Answered step by step

Verified Expert Solution

Question

1 Approved Answer

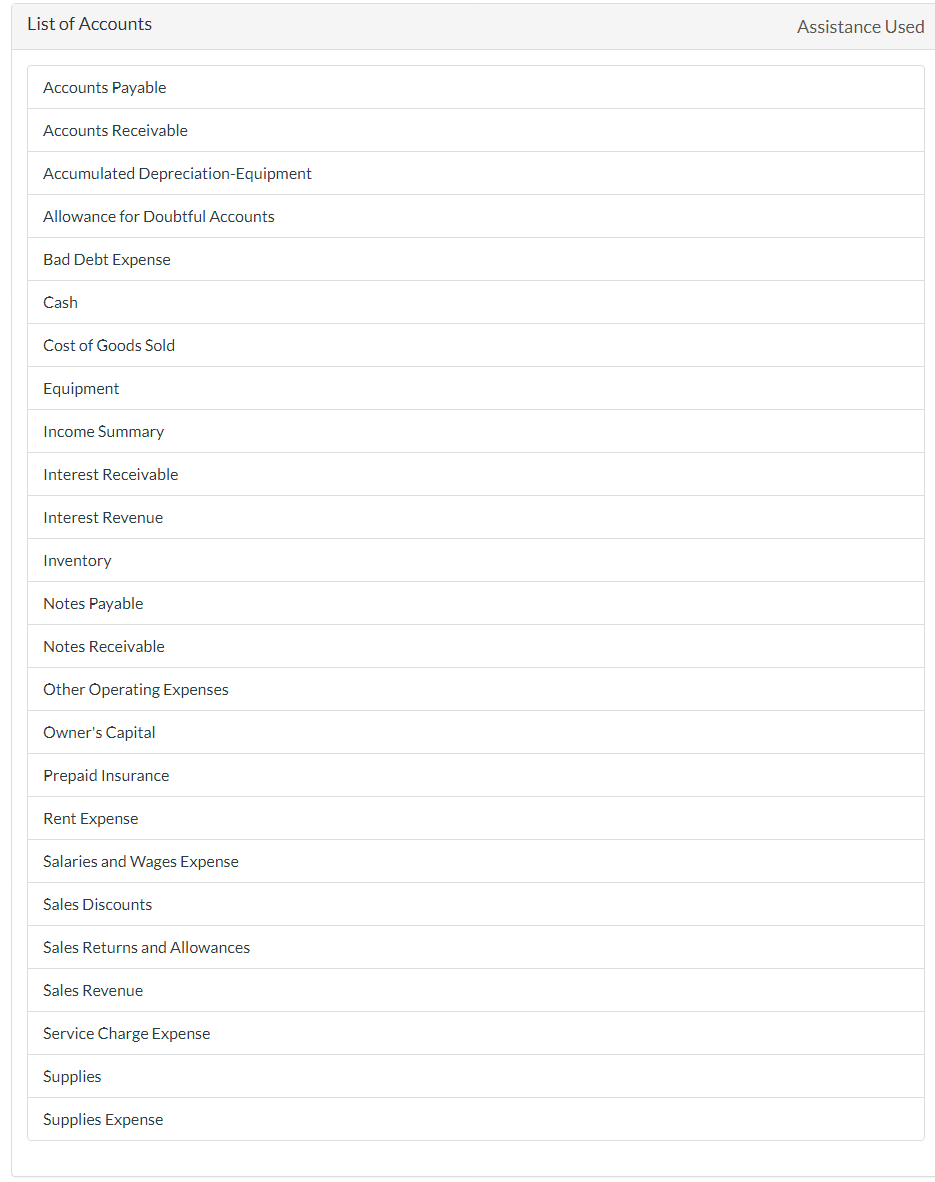

List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debt Expense Cash Cost of Goods Sold Equipment Income Summary

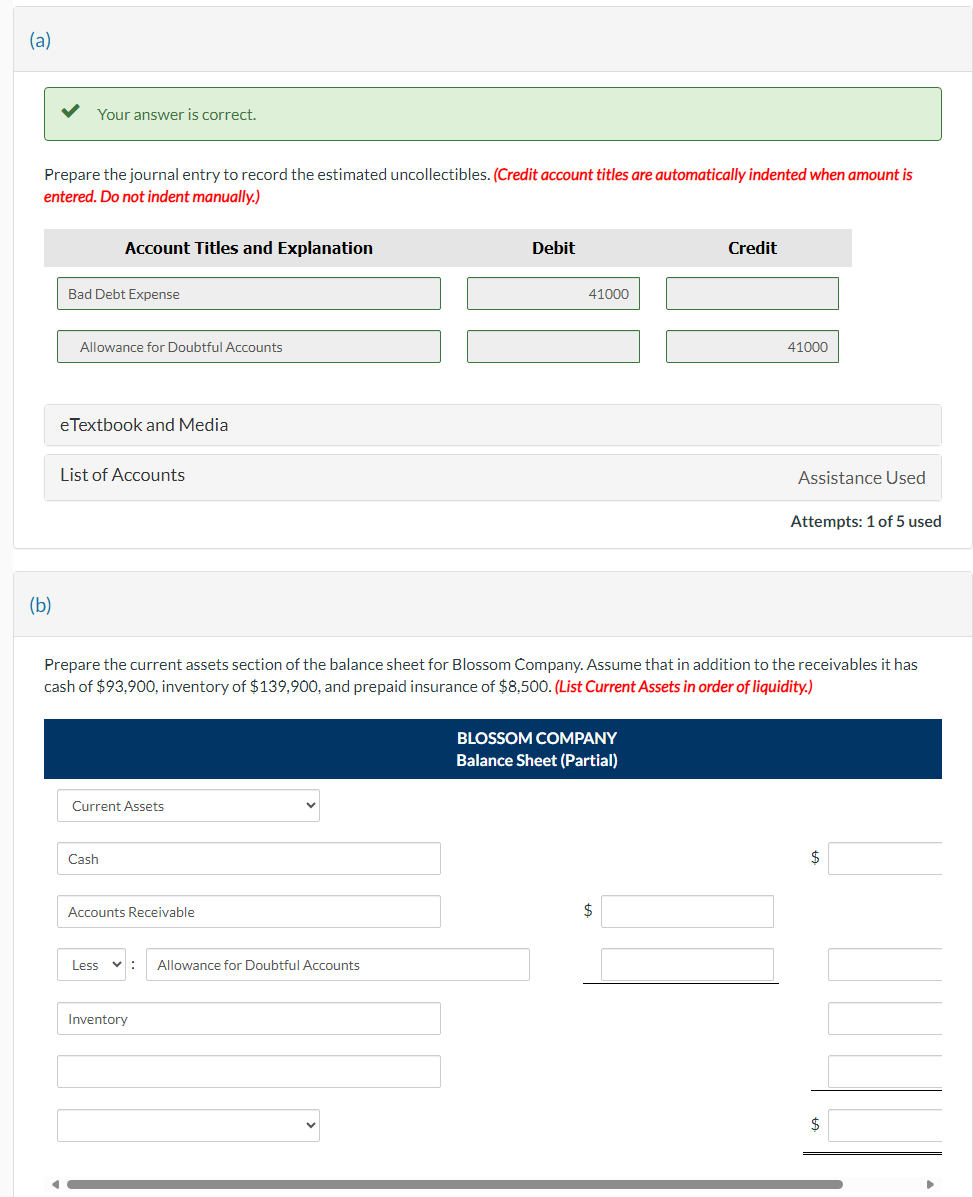

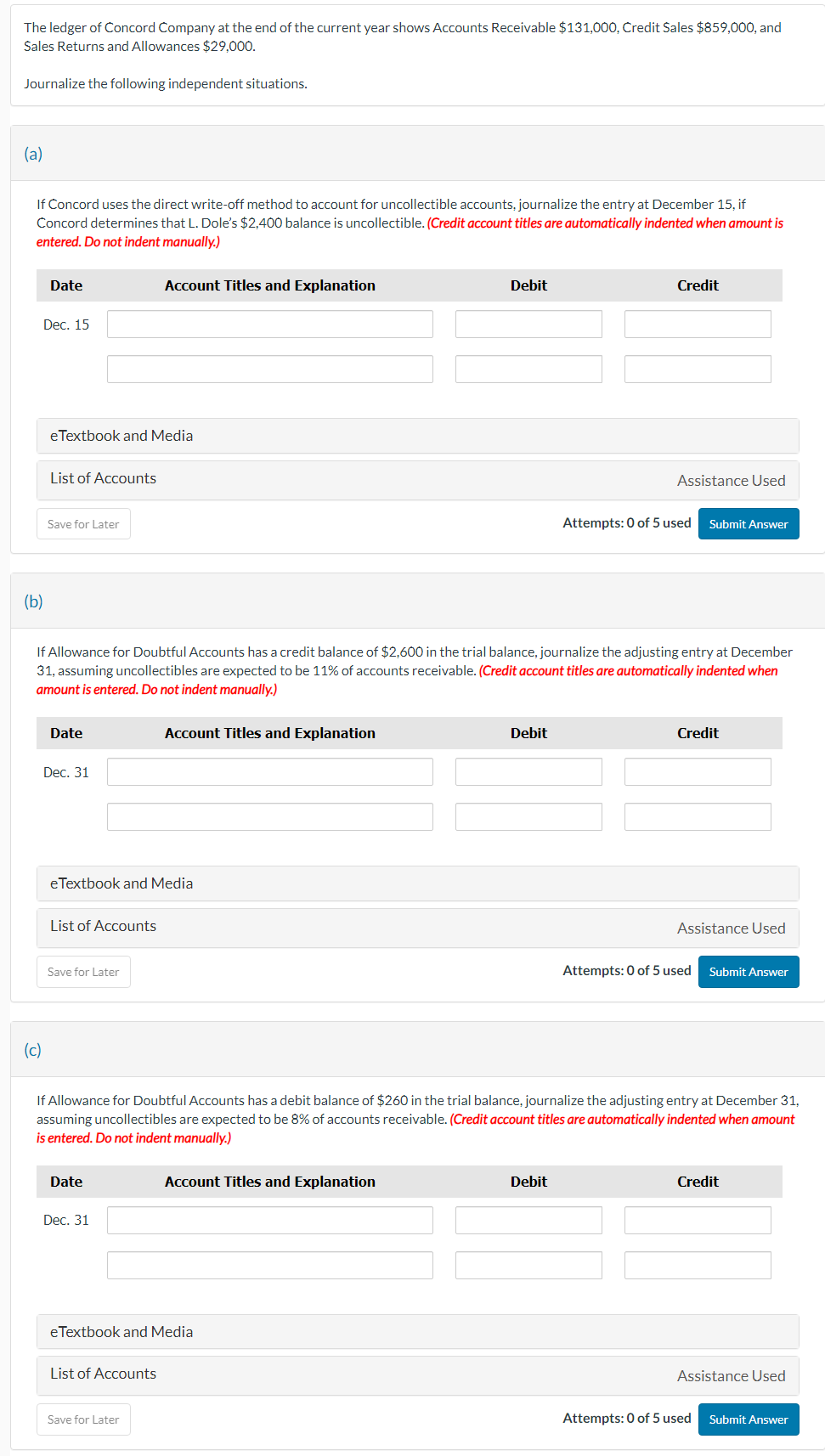

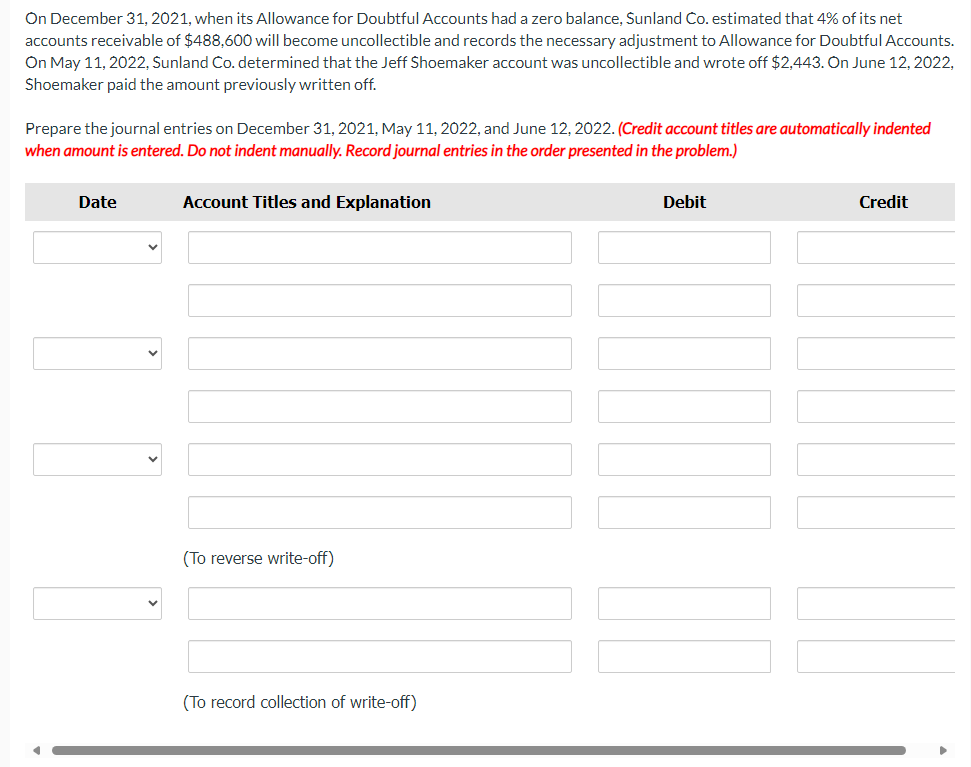

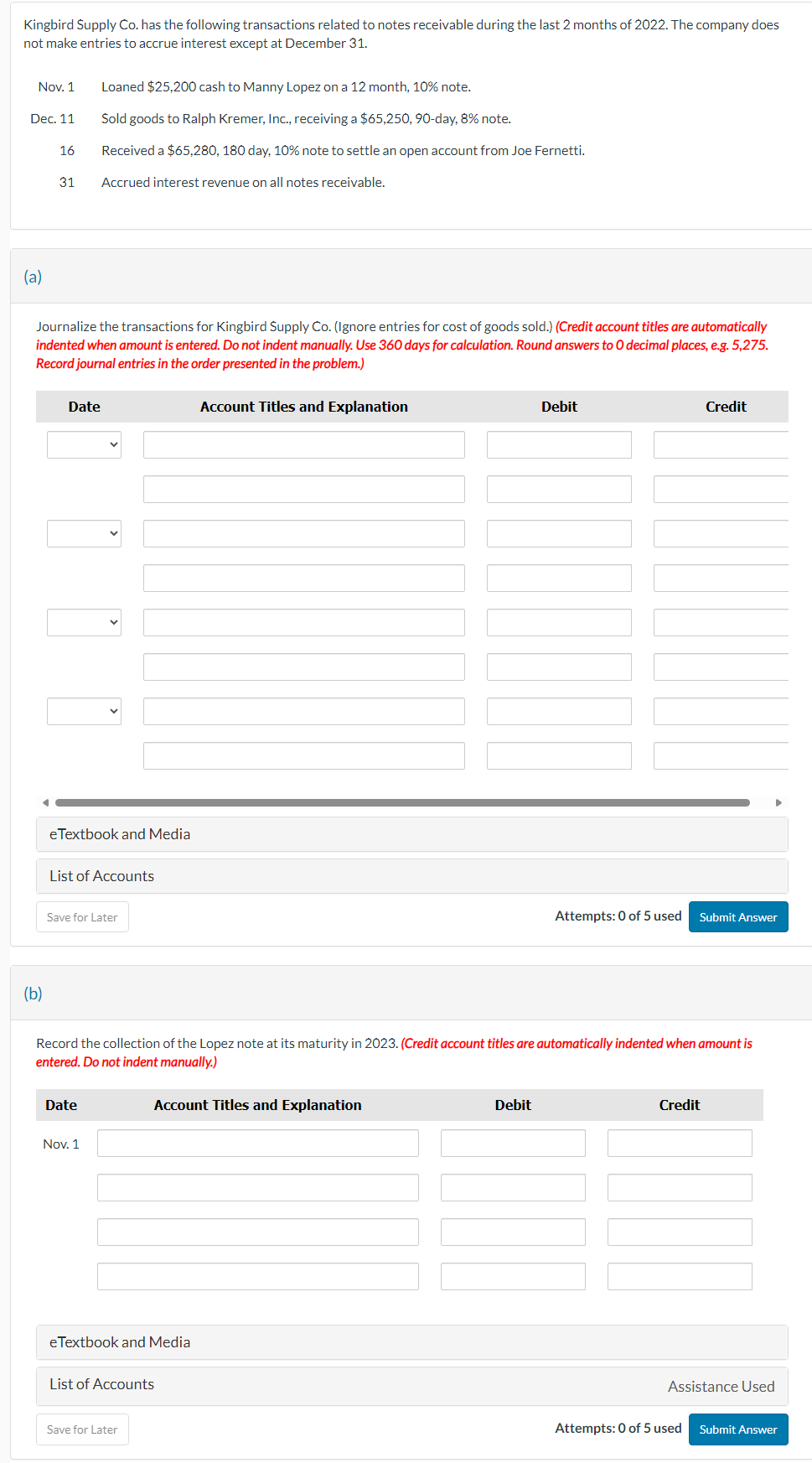

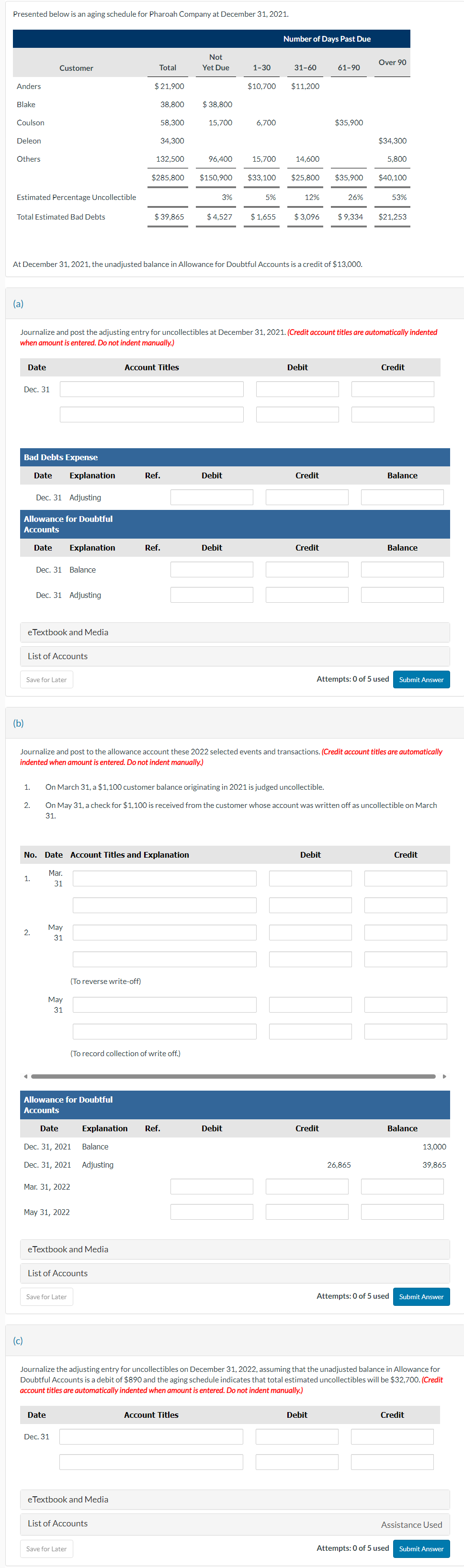

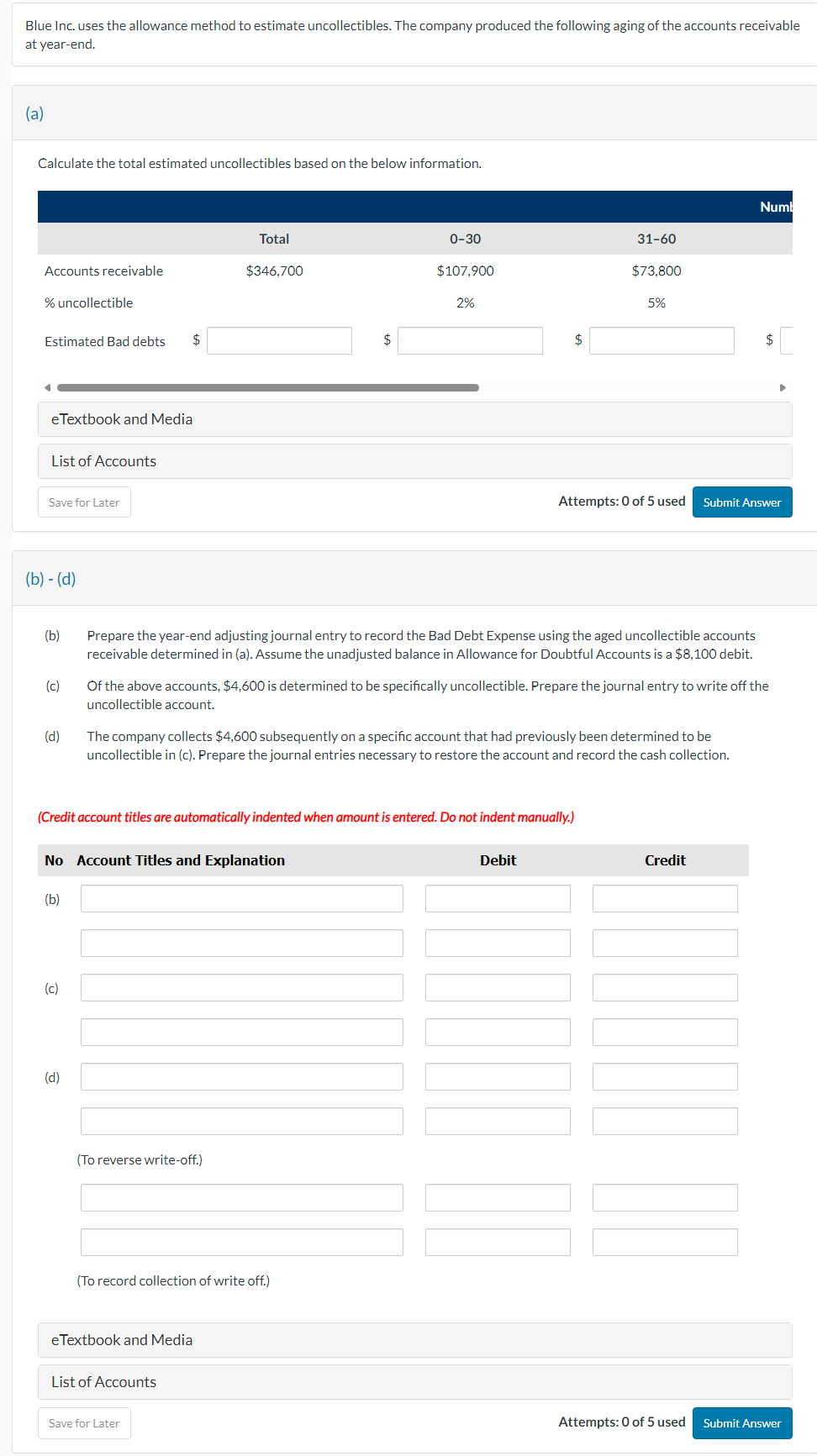

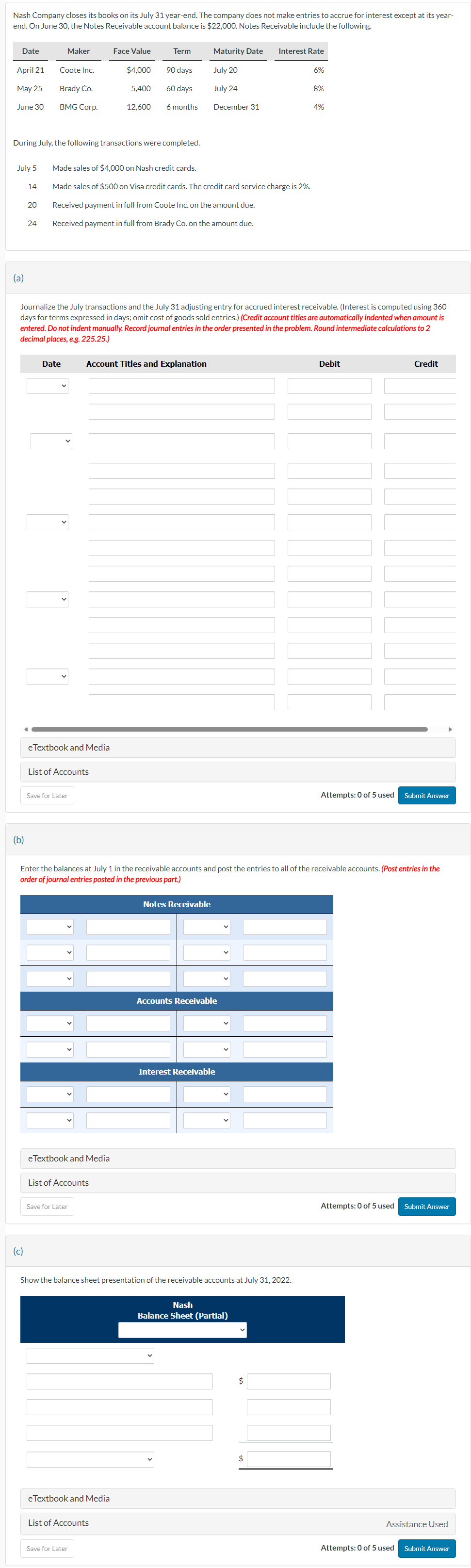

List of Accounts Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debt Expense Cash Cost of Goods Sold Equipment Income Summary Interest Receivable Interest Revenue Inventory Notes Payable Notes Receivable Other Operating Expenses Owner's Capital Prepaid Insurance Rent Expense Salaries and Wages Expense Sales Discounts Sales Returns and Allowances Sales Revenue Service Charge Expense Supplies Supplies Expense Assistance Used (a) Your answer is correct. Prepare the journal entry to record the estimated uncollectibles. