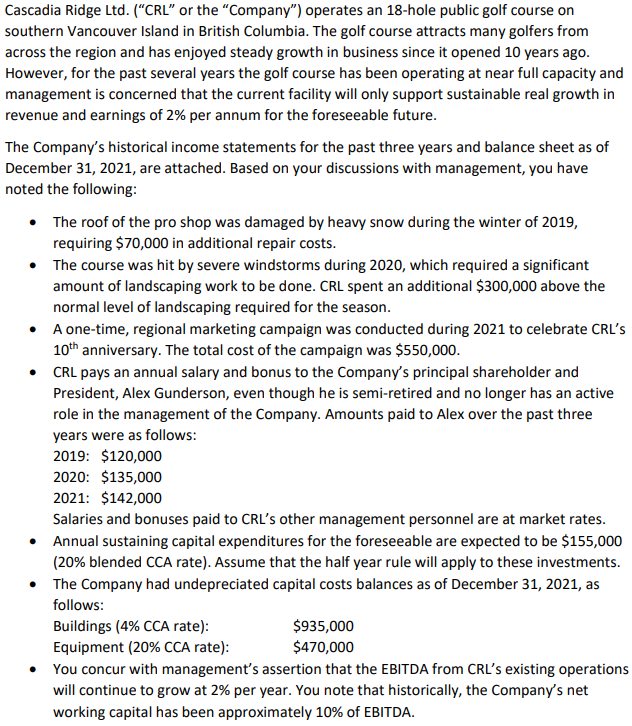

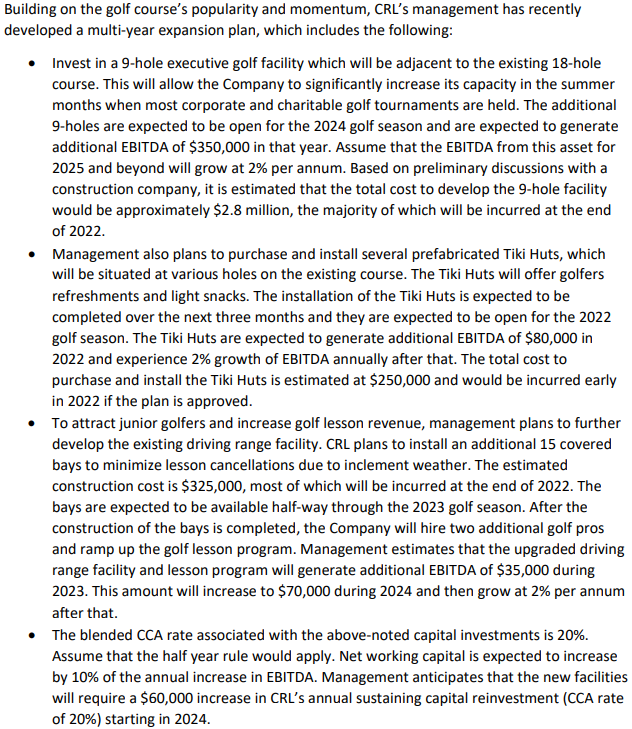

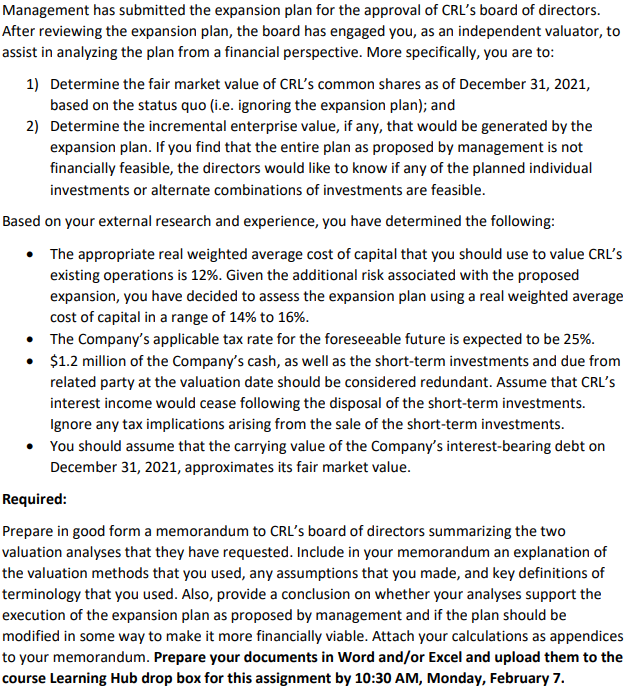

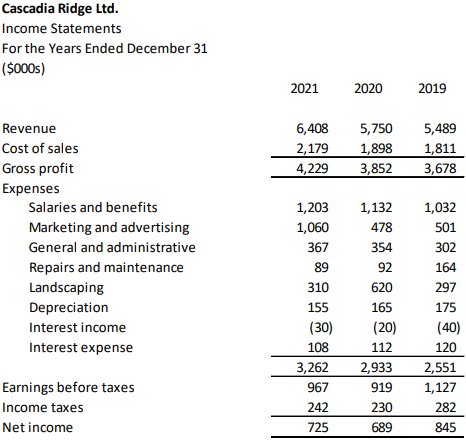

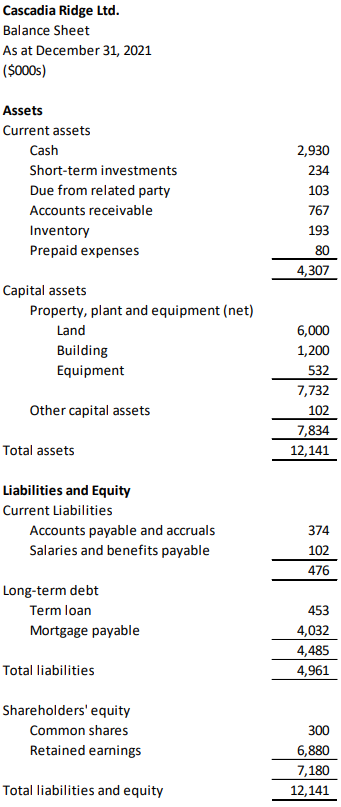

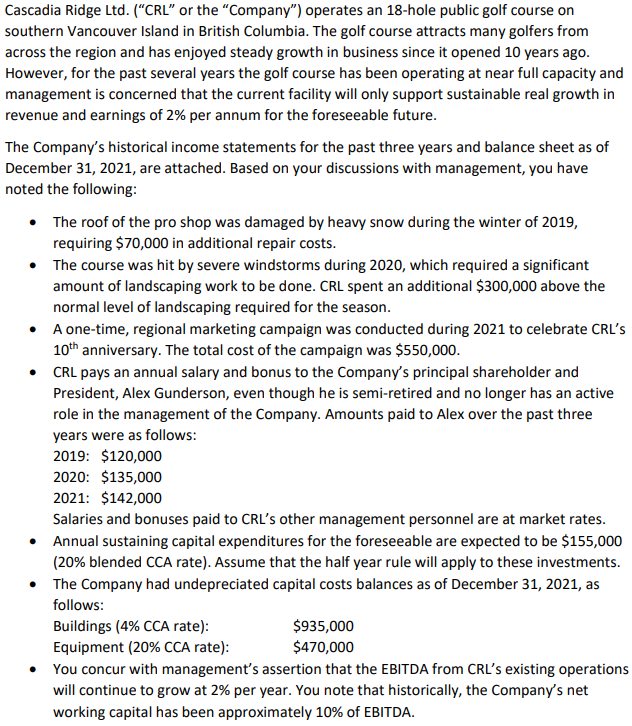

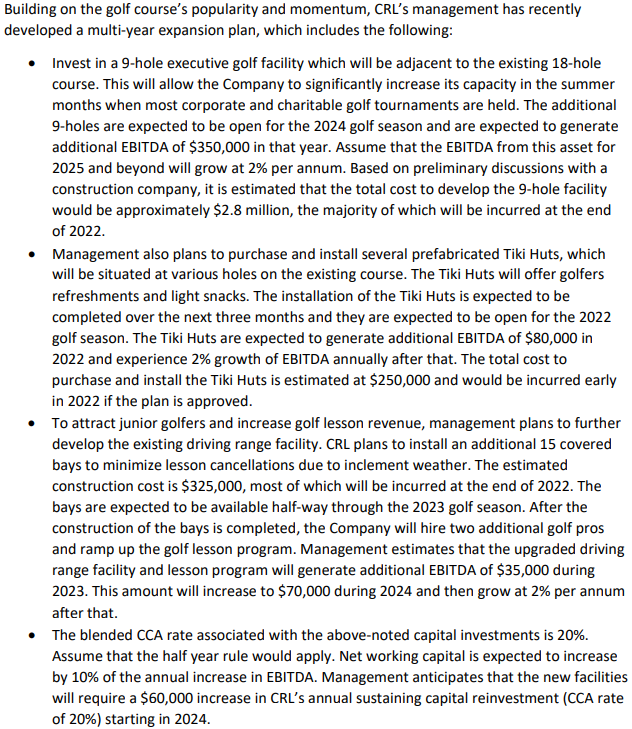

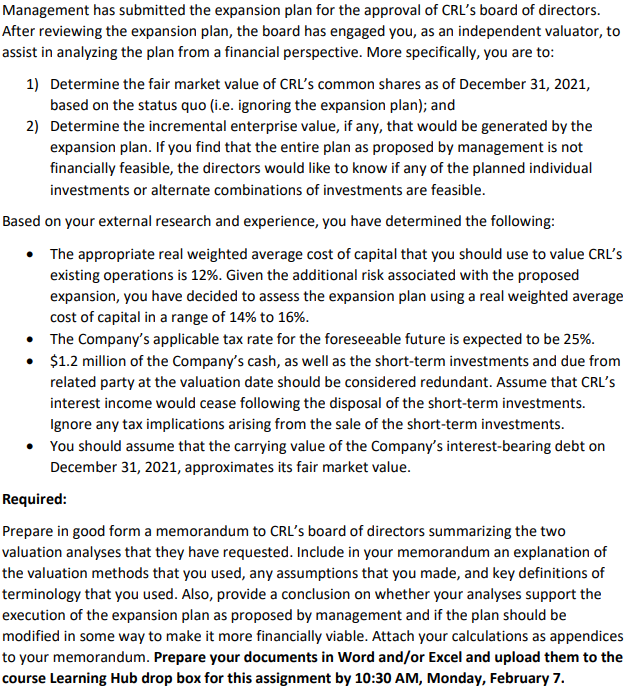

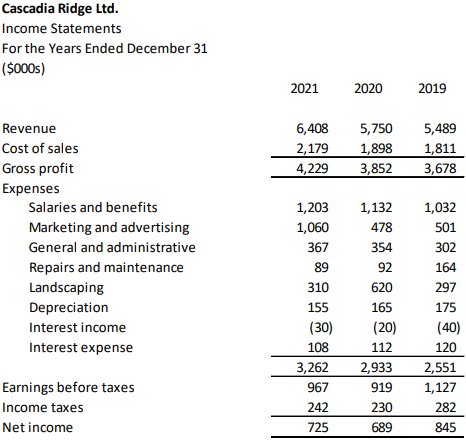

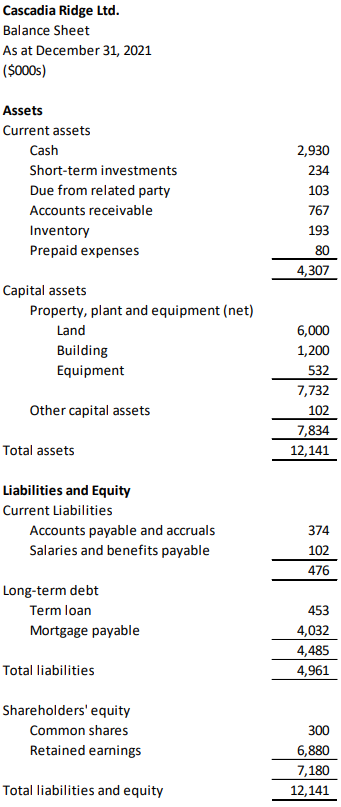

Cascadia Ridge Ltd. ("CRL" or the "Company") operates an 18-hole public golf course on southern Vancouver Island in British Columbia. The golf course attracts many golfers from across the region and has enjoyed steady growth in business since it opened 10 years ago. However, for the past several years the golf course has been operating at near full capacity and management is concerned that the current facility will only support sustainable real growth in revenue and earnings of 2% per annum for the foreseeable future. The Company's historical income statements for the past three years and balance sheet as of December 31, 2021, are attached. Based on your discussions with management, you have noted the following: The roof of the pro shop was damaged by heavy snow during the winter of 2019, requiring $70,000 in additional repair costs. The course was hit by severe windstorms during 2020, which required a significant amount of landscaping work to be done. CRL spent an additional $300,000 above the normal level of landscaping required for the season. A one-time, regional marketing campaign was conducted during 2021 to celebrate CRL's 10th anniversary. The total cost of the campaign was $550,000. CRL pays an annual salary and bonus to the Company's principal shareholder and President, Alex Gunderson, even though he is semi-retired and no longer has an active role in the management of the Company. Amounts paid to Alex over the past three years were as follows: 2019: $120,000 2020: $135,000 2021: $142,000 Salaries and bonuses paid to CRL's other management personnel are at market rates. Annual sustaining capital expenditures for the foreseeable are expected to be $155,000 (20% blended CCA rate). Assume that the half year rule will apply to these investments. The Company had undepreciated capital costs balances as of December 31, 2021, as follows: Buildings (4% CCA rate): $935,000 Equipment (20% CCA rate): $470,000 You concur with management's assertion that the EBITDA from CRL's existing operations will continue to grow at 2% per year. You note that historically, the Company's net working capital has been approximately 10% of EBITDA. Building on the golf course's popularity and momentum, CRL's management has recently developed a multi-year expansion plan, which includes the following: Invest in a 9-hole executive golf facility which will be adjacent to the existing 18-hole course. This will allow the Company to significantly