Answered step by step

Verified Expert Solution

Question

1 Approved Answer

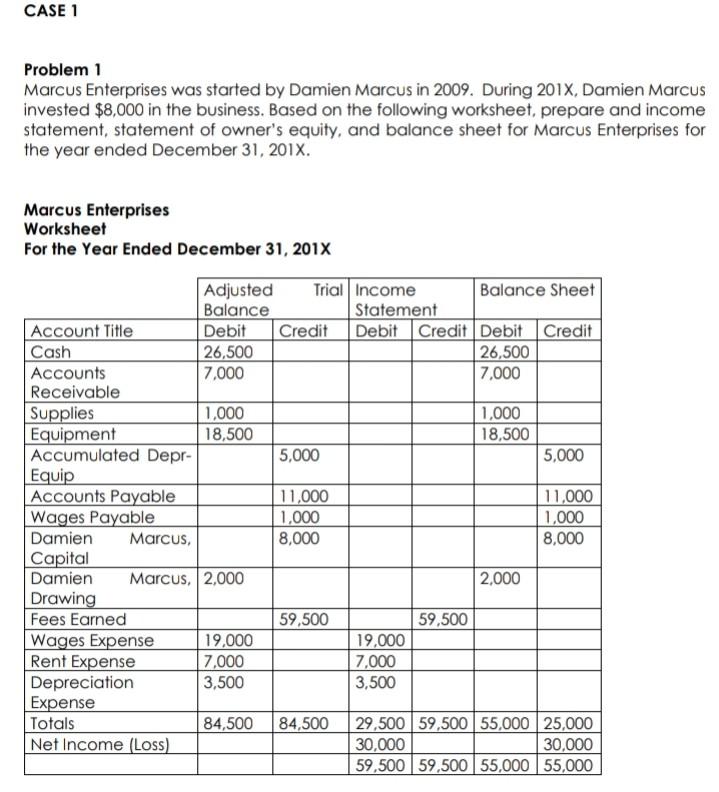

CASE 1 Problem 1 Marcus Enterprises was started by Damien Marcus in 2009. During 2017, Damien Marcus invested $8,000 in the business. Based on the

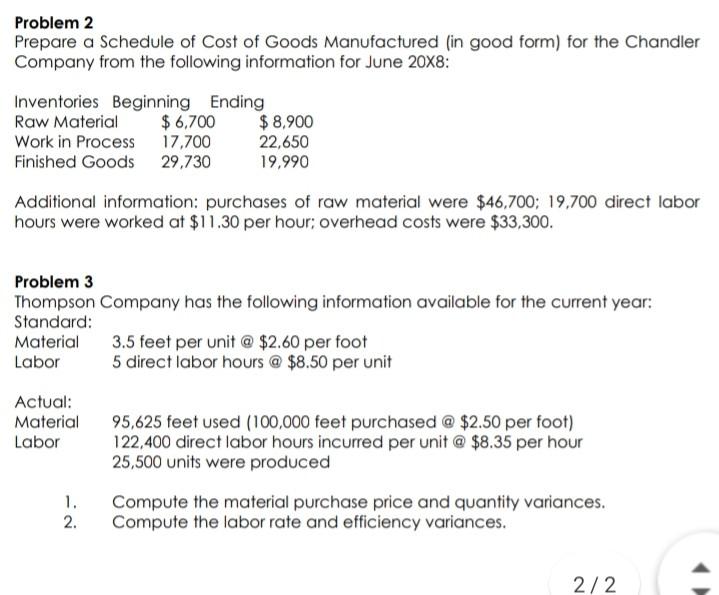

CASE 1 Problem 1 Marcus Enterprises was started by Damien Marcus in 2009. During 2017, Damien Marcus invested $8,000 in the business. Based on the following worksheet, prepare and income statement, statement of owner's equity, and balance sheet for Marcus Enterprises for the year ended December 31, 2018. Marcus Enterprises Worksheet For the Year Ended December 31, 2017 Adjusted Trial Income Balance Sheet Balance Statement Account Title Debit Credit Debit Credit Debit Credit Cash 26,500 26,500 Accounts 7,000 7,000 Receivable Supplies 1,000 1,000 Equipment 18,500 18,500 Accumulated Depr- 5,000 5,000 Equip Accounts Payable 11,000 11,000 Wages Payable 1,000 1,000 Damien Marcus, 8,000 8,000 Capital Damien Marcus, 2,000 2.000 Drawing Fees Earned 59,500 59.500 Wages Expense 19,000 19,000 Rent Expense 7,000 7,000 Depreciation 3,500 3,500 Expense Totals 84,500 84,500 29,500 59,500 55,000 25,000 Net Income Loss) 30,000 30,000 59,500 59,500 55,000 55,000 Problem 2 Prepare a Schedule of Cost of Goods Manufactured in good form) for the Chandler Company from the following information for June 20x8: Inventories Beginning Ending Raw Material $ 6,700 $8.900 Work in Process 17.700 22,650 Finished Goods 29,730 19,990 Additional information: purchases of raw material were $46,700; 19,700 direct labor hours were worked at $11.30 per hour overhead costs were $33,300. Problem 3 Thompson Company has the following information available for the current year: Standard: Material 3.5 feet per unit @ $2.60 per foot Labor 5 direct labor hours @ $8.50 per unit Actual: Material Labor 95,625 feet used (100,000 feet purchased @ $2.50 per foot) 122.400 direct labor hours incurred per unit @ $8.35 per hour 25,500 units were produced Compute the material purchase price and quantity variances. Compute the labor rate and efficiency variances. 1. 2. 2/2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started