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Account Titles and Explanation Bad Debt Expense Allowance for Doubtful Accounts eTextbook and Media List of Accounts Debit 41000 Credit 41000 Assistance Used Attempts: 1 of 5 used Prepare the current assets section of the balance sheet for Blossom Company. Assume that in addition to the receivables it has cash of $93,900, inventory of $139,900, and prepaid insurance of $8,500. (List Current Assets in order of liquidity.) Current Assets Cash Accounts Receivable Less Allowance for Doubtful Accounts Inventory BLOSSOM COMPANY Balance Sheet (Partial) $ $ $ The ledger of Concord Company at the end of the current year shows Accounts Receivable $131,000, Credit Sales $859,000, and Sales Returns and Allowances $29,000. Journalize the following independent situations. (a) If Concord uses the direct write-off method to account for uncollectible accounts, journalize the entry at December 15, if Concord determines that L. Dole's $2,400 balance is uncollectible. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Date Account Titles and Explanation Dec. 15 eTextbook and Media List of Accounts Save for Later Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer If Allowance for Doubtful Accounts has a credit balance of $2,600 in the trial balance, journalize the adjusting entry at December 31, assuming uncollectibles are expected to be 11% of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (c) Date Account Titles and Explanation Dec. 31 eTextbook and Media List of Accounts Save for Later Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer If Allowance for Doubtful Accounts has a debit balance of $260 in the trial balance, journalize the adjusting entry at December 31, assuming uncollectibles are expected to be 8% of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Dec. 31 eTextbook and Media List of Accounts Save for Later Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer On December 31, 2021, when its Allowance for Doubtful Accounts had a zero balance, Sunland Co. estimated that 4% of its net accounts receivable of $488,600 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. On May 11, 2022, Sunland Co. determined that the Jeff Shoemaker account was uncollectible and wrote off $2,443. On June 12, 2022, Shoemaker paid the amount previously written off. Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation (To reverse write-off) (To record collection of write-off) Debit Credit Kingbird Supply Co. has the following transactions related to notes receivable during the last 2 months of 2022. The company does not make entries to accrue