Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 1: Lionel operates a commercial cleaning business under the name Nettoyage Lionel >> as an unincorporated sole proprietor. The company's office and commercial

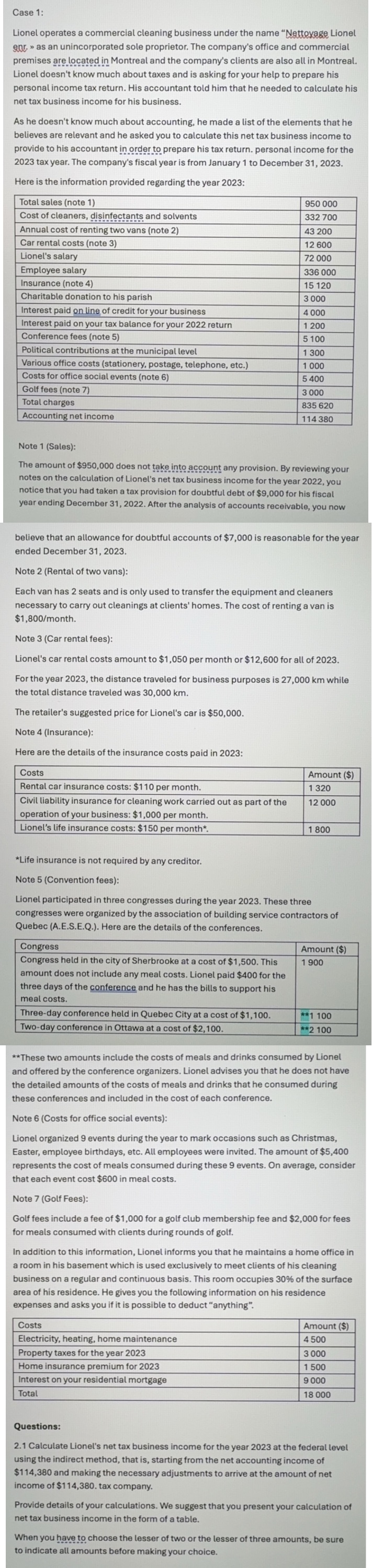

Case 1: Lionel operates a commercial cleaning business under the name "Nettoyage Lionel >> as an unincorporated sole proprietor. The company's office and commercial premises are located in Montreal and the company's clients are also all in Montreal. Lionel doesn't know much about taxes and is asking for your help to prepare his personal income tax return. His accountant told him that he needed to calculate his net tax business income for his business. As he doesn't know much about accounting, he made a list of the elements that he believes are relevant and he asked you to calculate this net tax business income to provide to his accountant in order to prepare his tax return. personal income for the 2023 tax year. The company's fiscal year is from January 1 to December 31, 2023. Here is the information provided regarding the year 2023: Total sales (note 1) Cost of cleaners, disinfectants and solvents Annual cost of renting two vans (note 2) Car rental costs (note 3) Lionel's salary Employee salary 950 000 332 700 43 200 12 600 72 000 336 000 Insurance (note 4) Charitable donation to his parish 15 120 3 000 Interest paid on line of credit for your business 4 000 Interest paid on your tax balance for your 2022 return 1 200 Conference fees (note 5) 5 100 1 300 1000 Political contributions at the municipal level Various office costs (stationery, postage, telephone, etc.) Costs for office social events (note 6) Golf fees (note 7) Total charges Accounting net income Note 1 (Sales): 5 400 3 000 835 620 114 380 The amount of $950,000 does not take into account any provision. By reviewing your notes on the calculation of Lionel's net tax business income for the year 2022, you notice that you had taken a tax provision for doubtful debt of $9,000 for his fiscal year ending December 31, 2022. After the analysis of accounts receivable, you now believe that an allowance for doubtful accounts of $7,000 is reasonable for the year ended December 31, 2023. Note 2 (Rental of two vans): Each van has 2 seats and is only used to transfer the equipment and cleaners necessary to carry out cleanings at clients' homes. The cost of renting a van is $1,800/month. Note 3 (Car rental fees): Lionel's car rental costs amount to $1,050 per month or $12,600 for all of 2023. For the year 2023, the distance traveled for business purposes is 27,000 km while the total distance traveled was 30,000 km. The retailer's suggested price for Lionel's car is $50,000. Note 4 (Insurance): Here are the details of the insurance costs paid in 2023: Costs Rental car insurance costs: $110 per month. Amount ($) 1320 Civil liability insurance for cleaning work carried out as part of the 12 000 operation of your business: $1,000 per month. Lionel's life insurance costs: $150 per month*. *Life insurance is not required by any creditor. Note 5 (Convention fees): 1.800 Lionel participated in three congresses during the year 2023. These three congresses were organized by the association of building service contractors of Quebec (A.E.S.E.Q.). Here are the details of the conferences. Congress Congress held in the city of Sherbrooke at a cost of $1,500. This amount does not include any meal costs. Lionel paid $400 for the three days of the conference and he has the bills to support his meal costs. Amount ($) 1900 Three-day conference held in Quebec City at a cost of $1,100. Two-day conference in Ottawa at a cost of $2,100. **1 100 **2 100 **These two amounts include the costs of meals and drinks consumed by Lionel and offered by the conference organizers. Lionel advises you that he does not have the detailed amounts of the costs of meals and drinks that he consumed during these conferences and included in the cost of each conference. Note 6 (Costs for office social events): Lionel organized 9 events during the year to mark occasions such as Christmas, Easter, employee birthdays, etc. All employees were invited. The amount of $5,400 represents the cost of meals consumed during these 9 events. On average, consider that each event cost $600 in meal costs. Note 7 (Golf Fees): Golf fees include a fee of $1,000 for a golf club membership fee and $2,000 for fees for meals consumed with clients during rounds of golf. In addition to this information, Lionel informs you that he maintains a home office in a room in his basement which is used exclusively to meet clients of his cleaning business on a regular and continuous basis. This room occupies 30% of the surface area of his residence. He gives you the following information on his residence expenses and asks you if it is possible to deduct "anything". Costs Electricity, heating, home maintenance Property taxes for the year 2023 Home insurance premium for 2023 Interest on your residential mortgage Total Amount ($) 4500 3 000 1 500 9000 18 000 Questions: 2.1 Calculate Lionel's net tax business income for the year 2023 at the federal level using the indirect method, that is, starting from the net accounting income of $114,380 and making the necessary adjustments to arrive at the amount of net income of $114,380. tax company. Provide details of your calculations. We suggest that you present your calculation of net tax business income in the form of a table. When you have to choose the lesser of two or the lesser of three amounts, be sure to indicate all amounts before making your choice.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started