Answered step by step

Verified Expert Solution

Question

1 Approved Answer

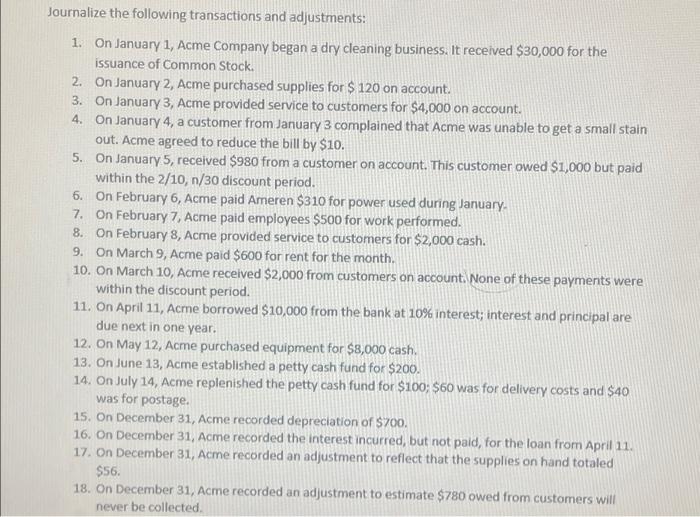

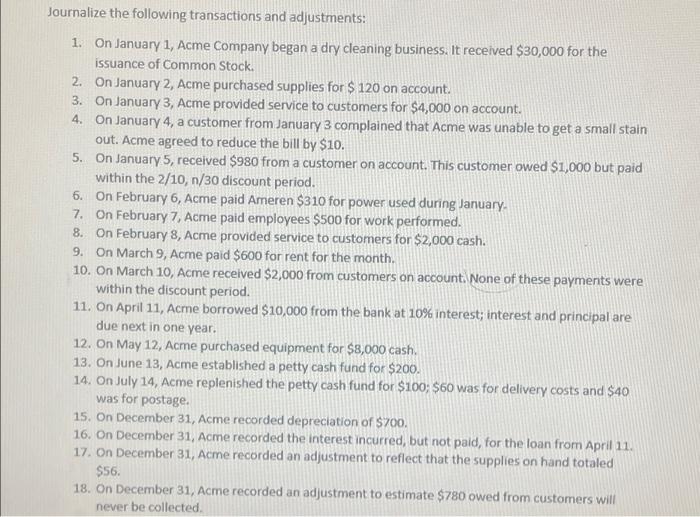

need help 1-18 Journalize the following transactions and adjustments: 1. On January 1, Acme Company began a dry cleaning business. It received $30,000 for the

need help 1-18

Journalize the following transactions and adjustments: 1. On January 1, Acme Company began a dry cleaning business. It received $30,000 for the issuance of Common Stock. 2. On January 2, Acme purchased supplies for $ 120 on account. 3. On January 3, Acme provided service to customers for $4,000 on account. 4. On January 4, a customer from January 3 complained that Acme was unable to get a small stain out. Acme agreed to reduce the bill by $10. 5. On January 5, received $980 from a customer on account. This customer owed $1,000 but paid within the 2/10, n/30 discount period. 6. On February 6, Acme paid Ameren $310 for power used during January 7. On February 7, Acme paid employees $500 for work performed. 8. On February 8, Acme provided service to customers for $2,000 cash. 9. On March 9, Acme paid $600 for rent for the month. 10. On March 10, Acme received $2,000 from customers on account. None of these payments were within the discount period. 11. On April 11, Acme borrowed $10,000 from the bank at 10% interest; interest and principal are due next in one year. 12. On May 12, Acme purchased equipment for $8,000 cash. 13. On June 13, Acme established a petty cash fund for $200. 14. On July 14, Acme replenished the petty cash fund for $100; $60 was for delivery costs and $40 was for postage. 15. On December 31, Acme recorded depreciation of $700. 16. On December 31, Acme recorded the interest incurred, but not paid, for the loan from April 11. 17. On December 31, Acme recorded an adjustment to reflect that the supplies on hand totaled $56. 18. On December 31, Acme recorded an adjustment to estimate $780 owed from customers will never be collected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started