Question

CASE 1 Mr. Jasper Jay Rodavia, the CEO of Rodavia Corporation, rushingly went to his office and banged the door. Everyone in the office was

CASE 1

Mr. Jasper Jay Rodavia, the CEO of Rodavia Corporation, rushingly went to his office and banged the door. Everyone in the office was shocked because it has been the first time he acted like that since the business started its operations three years ago.

Jeremiah: Did you see that? I heard that the company had failed to earn profits since it started operating. From what Ive heard, we will be liable already to pay for taxes even if we cannot generate profits beginning the 4th year.

Rogue: Really? That is so awful. This must have been so stressful for Mr. Rodavia that is why he acted like that earlier.

Aldrin: I bet! I am also worried. What would happen to us now?! Are we going bankrupt? Huhu.

Rogue: Really now?? I think we can still do something to help Mr. Rodavia and the company reach greater heights. Right, Jeremiah?

Jeremiah: Yes, I actually can remember that we can do financial statement analysis to help forecast the companys financial health. I think we can do that now.

Aldrin: Okay, but we need the financial statement figures for the past three years. Do both of you have any idea where we can get it?

Rogue: I saw it in that filing cabinet. Ill ask the custodian to let us have a copy so we can start analyzing now.

*The three now were finally able to have a copy*

Jeremiah: Good job, Rogue! You are really as reliable as ever.

Rogue: Thats nothing! Haha!

Aldrin: Enough with the talk. Let us just start gathering data and analyzing now!

