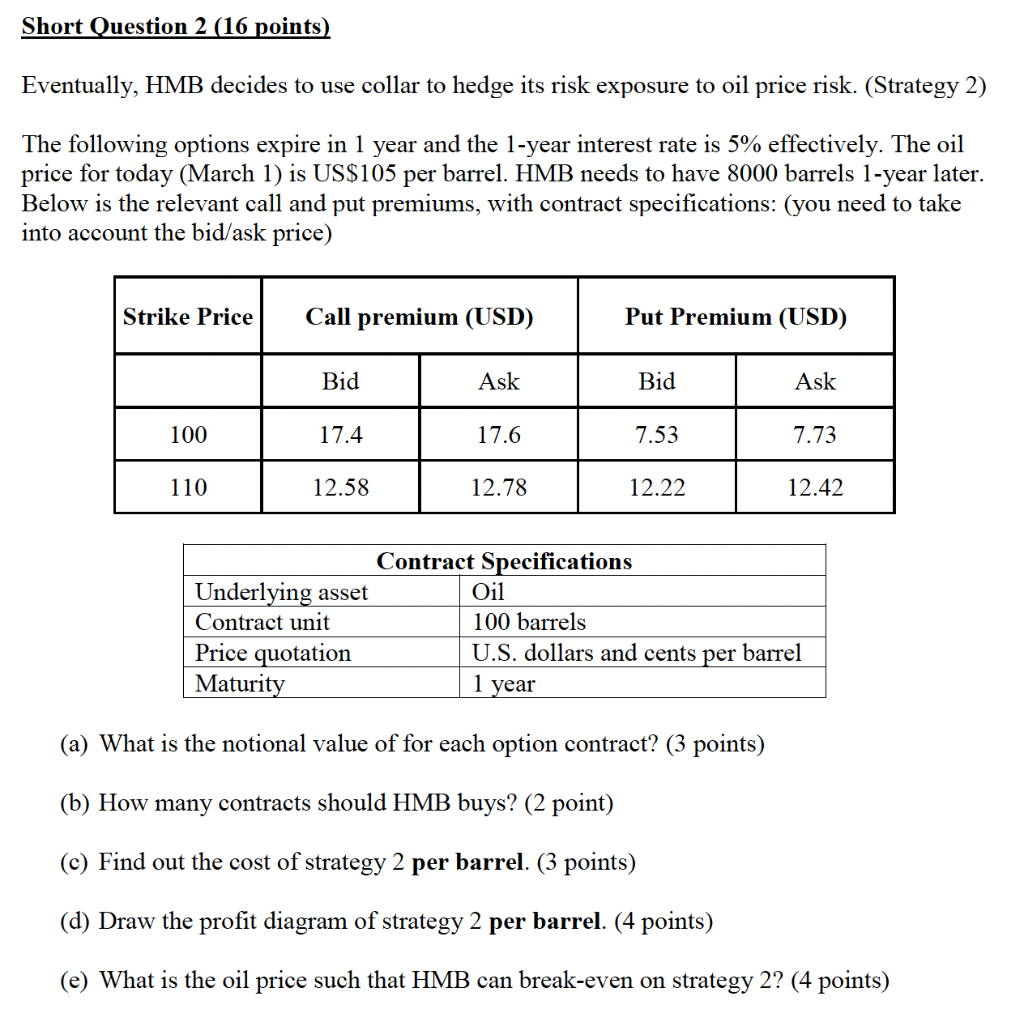

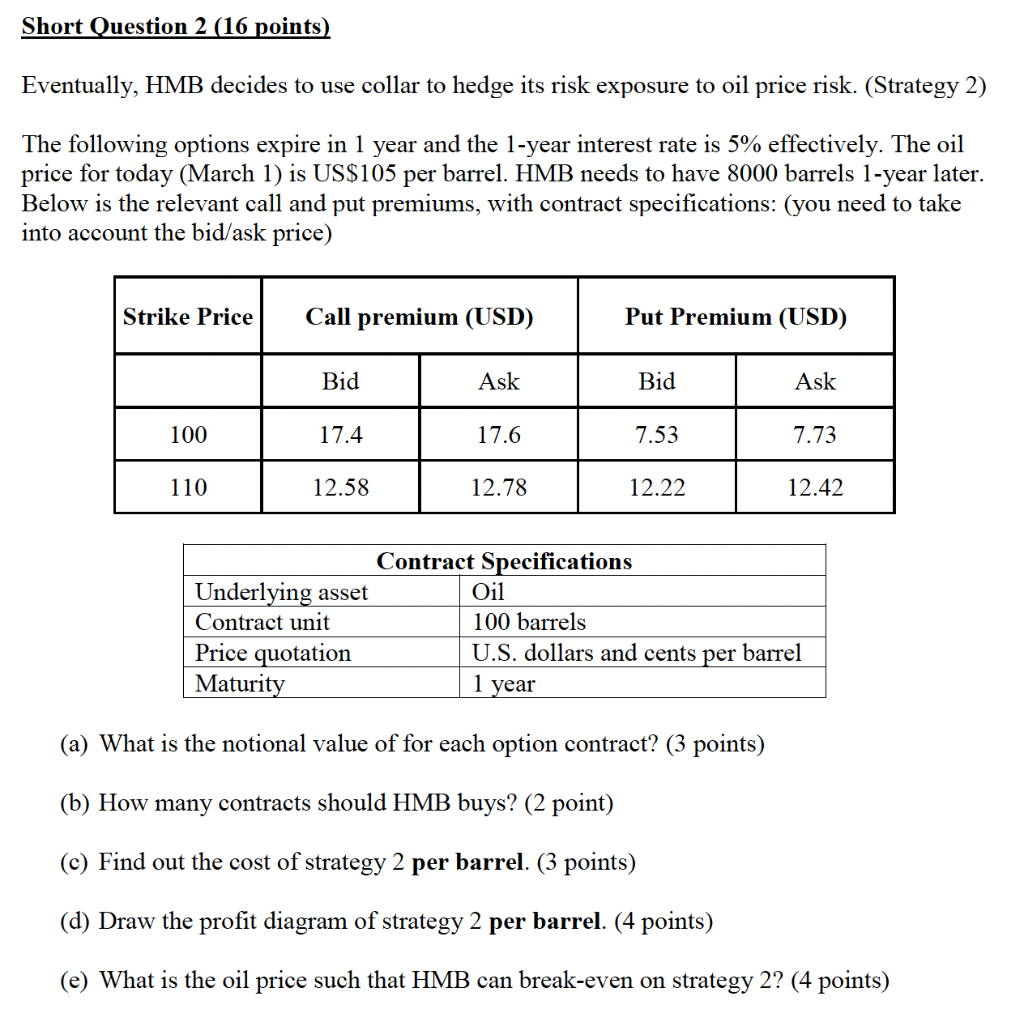

Case 1 Hong Kong Motor Bus Company Hong Kong Motor Bus Company (HMB) is your client and operates most bus routes in Hong Kong. With the war in Ukraine, the oil price has been very volatile and appears to have a upward trend recently. HMB has come to you for advice in risk management./ First of all, HMB buys oil in operation. They are considering whether or not to hedge their oil price risk. You explained to them what the advantages of hedging are and also explained reasons not to hedge. Short Question 2 (16 points) Eventually, HMB decides to use collar to hedge its risk exposure to oil price risk. (Strategy 2) The following options expire in 1 year and the 1-year interest rate is 5% effectively. The oil price for today (March 1) is US$105 per barrel. HMB needs to have 8000 barrels 1-year later. Below is the relevant call and put premiums, with contract specifications: (you need to take into account the bid/ask price) Strike Price Call premium (USD) Put Premium (USD) Bid Ask Bid Ask 100 17.4 17.6 7.53 7.73 110 12.58 12.78 12.22 12.42 Contract Specifications Underlying asset Oil Contract unit 100 barrels Price quotation U.S. dollars and cents per barrel Maturity 1 year (a) What is the notional value of for each option contract? (3 points) (b) How many contracts should HMB buys? (2 point) (c) Find out the cost of strategy 2 per barrel. (3 points) (d) Draw the profit diagram of strategy 2 per barrel. (4 points) (e) What is the oil price such that HMB