interest except at December 31. Nov. 1 Loaned $25,200 cash to Manny Lopez on a 12 month, 10% note. Dec. 11 Sold goods to Ralph Kremer, Inc., receiving a $65,250, 90-day, 8% note. 16 Received a $65,280, 180 day, 10% note to settle an open account from Joe Fernetti. 31 Accrued interest revenue on all notes receivable. (a) Journalize the transactions for Kingbird Supply Co. (Ignore entries for cost of goods sold.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Use 360 days for calculation. Round answers to O decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) (b) Date eTextbook and Media List of Accounts Save for Later Account Titles and Explanation Debit Credit Attempts: 0 of 5 used Submit Answer Record the collection of the Lopez note at its maturity in 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Nov. 1 eTextbook and Media List of Accounts Save for Later Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer Presented below is an aging schedule for Pharoah Company at December 31, 2021. Number of Days Past Due Not Over 90 Customer Total Yet Due 1-30 31-60 61-90 Anders $ 21,900 $10,700 $11,200 Blake 38,800 $38,800 Coulson 58,300 15,700 6,700 $35,900 Deleon 34,300 $34,300 Others 132,500 96,400 15.700 14,600 5,800 $285,800 $150,900 $33,100 $25,800 $35,900 $40,100 Estimated Percentage Uncollectible 3% 5% 12% 26% 53% Total Estimated Bad Debts $39,865 $4,527 $ 1.655 $ 3,096 $9,334 $21,253 At December 31, 2021, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $13,000. (a) Journalize and post the adjusting entry for uncollectibles at December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (b) Date Dec. 31 Bad Debts Expense Date Account Titles Debit Credit Explanation Ref. Debit Credit Balance Dec. 31 Adjusting Allowance for Doubtful Accounts Date Explanation Ref. Debit Credit Balance Dec. 31 Balance Dec. 31 Adjusting eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Journalize and post to the allowance account these 2022 selected events and transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (c) 1. On March 31, a $1,100 customer balance originating in 2021 is judged uncollectible. 2. On May 31, a check for $1,100 is received from the customer whose account was written off as uncollectible on March 31. No. Date Account Titles and Explanation Mar. 1. 