Case 1: Consider the Following Case:

Jenny Cochran, a recent graduate of the University of Ottawa with four years of banking experience, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components.

The company doubled its plant capacity, opened new sales offices outside its home territory, and launched an expensive advertising campaign. Computron's results were not satisfactory, to put it mildly. Its board of directors, which consisted of its president and vice-president plus its major stockholders (who were all local business people), was most upset when directors learned how the expansion was going. Suppliers were being paid late and were unhappy, and the bank was complaining about the deteriorating situation and threatening to cut off credit. As a result, Al Watkins, Computron's president, was informed that changes would have to be made, and quickly, or he would be fired. Also, at the board's insistence Donna Jenny Cochran was brought in and given the job of assistant to Gary Meissner, a retired banker who was Computron's chairman and largest stockholder. Gary agreed to give up a few of his golfing days and to help nurse the company back to health, with Meissner's help.

Cochran began by gathering financial statements and other data. Assume that you are Cochran's assistant, and you must help her answer the following questions for Gary. Cochran began by gathering financial statements and other data that are enclosed herewith.

Now answer the following question based on available information in the tables below.

a: What is Computron's 2015's operating current assets?

b : What is 2015's operating current liabilities?

c : How much net operating working capital did Computron have in 2015?

d : How much total net operating capital did Computron have in 2015 and in 2014, respectively?

e: What was Computron's net operating profit after taxes (NOPAT) in 2015?

f What was Computron's free cash flow (FCF) in 2015?

[Answer the questions for 2015, however, you may have to calculate 2014's values to answer some of the questions.]

