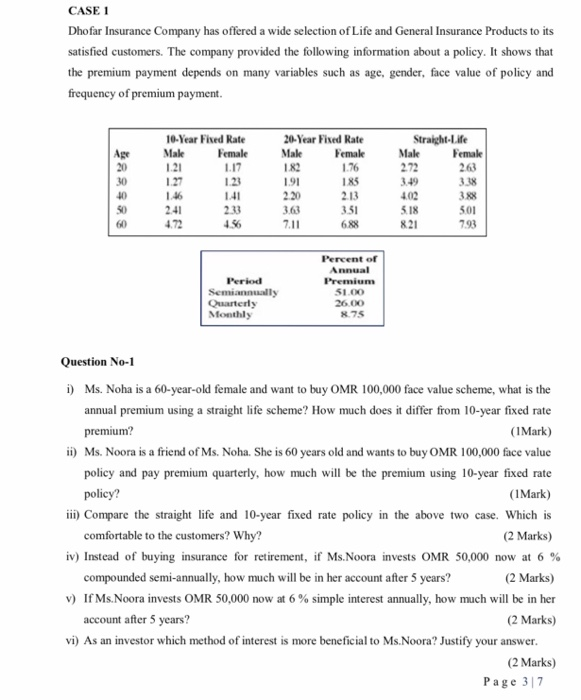

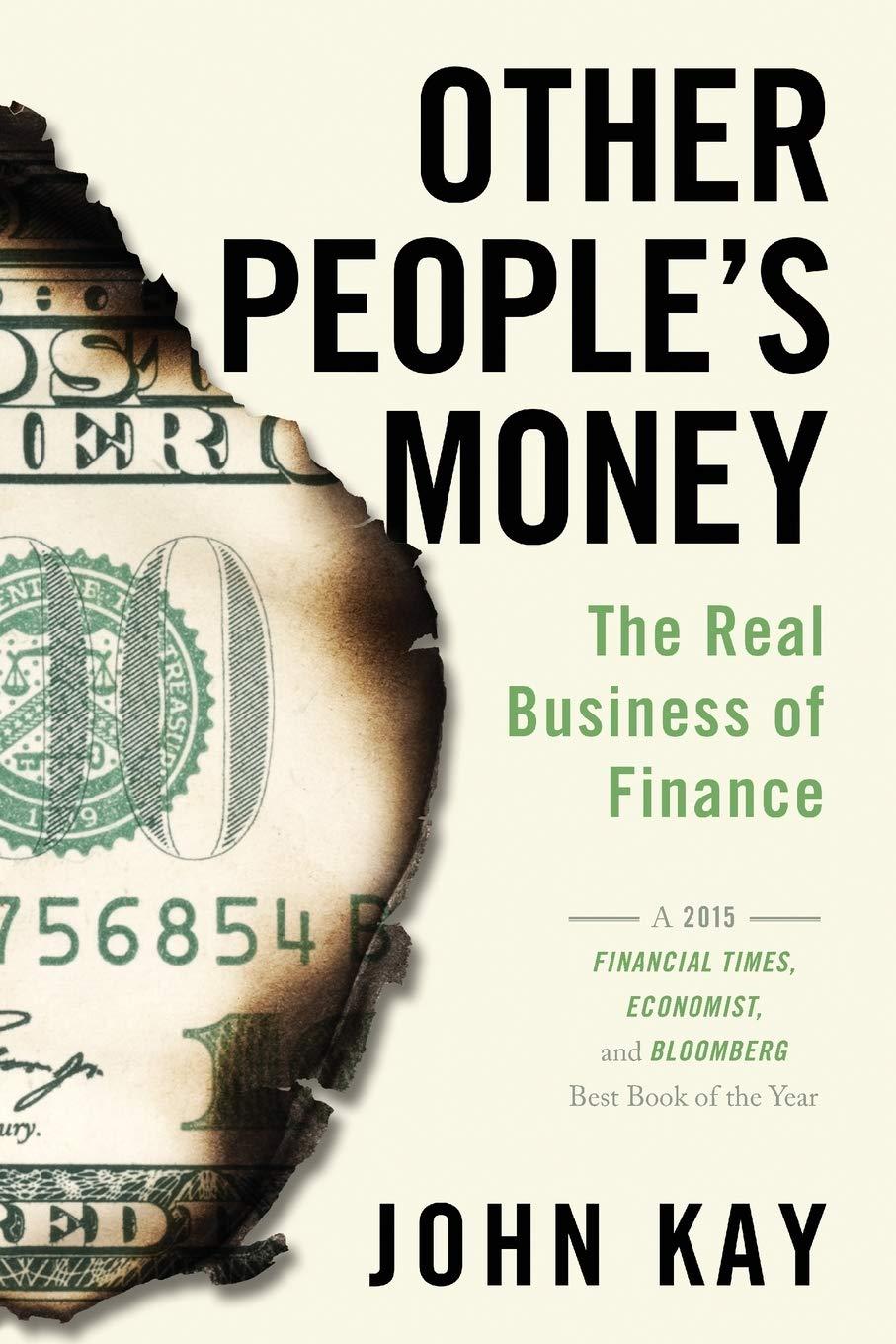

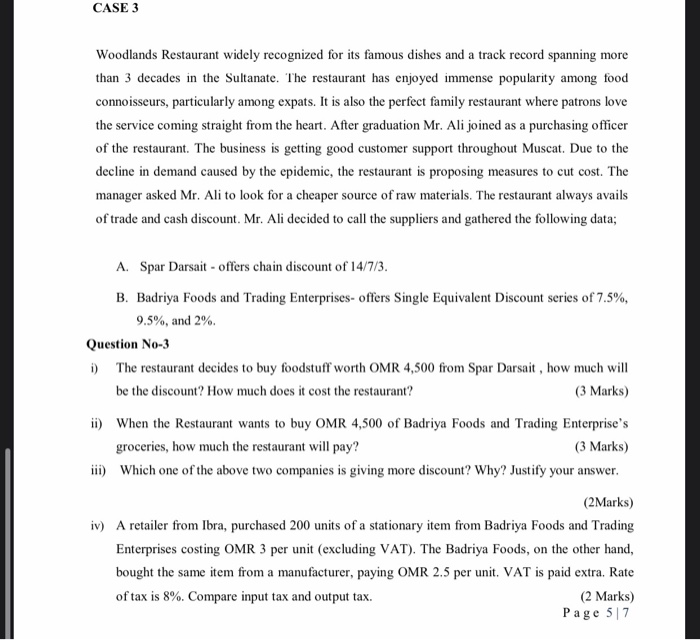

CASE 1 Dhofar Insurance Company has offered a wide selection of Life and General Insurance Products to its satisfied customers. The company provided the following information about a policy. It shows that the premium payment depends on many variables such as age, gender, face value of policy and frequency of premium payment. 20 30 40 50 60 10-Year Fixed Rate Mak Female 1.21 1.17 1.27 1.23 1.46 2.41 233 4.72 20-Year Fixed Rate Make Femak 182 176 1.91 185 2.20 2.13 3.63 3.51 7.11 Straight-Life Make Female 2.72 263 3.38 3.88 5.18 501 821 793 1.41 Period Semiannually Quarterly Monthly Percent of Annual Premium 51.00 26.00 8.75 Question No-1 i) Ms. Noha is a 60-year-old female and want to buy OMR 100,000 face value scheme, what is the annual premium using a straight life scheme? How much does it differ from 10-year fixed rate premium? (I Mark) ii) Ms. Noora is a friend of Ms. Noha. She is 60 years old and wants to buy OMR 100,000 face value policy and pay premium quarterly, how much will be the premium using 10-year fixed rate policy? (1 Mark) iii) Compare the straight life and 10-year fixed rate policy in the above two case. Which is comfortable to the customers? Why? (2 Marks) iv) Instead of buying insurance for retirement, if Ms.Noora invests OMR 50,000 now at 6 % compounded semi-annually, how much will be in her account after 5 years? (2 Marks) v) If Ms.Noora invests OMR 50,000 now at 6% simple interest annually, how much will be in her account after 5 years? (2 Marks) vi) As an investor which method of interest is more beneficial to Ms.Noora? Justify your answer. (2 Marks) Page 317 CASE 3 Woodlands Restaurant widely recognized for its famous dishes and a track record spanning more than 3 decades in the Sultanate. The restaurant has enjoyed immense popularity among food connoisseurs, particularly among expats. It is also the perfect family restaurant where patrons love the service coming straight from the heart. After graduation Mr. Ali joined as a purchasing officer of the restaurant. The business is getting good customer support throughout Muscat. Due to the decline in demand caused