31 2. May 31 May 31 (To reverse write-off) (To record collection of write off.) Allowance for Doubtful Accounts Date Debit Credit Explanation Ref. Debit Credit Dec. 31, 2021 Balance Dec. 31, 2021 Adjusting Mar. 31, 2022 May 31, 2022 eTextbook and Media List of Accounts Save for Later 26,865 Balance 13,000 39,865 Attempts: 0 of 5 used Submit Answer Journalize the adjusting entry for uncollectibles on December 31, 2022, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $890 and the aging schedule indicates that total estimated uncollectibles will be $32,700. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Dec. 31 eTextbook and Media List of Accounts Save for Later Account Titles Debit Credit Assistance Used Attempts: 0 of 5 used Submit Answer Blue Inc. uses the allowance method to estimate uncollectibles. The company produced the following aging of the accounts receivable at year-end. (a) Calculate the total estimated uncollectibles based on the below information. Total Accounts receivable $346,700 % uncollectible Estimated Bad debts $ eTextbook and Media List of Accounts Save for Later (b) - (d) Numb 0-30 31-60 $107,900 $73,800 2% 5% $ $ $ Attempts: 0 of 5 used Submit Answer (b) (c) (d) Prepare the year-end adjusting journal entry to record the Bad Debt Expense using the aged uncollectible accounts receivable determined in (a). Assume the unadjusted