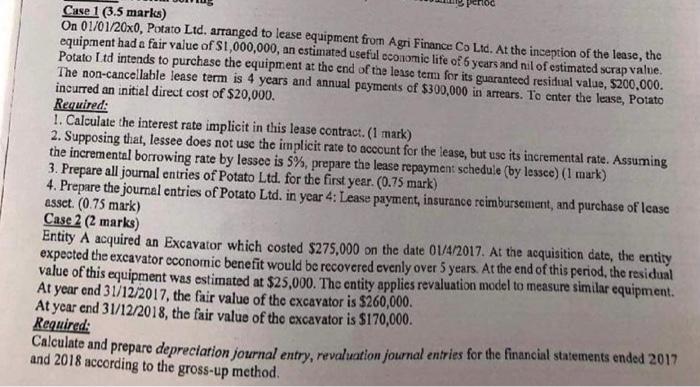

Case 1 (3.5 marks) equipment had a fair value of $1,000,000, an estimated useful ceonomic life of 5 years and nil of estimated scrap value. Potato Ltd intends to purchase the equipment at the end of the lease term for its guaranteed residual value, 5200,000 . The non-cancellable lease term is 4 years and annual payments of $300,000 in arrears. To cnter the lease, Potato incurred an initial direct cost of $20,000. Required: 1. Calculate the interest rate implicit in this lease contract. ( 1 mark) 2. Supposing that, lessee does not use the implicit rate to account for the lease, but uso its incremental rate. Assuming the incremental borrowing rate by lessee is 5%, prepare the lease repayment schedule (by lessec) (1mark) 3. Prepare all journal entries of Potato Ltd. for the first year. (0.75 mark) 4. Prepare the joumal entries of Potato Ltd. in year 4 : Lease payment, insurance reimbursement, and purchase of lease asset. ( 0.75mark) Case 2 (2 marks) Entity A acquired an Excavator which costed $275,000 on the date 01/4/2017. At the acquisition date, the entity expected the excavator cconomic benefit would be recovered evenly over 5 years. At the end of this period, the residual value of this equipment was estimated at $25,000. The entity applies revaluation model to measure similar equipment. At year end 31/12/2017, the fair value of the cxcavator is $260,000. At year end 31/12/2018, the fair value of the excavator is $170,000. Required: Calculate and prepare depreciation journal entry, revaluation joumal entries for the financial statements ended 2017 and 2018 according to the gross-up method. Case 1 (3.5 marks) equipment had a fair value of $1,000,000, an estimated useful ceonomic life of 5 years and nil of estimated scrap value. Potato Ltd intends to purchase the equipment at the end of the lease term for its guaranteed residual value, 5200,000 . The non-cancellable lease term is 4 years and annual payments of $300,000 in arrears. To cnter the lease, Potato incurred an initial direct cost of $20,000. Required: 1. Calculate the interest rate implicit in this lease contract. ( 1 mark) 2. Supposing that, lessee does not use the implicit rate to account for the lease, but uso its incremental rate. Assuming the incremental borrowing rate by lessee is 5%, prepare the lease repayment schedule (by lessec) (1mark) 3. Prepare all journal entries of Potato Ltd. for the first year. (0.75 mark) 4. Prepare the joumal entries of Potato Ltd. in year 4 : Lease payment, insurance reimbursement, and purchase of lease asset. ( 0.75mark) Case 2 (2 marks) Entity A acquired an Excavator which costed $275,000 on the date 01/4/2017. At the acquisition date, the entity expected the excavator cconomic benefit would be recovered evenly over 5 years. At the end of this period, the residual value of this equipment was estimated at $25,000. The entity applies revaluation model to measure similar equipment. At year end 31/12/2017, the fair value of the cxcavator is $260,000. At year end 31/12/2018, the fair value of the excavator is $170,000. Required: Calculate and prepare depreciation journal entry, revaluation joumal entries for the financial statements ended 2017 and 2018 according to the gross-up method