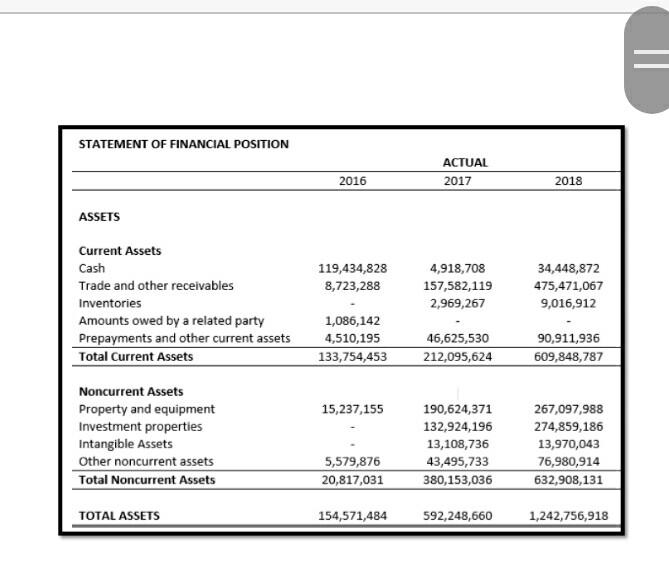

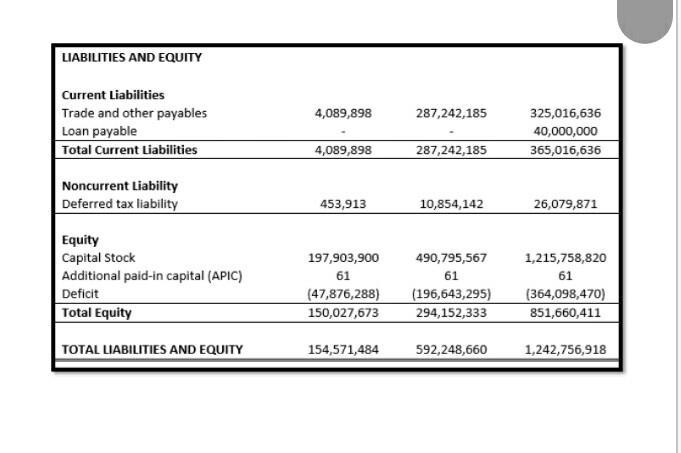

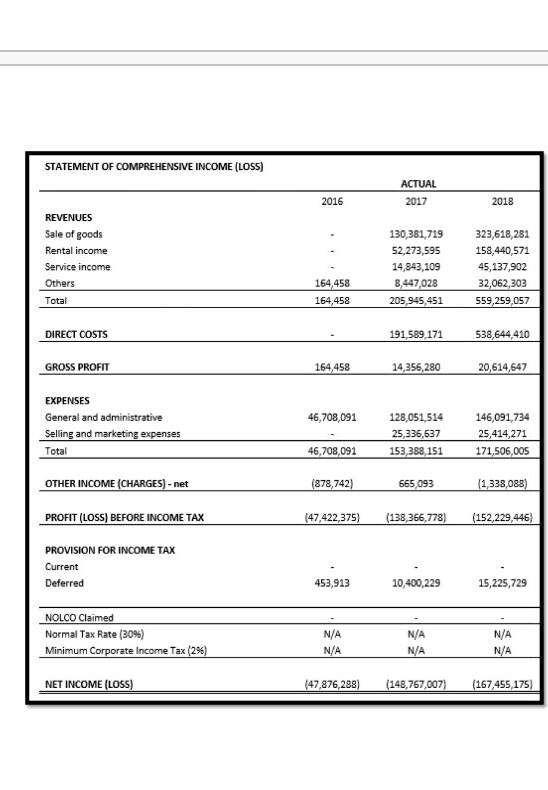

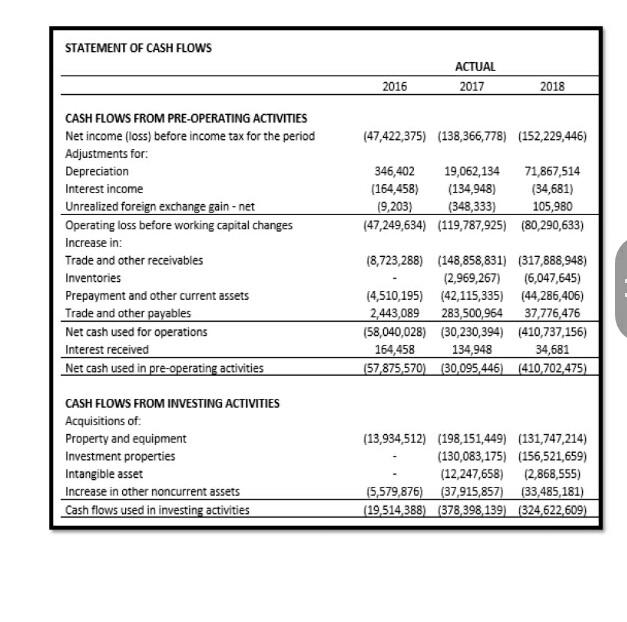

*The three came up with the summary of financial statement figures as shown on the next pages*