increase its capacity in the summer months when most corporate and charitable golf tournaments are held. The additional 9-holes are expected to be open for the 2024 golf season and are expected to generate additional EBITDA of $350,000 in that year. Assume that the EBITDA from this asset for 2025 and beyond will grow at 2% per annum. Based on preliminary discussions with a construction company, it is estimated that the total cost to develop the 9-hole facility would be approximately $2.8 million, the majority of which will be incurred at the end of 2022. Management also plans to purchase and install several prefabricated Tiki Huts, which will be situated at various holes on the existing course. The Tiki Huts will offer golfers refreshments and light snacks. The installation of the Tiki Huts is expected to be completed over the next three months and they are expected to be open for the 2022 golf season. The Tiki Huts are expected to generate additional EBITDA of $80,000 in 2022 and experience 2% growth of EBITDA annually after that. The total cost to purchase and install the Tiki Huts is estimated at $250,000 and would be incurred early in 2022 if the plan is approved. To attract junior golfers and increase golf lesson revenue, management plans to further develop the existing driving range facility. CRL plans to install an additional 15 covered bays to minimize lesson cancellations due to inclement weather. The estimated construction cost is $325,000, most of which will be incurred at the end of 2022. The bays are expected to be available half-way through the 2023 golf season. After the construction of the bays is completed, the Company will hire two additional golf pros and ramp up the golf lesson program. Management estimates that the upgraded driving range facility and lesson program will generate additional EBITDA of $35,000 during 2023. This amount will increase to $70,000 during 2024 and then grow at 2% per annum after that. The blended CCA rate associated with the above-noted capital investments is 20%. Assume that the half year rule would apply. Net working capital is expected to increase by 10% of the annual increase in EBITDA. Management anticipates that the new facilities will require a $60,000 increase in CRL's annual sustaining capital reinvestment (CCA rate of 20%) starting in 2024. Management has submitted the expansion plan for the approval of CRL's board of directors. After reviewing the expansion plan, the board has engaged you, as an independent valuator, to assist in analyzing the plan from a financial perspective. More specifically, you are to: 1) Determine the fair market value of CRL's common shares as of December 31, 2021, based on the status quo (i.e. ignoring the expansion plan); and 2) Determine the incremental enterprise value, if any, that would be generated by the expansion plan. If you find