by the epidemic, the restaurant is proposing measures to cut cost. The manager asked Mr. Ali to look for a cheaper source of raw materials. The restaurant always avails of trade and cash discount. Mr. Ali decided to call the suppliers and gathered the following data; A. Spar Darsait - offers chain discount of 14/7/3. B. Badriya Foods and Trading Enterprises- offers Single Equivalent Discount series of 7.5%, 9.5%, and 2% Question No-3 i) The restaurant decides to buy foodstuff worth OMR 4,500 from Spar Darsait, how much will be the discount? How much does it cost the restaurant? (3 Marks) ii) When the Restaurant wants to buy OMR 4,500 of Badriya Foods and Trading Enterprise's groceries, how much the restaurant will pay? (3 Marks) iii) Which one of the above two companies is giving more discount? Why? Justify your answer. (2Marks) iv) A retailer from Ibra, purchased 200 units of a stationary item from Badriya Foods and Trading Enterprises costing OMR 3 per unit (excluding VAT). The Badriya Foods, on the other hand, bought the same item from a manufacturer, paying OMR 2.5 per unit. VAT is paid extra. Rate of tax is 8%. Compare input tax and output tax. (2 Marks) Page 517 CASE 1 Dhofar Insurance Company has offered a wide selection of Life and General Insurance Products to its satisfied customers. The company provided the following information about a policy. It shows that the premium payment depends on many variables such as age, gender, face value of policy and frequency of premium payment. 20 30 40 50 60 10-Year Fixed Rate Mak Female 1.21 1.17 1.27 1.23 1.46 2.41 233 4.72 20-Year Fixed Rate Make Femak 182 176 1.91 185 2.20 2.13 3.63 3.51 7.11 Straight-Life Make Female 2.72 263 3.38 3.88 5.18 501 821 793 1.41 Period Semiannually Quarterly Monthly Percent of Annual Premium 51.00 26.00 8.75 Question No-1 i) Ms. Noha is a 60-year-old female and want to buy OMR 100,000 face value scheme, what is the annual premium using a straight life scheme? How much does it differ from 10-year fixed rate premium? (I Mark) ii) Ms. Noora is a friend of Ms. Noha. She is 60 years old and wants to buy OMR 100,000 face value policy and pay premium quarterly, how much will be the premium using 10-year fixed rate policy? (1 Mark) iii) Compare