Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE 1 Foodie Corporation After being inspired by a movie showcasing a young woman who left her successful corporate career to launch a thriving baby

CASE

Foodie Corporation

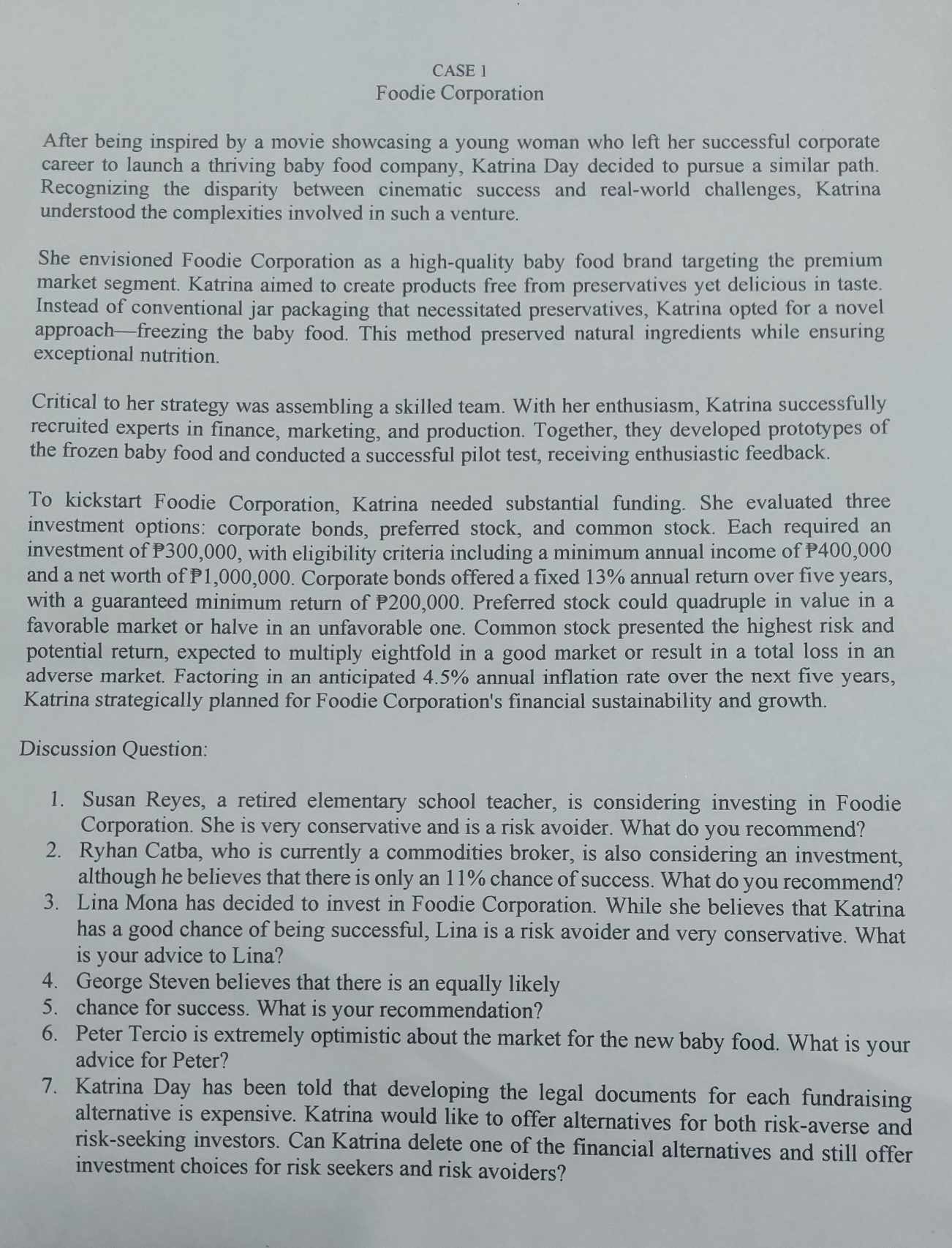

After being inspired by a movie showcasing a young woman who left her successful corporate

career to launch a thriving baby food company, Katrina Day decided to pursue a similar path.

Recognizing the disparity between cinematic success and realworld challenges, Katrina

understood the complexities involved in such a venture.

She envisioned Foodie Corporation as a highquality baby food brand targeting the premium

market segment. Katrina aimed to create products free from preservatives yet delicious in taste.

Instead of conventional jar packaging that necessitated preservatives, Katrina opted for a novel

approachfreezing the baby food. This method preserved natural ingredients while ensuring

exceptional nutrition.

Critical to her strategy was assembling a skilled team. With her enthusiasm, Katrina successfully

recruited experts in finance, marketing, and production. Together, they developed prototypes of

the frozen baby food and conducted a successful pilot test, receiving enthusiastic feedback.

To kickstart Foodie Corporation, Katrina needed substantial funding. She evaluated three

investment options: corporate bonds, preferred stock, and common stock. Each required an

investment of with eligibility criteria including a minimum annual income of

and a net worth of Corporate bonds offered a fixed annual return over five years,

with a guaranteed minimum return of Preferred stock could quadruple in value in a

favorable market or halve in an unfavorable one. Common stock presented the highest risk and

potential return, expected to multiply eightfold in a good market or result in a total loss in an

adverse market. Factoring in an anticipated annual inflation rate over the next five years,

Katrina strategically planned for Foodie Corporation's financial sustainability and growth.

Discussion Question:

Susan Reyes, a retired elementary school teacher, is considering investing in Foodie

Corporation. She is very conservative and is a risk avoider. What do you recommend?

Ryhan Catba, who is currently a commodities broker, is also considering an investment,

although he believes that there is only an chance of success. What do you recommend?

Lina Mona has decided to invest in Foodie Corporation. While she believes that Katrina

has a good chance of being successful, Lina is a risk avoider and very conservative. What

is your advice to Lina?

George Steven believes that there is an equally likely

chance for success. What is your recommendation?

Peter Tercio is extremely optimistic about the market for the new baby food. What is your

advice for Peter?

Katrina Day has been told that developing the legal documents for each fundraising

alternative is expensive. Katrina would like to offer alternatives for both riskaverse and

riskseeking investors. Can Katrina delete one of the financial alternatives and still offer

investment choices for risk seekers and risk avoiders?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started