can break-even on strategy 2? (4 points) Case 1 Hong Kong Motor Bus Company Hong Kong Motor Bus Company (HMB) is your client and operates most bus routes in Hong Kong. With the war in Ukraine, the oil price has been very volatile and appears to have a upward trend recently. HMB has come to you for advice in risk management./ First of all, HMB buys oil in operation. They are considering whether or not to hedge their oil price risk. You explained to them what the advantages of hedging are and also explained reasons not to hedge. Short Question 2 (16 points) Eventually, HMB decides to use collar to hedge its risk exposure to oil price risk. (Strategy 2) The following options expire in 1 year and the 1-year interest rate is 5% effectively. The oil price for today (March 1) is US$105 per barrel. HMB needs to have 8000 barrels 1-year later. Below is the relevant call and put premiums, with contract specifications: (you need to take into account the bid/ask price) Strike Price Call premium (USD) Put Premium (USD) Bid Ask Bid Ask 100 17.4 17.6 7.53 7.73 110 12.58 12.78 12.22 12.42 Contract Specifications Underlying asset Oil Contract unit 100 barrels Price quotation U.S. dollars and cents per barrel Maturity 1 year (a) What is the notional value of for each option contract? (3 points) (b) How many contracts should HMB buys? (2 point) (c) Find out the cost of strategy 2 per barrel. (3 points) (d) Draw the profit diagram of strategy 2 per barrel. (4 points) (e) What is the oil price such that HMB can break-even on strategy 2? (4 points)