the straight life and 10-year fixed rate policy in the above two case. Which is comfortable to the customers? Why? (2 Marks) iv) Instead of buying insurance for retirement, if Ms.Noora invests OMR 50,000 now at 6 % compounded semi-annually, how much will be in her account after 5 years? (2 Marks) v) If Ms.Noora invests OMR 50,000 now at 6% simple interest annually, how much will be in her account after 5 years? (2 Marks) vi) As an investor which method of interest is more beneficial to Ms.Noora? Justify your answer. (2 Marks) Page 317 CASE 3 Woodlands Restaurant widely recognized for its famous dishes and a track record spanning more than 3 decades in the Sultanate. The restaurant has enjoyed immense popularity among food connoisseurs, particularly among expats. It is also the perfect family restaurant where patrons love the service coming straight from the heart. After graduation Mr. Ali joined as a purchasing officer of the restaurant. The business is getting good customer support throughout Muscat. Due to the decline in demand caused by the epidemic, the restaurant is proposing measures to cut cost. The manager asked Mr. Ali to look for a cheaper source of raw materials. The restaurant always avails of trade and cash discount. Mr. Ali decided to call the suppliers and gathered the following data; A. Spar Darsait - offers chain discount of 14/7/3. B. Badriya Foods and Trading Enterprises- offers Single Equivalent Discount series of 7.5%, 9.5%, and 2% Question No-3 i) The restaurant decides to buy foodstuff worth OMR 4,500 from Spar Darsait, how much will be the discount? How much does it cost the restaurant? (3 Marks) ii) When the Restaurant wants to buy OMR 4,500 of Badriya Foods and Trading Enterprise's groceries, how much the restaurant will pay? (3 Marks) iii) Which one of the above two companies is giving more discount? Why? Justify your answer. (2Marks) iv) A retailer from Ibra, purchased 200 units of a stationary item from Badriya Foods and Trading Enterprises costing OMR 3 per unit (excluding VAT). The Badriya Foods, on the other hand, bought the same item from a manufacturer, paying OMR 2.5 per unit. VAT is paid extra. Rate of tax is 8%. Compare input tax and output tax. (2 Marks) Page 517