Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case #1 Detection Financial Fraud of Chipmunk Based on given financial information from this text case (p376-p377), #1 Some students can help calculate the change

Case #1 Detection Financial Fraud of Chipmunk

Based on given financial information from this text case (p376-p377),

#1 Some students can help calculate the change and the percentage change for the ratios.

Following these calculated ratios, what is your evaluation on its financial performance? Anything noticeable?

#2 Where do you think fraud may have occurred? and your reasons?

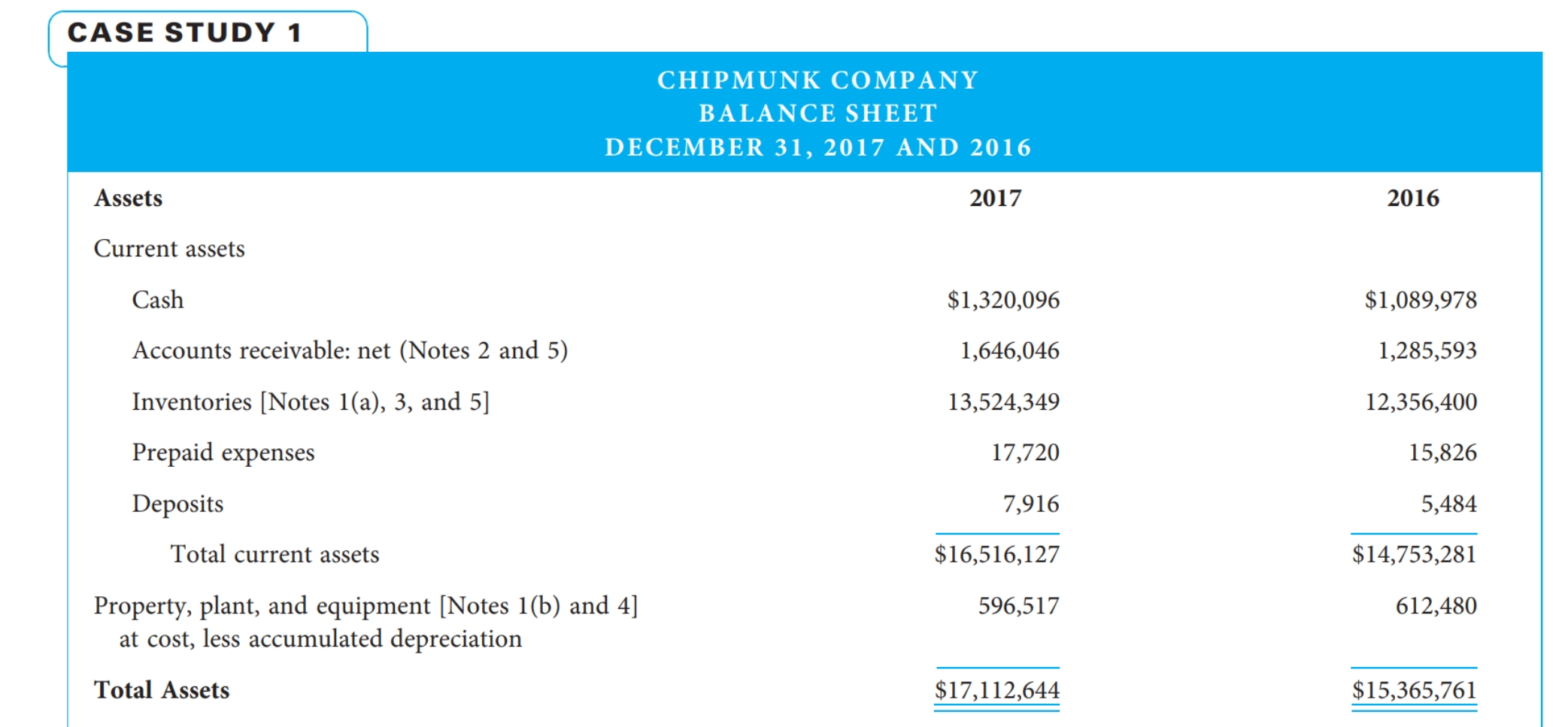

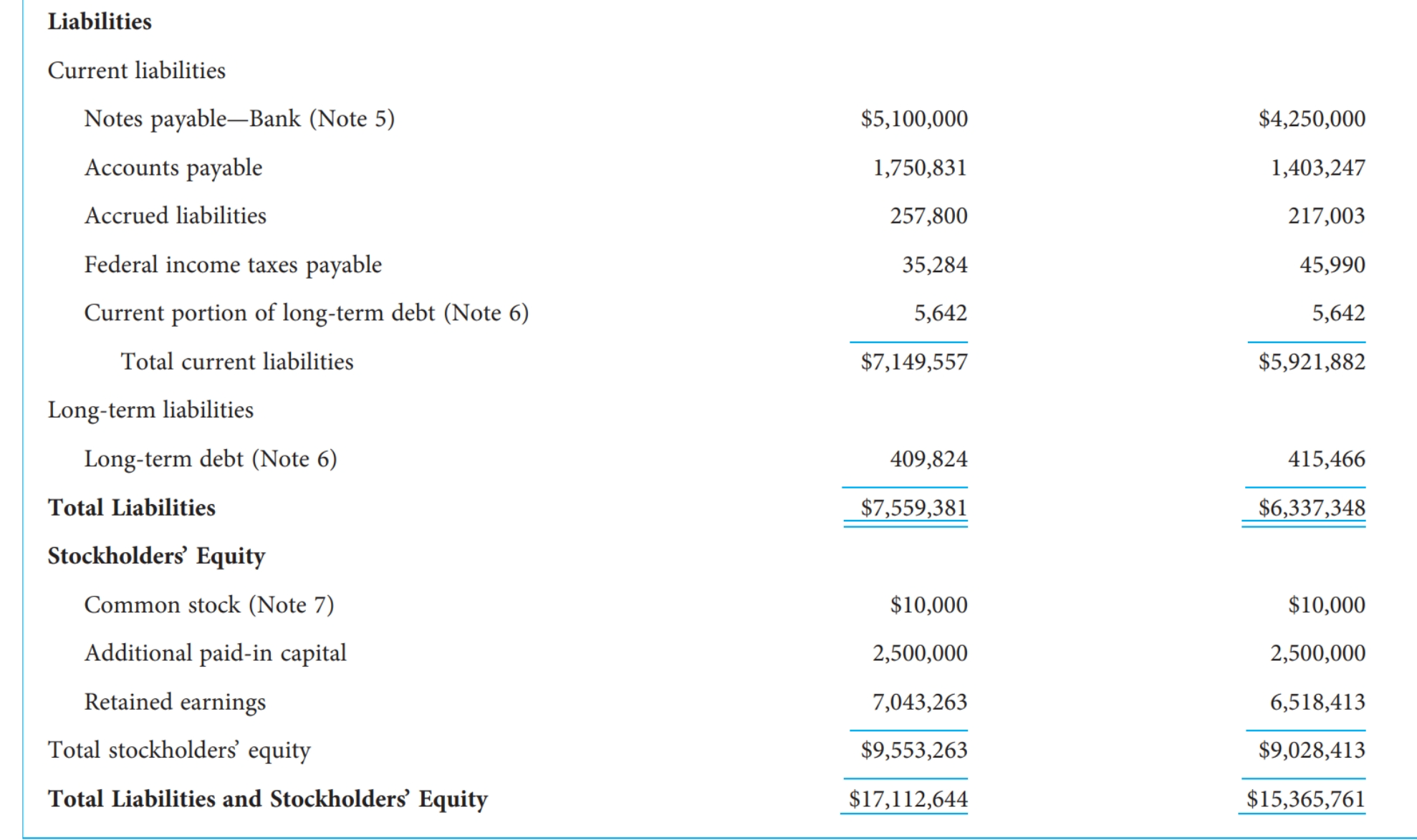

Case Study 1 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company. You have been provided with the financial statements on the following pages and are now beginning your analysis of those financial statements. Please note: the balance in inventories on January 1, 2016 was $11,427,937. CASE STUDY 1 CHIPMUNK COMPANY BALANCE SHEET DECEMBER 31, 2017 AND 2016 Assets Current assets Cash Accounts receivable: net (Notes 2 and 5) Inventories [Notes 1(a), 3, and 5] Prepaid expenses Deposits Total current assets Property, plant, and equipment [Notes 1(b) and 4] at cost, less accumulated depreciation Total Assets 2017 $1,320,096 1,646,046 13,524,349 17,720 $16,516,1277,916 596,517 $17,112,644 2016 $1,089,978 1,285,593 12,356,400 15,826 $14,753,2815,484 612,480 $15,365,761 Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) Total current liabilities Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity $5,100,0001,750,831257,80035,2845,642$7,149,557 409,824$7,559,381 $10,0002,500,0007,043,263$9,553,263$17,112,644 $4,250,000 1,403,247 217,003 45,990 $5,921,8825,642 415,466$6,337,348 $10,000 2,500,000 $9,028,4136,518,413 $15,365,761