that the entire plan as proposed by management is not financially feasible, the directors would like to know if any of the planned individual investments or alternate combinations of investments are feasible. Based on your external research and experience, you have determined the following: The appropriate real weighted average cost of capital that you should use to value CRL's existing operations is 12%. Given the additional risk associated with the proposed expansion, you have decided to assess the expansion plan using a real weighted average cost of capital in a range of 14% to 16%. The Company's applicable tax rate for the foreseeable future is expected to be 25%. $1.2 million of the Company's cash, as well as the short-term investments and due from related party at the valuation date should be considered redundant. Assume that CRL's interest income would cease following the disposal of the short-term investments. Ignore any tax implications arising from the sale of the short-term investments. You should assume that the carrying value of the Company's interest-bearing debt on December 31, 2021, approximates its fair market value. Required: Prepare in good form a memorandum to CRL's board of directors summarizing the two valuation analyses that they have requested. Include in your memorandum an explanation of the valuation methods that you used, any assumptions that you made, and key definitions of terminology that you used. Also, provide a conclusion on whether your analyses support the execution of the expansion plan as proposed by management and if the plan should be modified in some way to make it more financially viable. Attach your calculations as appendices to your memorandum. Prepare your documents in Word and/or Excel and upload them to the course Learning Hub drop box for this assignment by 10:30 AM, Monday, February 7. Cascadia Ridge Ltd. Income Statements For the Years Ended December 31 ($000s) 2021 2020 2019 5,489 6,408 2,179 4,229 5,750 1,898 3,852 1,811 3,678 Revenue Cost of sales Gross profit Expenses Salaries and benefits Marketing and advertising General and administrative Repairs and maintenance Landscaping Depreciation Interest income Interest expense 1,203 1,060 367 89 310 155 (30) 108 3,262 967 242 725 1,132 478 354 92 620 165 (20) 112 2,933 919 230 689 1,032 501 302 164 297 175 (40) 120 2,551 1,127 282 Earnings before taxes Income taxes Net income 845 Cascadia Ridge Ltd. Balance Sheet As at December 31, 2021 ($000s) Assets Current assets Cash Short-term investments Due from related party Accounts receivable Inventory Prepaid expenses 2,930 234 103 767 193 80 4,307 Capital assets Property, plant and equipment (net) Land Building Equipment 6,000 1,200 532 7,732 102 7,834 12,141 Other capital assets Total assets Liabilities and Equity Current Liabilities Accounts payable and accruals Salaries and benefits