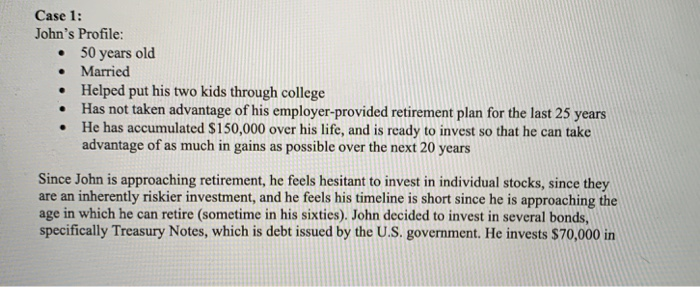

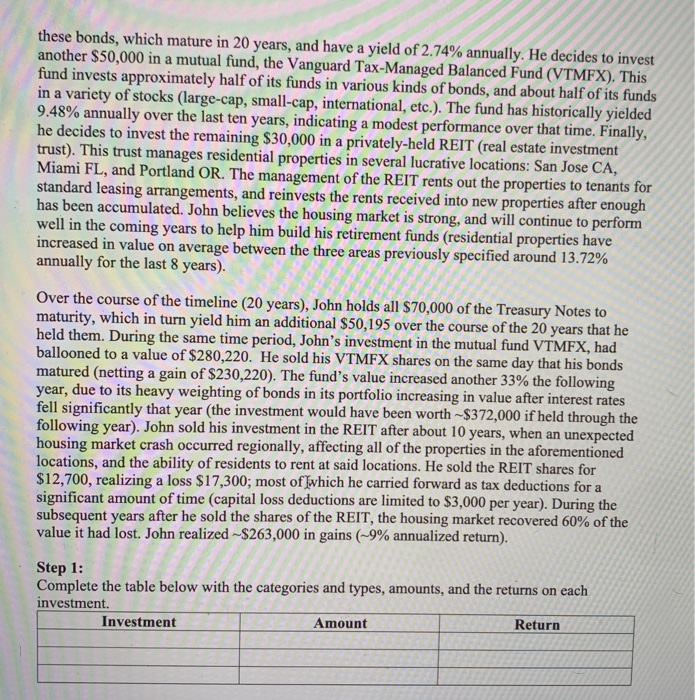

Case 1: John's Profile: 50 years old Married Helped put his two kids through college Has not taken advantage of his employer-provided retirement plan for the last 25 years He has accumulated $150,000 over his life, and is ready to invest so that he can take advantage of as much in gains as possible over the next 20 years Since John is approaching retirement, he feels hesitant to invest in individual stocks, since they are an inherently riskier investment, and he feels his timeline is short since he is approaching the age in which he can retire (sometime in his sixties). John decided to invest in several bonds, specifically Treasury Notes, which is debt issued by the U.S. government. He invests $70,000 in these bonds, which mature in 20 years, and have a yield of 2.74% annually. He decides to invest another $50,000 in a mutual fund, the Vanguard Tax-Managed Balanced Fund (VTMFX). This fund invests approximately half of its funds in various kinds of bonds, and about half of its funds in a variety of stocks (large-cap, small-cap, international, etc.). The fund has historically yielded 9.48% annually over the last ten years, indicating a modest performance over that time. Finally, he decides to invest the remaining $30,000 in a privately held REIT (real estate investment trust). This trust manages residential properties in several lucrative locations: San Jose CA, Miami FL, and Portland OR. The management of the REIT rents out the properties to tenants for standard leasing arrangements, and reinvests the rents received into new properties after enough has been accumulated. John believes the housing market is strong, and will continue to perform well in the coming years to help him build his retirement funds (residential properties have increased in value on average between the three areas previously specified around 13.72% annually for the last 8 years). Over the course of the timeline (20 years), John holds all $70,000 of the Treasury Notes to maturity, which in turn yield him an additional $50,195 over the course of the 20 years that he held them. During the same time period, John's investment in the mutual fund VTMFX, had ballooned to a value of $280,220. He sold his VTMFX shares on the same day that his bonds matured (netting a gain of $230,220). The fund's value increased another 33% the following year, due to its heavy weighting of bonds in its portfolio increasing in value after interest rates fell significantly that year (the investment would have been worth -$372,000 if held through the following year). John sold his investment in the REIT after about 10 years, when an unexpected housing market crash occurred regionally, affecting all of the properties in the aforementioned locations, and the ability of residents to rent at said locations. He sold the REIT shares for $12,700, realizing a loss $17,300; most of which he carried forward as tax deductions for a significant amount of time (capital loss deductions are limited to $3,000 per year). During the subsequent years after he sold the shares of the REIT, the housing market recovered 60% of the value it had lost. John realized -$263,000 in gains (-9% annualized return). Step 1: Complete the table below with the categories and types, amounts, and the returns on each investment Investment Amount Return