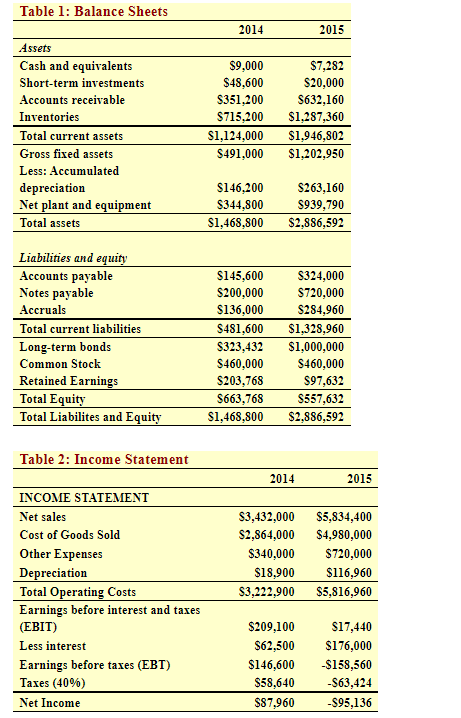

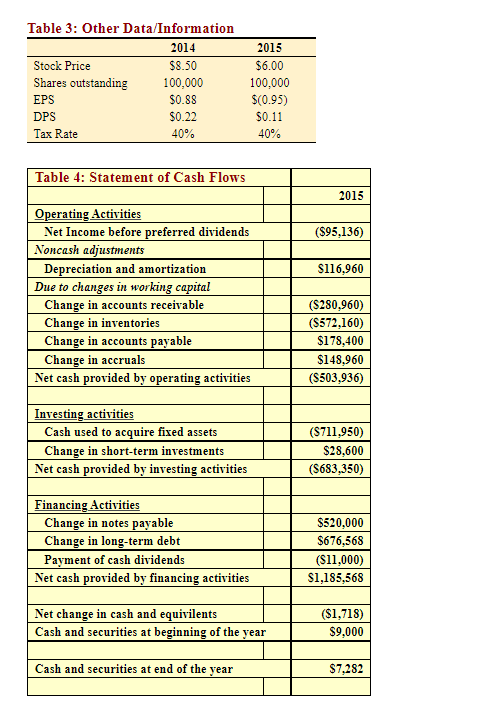

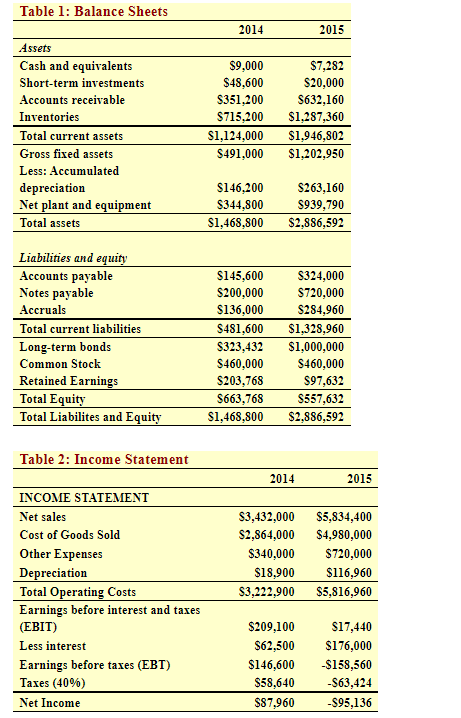

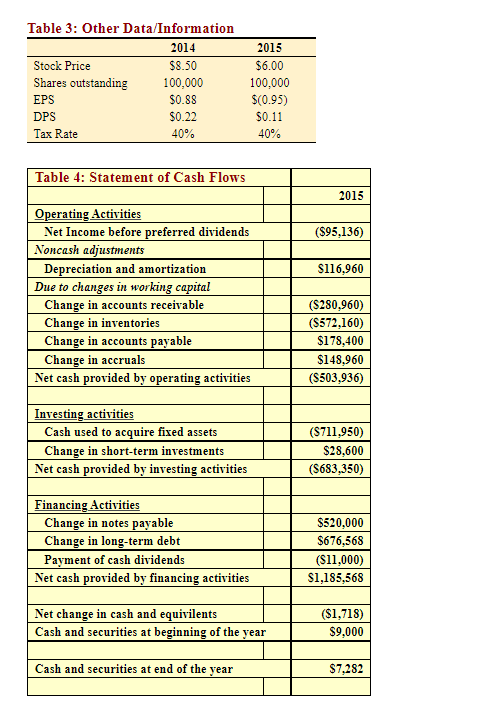

Table 1: Balance Sheets 2014 2015 Assets Cash and equivalents Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net plant and equipment Total assets $9,000 $48,600 $351,200 $715,200 $1,124,000 S491,000 $7,282 $20,000 S632,160 $1,287,360 $1,946,802 $1,202,950 $146,200 $344,800 $1,468,800 S263,160 S939,790 $2.886,592 Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Common Stock Retained Earnings Total Equity Total Liabilites and Equity $145,600 $200,000 $136,000 S481,600 $323,432 S460,000 S203,768 $663,768 $1,468,800 $324,000 S720,000 S284,960 $1,328,960 $1,000,000 S460,000 $97,632 S557,632 $2.886,592 Table 2: Income Statement 2014 2015 INCOME STATEMENT Net sales Cost of Goods Sold Other Expenses Depreciation Total Operating Costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes (40%) Net Income $3,432,000 S2,864,000 $340,000 $18.900 83,222,900 $5,834,400 $4,980,000 $720,000 $116,960 $5,816,960 $209,100 $62,500 $146,600 $58,640 $87,960 $17,440 $176,000 -$158,560 -S63,424 -S95,136 Table 3: Other Data/Information 2014 Stock Price Shares outstanding EPS DPS Tax Rate $8.50 100,000 $0.88 $0.22 40% 2015 $6.00 100,000 $(0.95) $0.11 40% Table 4: Statement of Cash Flows 2015 ($95,136) S116,960 Operating Activities Net Income before preferred dividends Noncash adjustments Depreciation and amortization Due to changes in working capital Change in accounts receivable Change in inventories Change in accounts payable Change in accruals Net cash provided by operating activities (S280,960) (S572,160) $178,400 $148,960 (5503,936) Investing activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities (S711,950) $28,600 (S683,350) Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities $520,000 $676,568 (11.000) $1,185,568 Net change in cash and equivilents Cash and securities at beginning of the year ($1,718) $9,000 Cash and securities at end of the year $7,282 Table 1: Balance Sheets 2014 2015 Assets Cash and equivalents Short-term investments Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net plant and equipment Total assets $9,000 $48,600 $351,200 $715,200 $1,124,000 S491,000 $7,282 $20,000 S632,160 $1,287,360 $1,946,802 $1,202,950 $146,200 $344,800 $1,468,800 S263,160 S939,790 $2.886,592 Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Common Stock Retained Earnings Total Equity Total Liabilites and Equity $145,600 $200,000 $136,000 S481,600 $323,432 S460,000 S203,768 $663,768 $1,468,800 $324,000 S720,000 S284,960 $1,328,960 $1,000,000 S460,000 $97,632 S557,632 $2.886,592 Table 2: Income Statement 2014 2015 INCOME STATEMENT Net sales Cost of Goods Sold Other Expenses Depreciation Total Operating Costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes (40%) Net Income $3,432,000 S2,864,000 $340,000 $18.900 83,222,900 $5,834,400 $4,980,000 $720,000 $116,960 $5,816,960 $209,100 $62,500 $146,600 $58,640 $87,960 $17,440 $176,000 -$158,560 -S63,424 -S95,136 Table 3: Other Data/Information 2014 Stock Price Shares outstanding EPS DPS Tax Rate $8.50 100,000 $0.88 $0.22 40% 2015 $6.00 100,000 $(0.95) $0.11 40% Table 4: Statement of Cash Flows 2015 ($95,136) S116,960 Operating Activities Net Income before preferred dividends Noncash adjustments Depreciation and amortization Due to changes in working capital Change in accounts receivable Change in inventories Change in accounts payable Change in accruals Net cash provided by operating activities (S280,960) (S572,160) $178,400 $148,960 (5503,936) Investing activities Cash used to acquire fixed assets Change in short-term investments Net cash provided by investing activities (S711,950) $28,600 (S683,350) Financing Activities Change in notes payable Change in long-term debt Payment of cash dividends Net cash provided by financing activities $520,000 $676,568 (11.000) $1,185,568 Net change in cash and equivilents Cash and securities at beginning of the year ($1,718) $9,000 Cash and securities at end of the year $7,282