payable 374 102 476 Long-term debt Term loan Mortgage payable 453 4,032 4,485 4,961 Total liabilities Shareholders' equity Common shares Retained earnings 300 6,880 7,180 12,141 Total liabilities and equity Cascadia Ridge Ltd. ("CRL" or the "Company") operates an 18-hole public golf course on southern Vancouver Island in British Columbia. The golf course attracts many golfers from across the region and has enjoyed steady growth in business since it opened 10 years ago. However, for the past several years the golf course has been operating at near full capacity and management is concerned that the current facility will only support sustainable real growth in revenue and earnings of 2% per annum for the foreseeable future. The Company's historical income statements for the past three years and balance sheet as of December 31, 2021, are attached. Based on your discussions with management, you have noted the following: The roof of the pro shop was damaged by heavy snow during the winter of 2019, requiring $70,000 in additional repair costs. The course was hit by severe windstorms during 2020, which required a significant amount of landscaping work to be done. CRL spent an additional $300,000 above the normal level of landscaping required for the season. A one-time, regional marketing campaign was conducted during 2021 to celebrate CRL's 10th anniversary. The total cost of the campaign was $550,000. CRL pays an annual salary and bonus to the Company's principal shareholder and President, Alex Gunderson, even though he is semi-retired and no longer has an active role in the management of the Company. Amounts paid to Alex over the past three years were as follows: 2019: $120,000 2020: $135,000 2021: $142,000 Salaries and bonuses paid to CRL's other management personnel are at market rates. Annual sustaining capital expenditures for the foreseeable are expected to be $155,000 (20% blended CCA rate). Assume that the half year rule will apply to these investments. The Company had undepreciated capital costs balances as of December 31, 2021, as follows: Buildings (4% CCA rate): $935,000 Equipment (20% CCA rate): $470,000 You concur with management's assertion that the EBITDA from CRL's existing operations will continue to grow at 2% per year. You note that historically, the Company's net working capital has been approximately 10% of EBITDA. Building on the golf course's popularity and momentum, CRL's management has recently developed a multi-year expansion plan, which includes the following: Invest in a 9-hole executive golf facility which will be adjacent to the existing 18-hole course. This will allow the Company to significantly increase its capacity in the summer months when most corporate and charitable golf tournaments are held. The additional 9-holes are expected to be open for the 2024 golf season and are expected to generate