Case Study 1 You are a fraud investigator who has been hired to detect financial statement fraud for the Chipmunk Company. You have been provided with the financial statements on the following pages and are now beginning your analysis of those financial statements. Please note: the balance in inventories on January 1, 2016 was $11,427,937. CASE STUDY 1 CHIPMUNK COMPANY BALANCE SHEET DECEMBER 31, 2017 AND 2016 Assets Current assets Cash Accounts receivable: net (Notes 2 and 5) Inventories [Notes 1(a), 3, and 5] Prepaid expenses Deposits Total current assets Property, plant, and equipment [Notes 1(b) and 4] at cost, less accumulated depreciation Total Assets 2017 $1,320,096 1,646,046 13,524,349 17,720 $16,516,1277,916 596,517 $17,112,644 2016 $1,089,978 1,285,593 12,356,400 15,826 $14,753,2815,484 612,480 $15,365,761 Liabilities Current liabilities Notes payable-Bank (Note 5) Accounts payable Accrued liabilities Federal income taxes payable Current portion of long-term debt (Note 6) Total current liabilities Long-term liabilities Long-term debt (Note 6) Total Liabilities Stockholders' Equity Common stock (Note 7) Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Stockholders' Equity $5,100,0001,750,831257,80035,2845,642$7,149,557 409,824$7,559,381 $10,0002,500,0007,043,263$9,553,263$17,112,644 $4,250,000 1,403,247 217,003 45,990 $5,921,8825,642 415,466$6,337,348 $10,000 2,500,000 $9,028,4136,518,413 $15,365,761 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started