balance in Allowance for Doubtful Accounts is a $8,100 debit. Of the above accounts, $4,600 is determined to be specifically uncollectible. Prepare the journal entry to write off the uncollectible account. The company collects $4,600 subsequently on a specific account that had previously been determined to be uncollectible in (c). Prepare the journal entries necessary to restore the account and record the cash collection. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No Account Titles and Explanation (b) (c) (d) (To reverse write-off.) (To record collection of write off.) eTextbook and Media List of Accounts Save for Later Debit Credit Attempts: 0 of 5 used Submit Answer Nash Company closes its books on its July 31 year-end. The company does not make entries to accrue for interest except at its year- end. On June 30, the Notes Receivable account balance is $22,000. Notes Receivable include the following. Date Maker Face Value Term Maturity Date Interest Rate April 21 May 25 June 30 Coote Inc. $4,000 90 days July 20 6% Brady Co. 5,400 60 days July 24 8% BMG Corp. 12,600 6 months December 31 4% During July, the following transactions were completed. July 5 Made sales of $4,000 on Nash credit cards. 14 Made sales of $500 on Visa credit cards. The credit card service charge is 2%. 20 Received payment in full from Coote Inc. on the amount due. 24 Received payment in full from Brady Co. on the amount due. (a) Journalize the July transactions and the July 31 adjusting entry for accrued interest receivable. (Interest is computed using 360 days for terms expressed in days; omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round intermediate calculations to 2 decimal places, e.g. 225.25.) (b) (c) Date Account Titles and Explanation eTextbook and Media List of Accounts Save for Later Debit Credit Attempts: 0 of 5 used Submit Answer Enter the balances at July 1 in the receivable accounts and post the entries to all of the receivable accounts. (Post entries in the order of journal entries posted in the previous part.) eTextbook and Media List of Accounts Save for Later Notes Receivable Accounts Receivable Interest Receivable Show the balance sheet presentation of the receivable accounts at July 31, 2022. Nash Balance Sheet (Partial) eTextbook and Media List of Accounts Save for Later $ $ Attempts: 0 of 5 used Submit Answer Assistance Used Attempts: 0 of 5 used Submit Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started