additional EBITDA of $350,000 in that year. Assume that the EBITDA from this asset for 2025 and beyond will grow at 2% per annum. Based on preliminary discussions with a construction company, it is estimated that the total cost to develop the 9-hole facility would be approximately $2.8 million, the majority of which will be incurred at the end of 2022. Management also plans to purchase and install several prefabricated Tiki Huts, which will be situated at various holes on the existing course. The Tiki Huts will offer golfers refreshments and light snacks. The installation of the Tiki Huts is expected to be completed over the next three months and they are expected to be open for the 2022 golf season. The Tiki Huts are expected to generate additional EBITDA of $80,000 in 2022 and experience 2% growth of EBITDA annually after that. The total cost to purchase and install the Tiki Huts is estimated at $250,000 and would be incurred early in 2022 if the plan is approved. To attract junior golfers and increase golf lesson revenue, management plans to further develop the existing driving range facility. CRL plans to install an additional 15 covered bays to minimize lesson cancellations due to inclement weather. The estimated construction cost is $325,000, most of which will be incurred at the end of 2022. The bays are expected to be available half-way through the 2023 golf season. After the construction of the bays is completed, the Company will hire two additional golf pros and ramp up the golf lesson program. Management estimates that the upgraded driving range facility and lesson program will generate additional EBITDA of $35,000 during 2023. This amount will increase to $70,000 during 2024 and then grow at 2% per annum after that. The blended CCA rate associated with the above-noted capital investments is 20%. Assume that the half year rule would apply. Net working capital is expected to increase by 10% of the annual increase in EBITDA. Management anticipates that the new facilities will require a $60,000 increase in CRL's annual sustaining capital reinvestment (CCA rate of 20%) starting in 2024. Management has submitted the expansion plan for the approval of CRL's board of directors. After reviewing the expansion plan, the board has engaged you, as an independent valuator, to assist in analyzing the plan from a financial perspective. More specifically, you are to: 1) Determine the fair market value of CRL's common shares as of December 31, 2021, based on the status quo (i.e. ignoring the expansion plan); and 2) Determine the incremental enterprise value, if any, that would be generated by the expansion plan. If you find that the entire plan as proposed by management is not financially feasible, the directors would like to know if any of the planned individual investments or alternate combinations of investments are feasible. Based