0.853 0.789 0.731 0.677 0.627 0.837 0.766 0.703 0.645 0.592 0.820 0.744 0.676 0.614 0.558 0.804 0.722 0.650 0.585 0.527 0.788 0.701 0.625 0.557 0.497 0.773 0.681 0.601 0.530 0.469 0.758 0.661 0.577 0.505 0.442 0.743 0.642 0.555 0.481 0.417 0.728 0.623 0.534 0.458 0.394 0.714 0.605 0.513 0.436 0.371 0.700 0.587 0.494 0.416 0.350 0.686 0.570 0.475 0.396 0.331 0.673 0.554 0.456 0.377 0.312 0.622 0.492 0.390 0.310 0.247 0.610 0.478 0.375 0.295 0.233 0.552 0.412 0.308 0.231 0.174 0.453 0.307 0.208 0.142 0.097 0.372 0.228 0.141 0.087 0.054 0.305 0.170 0.095 0.054 0.030 15% 16% 17% 18% 1.000 1.000 1.000 1.000 0.870 0.862 0.855 0.847 0.756 0.743 0.731 0.718 0.658 0.641 0.624 0.609 0.572 0.552 0.534 0.516 0.497 0.476 0.456 0.437 0.432 0.410 0.390 0.370 0.376 0.354 0.333 0.314 0.327 0.305 0.285 0.266 0.284 0.263 0.243 0.225 0.247 0.227 0.208 0.191 0.215 0.195 0.178 0.162 0.187 0.168 0.152 0.137 0.163 0.145 0.130 0.116 0.141 0.125 0.111 0.099 0.123 0.108 0.095 0.084 0.107 0.093 0.081 0.071 0.093 0.080 0.069 0.060 0.081 0.069 0.059 0.051 0.070 0.060 0.051 0.043 0.061 0.051 0.043 0.037 0.035 0.028 0.023 0.019 0.030 0.024 0.020 0.016 0.015 0.012 0.009 0.007 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 8% 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.158 0.146 0.099 0.046 0.021 0.010 20% 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 10% 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.102 0.092 0.057 0.022 0.009 0.003 28% 1.000 0.781 0.610 0.477 0.373 0.291 0.227 0.178 0.139 0.108 0.085 0.066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.003 0.002 0.001 0.000 0.000 0.000 11% 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32% 1.000 0.758 0.574 0.435 0.329 0.250 0.189 0.143 0.108 0.082 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 12% 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 36% 1.000 0.735 0.541 0.398 0.292 0.215 0.158 0.116 0.085 0.063 0.046 0.034 0.025 0.018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000 Period, 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 24 25 30 40 50 60 14% 1.000 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.043 0.038 0.020 0.005 0.001 0.000 19% 1.000 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 24% 1.000 0.806 0.650 0.524 0.423 0.341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.061 0.049 0.040 0.032 0.026 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 40% 1.000 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000