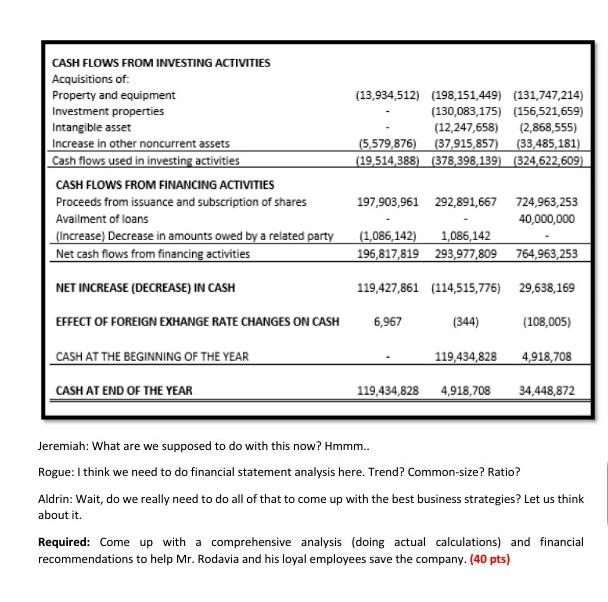

STATEMENT OF FINANCIAL POSITION ACTUAL 2017 2016 2018 ASSETS 119,434,828 8,723,288 Current Assets Cash Trade and other receivables Inventories Amounts owed by a related party Prepayments and other current assets Total Current Assets 4,918,708 157,582,119 2,969,267 34,448,872 475,471,067 9,016,912 1,086,142 4,510,195 133,754,453 46,625,530 212,095,624 90,911,936 609,848,787 15,237,155 Noncurrent Assets Property and equipment Investment properties Intangible Assets Other noncurrent assets Total Noncurrent Assets 190,624,371 132,924, 196 13,108,736 43,495,733 380,153,036 267,097,988 274,859,186 13,970,043 76,980,914 632,908,131 5,579,876 20,817,031 TOTAL ASSETS 154,571,484 592,248,660 1,242,756,918 LIABILITIES AND EQUITY 4,089,898 287,242,185 Current Liabilities Trade and other payables Loan payable Total Current Liabilities 325,016,636 40,000,000 365,016,636 4,089,898 287,242,185 Noncurrent liability Deferred tax liability 453,913 10,854,142 26,079,871 Equity Capital Stock Additional paid-in capital (APIC) Deficit Total Equity 197,903,900 61 (47,876,288) 150,027,673 490,795,567 61 (196,643,295) 294,152,333 1,215,758,820 61 (364,098,470) 851,660,411 TOTAL LIABILITIES AND EQUITY 154,571,484 592,248,660 1,242,756,918 STATEMENT OF COMPREHENSIVE INCOME (LOSS) ACTUAL 2017 2016 2018 REVENUES Sale of goods Rental income Service income Others Total 130,381,719 52,273,595 14,843,109 8,447,028 205,945,451 323,618,281 158,440,571 45,137,902 32,062,303 559,259,057 164,458 164,458 DIRECT COSTS 191.589,171 538,644,410 GROSS PROFIT 164,458 14,356,280 20,614,647 46,708,091 EXPENSES General and administrative Selling and marketing expenses Total 128,051,514 25,336,637 153,388,151 146,091,734 25,414,271 171,506,005 46,708,091 OTHER INCOME (CHARGES) - net (878,742) 665,093 (1,338,088) PROFIT (LOSS) BEFORE INCOME TAX (47,422,375) (138,356,778) (152,229,446 PROVISION FOR INCOME TAX Current Deferred 453,913 10,400,229 15,225,729 NOLCO Claimed Normal Tax Rate (30%) Minimum Corporate Income Tax (29) N/A N/A N/A N/A N/A N/A NET INCOME (LOSS) (47,876,288) (148,767,007) (167,455 175) STATEMENT OF CASH FLOWS ACTUAL 2017 2016 2018 (47,422,375) (138,366,778) (152,229,446) 346,402 19,062,134 71,867,514 (164,458) (134,948) (34,681) (9,203) (348,333) 105,980 (47,249,634) (119,787,925) (80,290,633) CASH FLOWS FROM PRE-OPERATING ACTIVITIES Net income (loss) before income tax for the period Adjustments for: Depreciation Interest income Unrealized foreign exchange gain - net Operating loss before working capital changes Increase in: Trade and other receivables Inventories Prepayment and other current assets Trade and other payables Net cash used for operations Interest received Net cash used in pre-operating activities (8,723,288) (148,858,831) (317,888,948) (2,969,267) (6,047,645) (4,510,195) (42,115,335) (44,286,406) 2,443,089 283,500,964 37,776,476 (58,040,028) (30,230,394) (410,737,156) 164,458 134,948 34,681 (57,875 570 (30,095,446 (410,702.475) CASH FLOWS FROM INVESTING ACTIVITIES Acquisitions of: Property and equipment Investment properties Intangible asset Increase in other noncurrent assets Cash flows used in investing activities (13,934,512) (198,151,449) (131,747,214) (130,083,175) (156,521,659) (12,247,658) (2,868,555) (5,579,876) (37,915,857) (33,485,181) (19,514,388) (378,398,139) (324,622,609) CASH FLOWS FROM INVESTING ACTIVITIES Acquisitions of: Property and equipment Investment properties Intangible asset Increase in other noncurrent assets Cash flows used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from issuance and subscription of shares Availment of loans (Increase) Decrease in amounts owed by a related party Net cash flows from financing activities (13,934,512) (198,151,449) (131,747,214) (130,083,175) (156,521,659) (12,247,658) (2,868,555) (5,579,876) (37,915,857) (33,485,181) (19,514,388) (378,398,139) (324,622,609) 197,903,961 292,891,667 724,963,253 40,000,000 (1,086,142) 1,086,142 196,817,819 293,977,809 764,963,253 NET INCREASE (DECREASE) IN CASH 119,427,861 (114,515,776) 29,638,169 EFFECT OF FOREIGN EXHANGE RATE CHANGES ON CASH 6,967 (344) (108,005) CASH AT THE BEGINNING OF THE YEAR 119,434,828 4,918,708 CASH AT END OF THE YEAR 119,434,828 4,918,708 34,448,872 Jeremiah: What are we supposed to do with this now? Hmmm.. Rogue: I think we need to do financial statement analysis here. Trend? Common-size? Ratio? Aldrin: Wait, do we really need to do all of that to come up with the best business strategies? Let us think about it. Required: Come up with a comprehensive analysis (doing actual calculations) and financial recommendations to help Mr. Rodavia and his loyal employees save the company. (40 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started