on your external research and experience, you have determined the following: The appropriate real weighted average cost of capital that you should use to value CRL's existing operations is 12%. Given the additional risk associated with the proposed expansion, you have decided to assess the expansion plan using a real weighted average cost of capital in a range of 14% to 16%. The Company's applicable tax rate for the foreseeable future is expected to be 25%. $1.2 million of the Company's cash, as well as the short-term investments and due from related party at the valuation date should be considered redundant. Assume that CRL's interest income would cease following the disposal of the short-term investments. Ignore any tax implications arising from the sale of the short-term investments. You should assume that the carrying value of the Company's interest-bearing debt on December 31, 2021, approximates its fair market value. Required: Prepare in good form a memorandum to CRL's board of directors summarizing the two valuation analyses that they have requested. Include in your memorandum an explanation of the valuation methods that you used, any assumptions that you made, and key definitions of terminology that you used. Also, provide a conclusion on whether your analyses support the execution of the expansion plan as proposed by management and if the plan should be modified in some way to make it more financially viable. Attach your calculations as appendices to your memorandum. Prepare your documents in Word and/or Excel and upload them to the course Learning Hub drop box for this assignment by 10:30 AM, Monday, February 7. Cascadia Ridge Ltd. Income Statements For the Years Ended December 31 ($000s) 2021 2020 2019 5,489 6,408 2,179 4,229 5,750 1,898 3,852 1,811 3,678 Revenue Cost of sales Gross profit Expenses Salaries and benefits Marketing and advertising General and administrative Repairs and maintenance Landscaping Depreciation Interest income Interest expense 1,203 1,060 367 89 310 155 (30) 108 3,262 967 242 725 1,132 478 354 92 620 165 (20) 112 2,933 919 230 689 1,032 501 302 164 297 175 (40) 120 2,551 1,127 282 Earnings before taxes Income taxes Net income 845 Cascadia Ridge Ltd. Balance Sheet As at December 31, 2021 ($000s) Assets Current assets Cash Short-term investments Due from related party Accounts receivable Inventory Prepaid expenses 2,930 234 103 767 193 80 4,307 Capital assets Property, plant and equipment (net) Land Building Equipment 6,000 1,200 532 7,732 102 7,834 12,141 Other capital assets Total assets Liabilities and Equity Current Liabilities Accounts payable and accruals Salaries and benefits payable 374 102 476 Long-term debt Term loan Mortgage payable 453 4,032 4,485 4,961 Total liabilities Shareholders' equity Common shares Retained earnings 300 6,880 7,180 12,141 Total liabilities and equity