Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 1 : Retirement Benefits Virginia state provides state employees with a choice between two retirement plans. The first plan is a 4 0 1

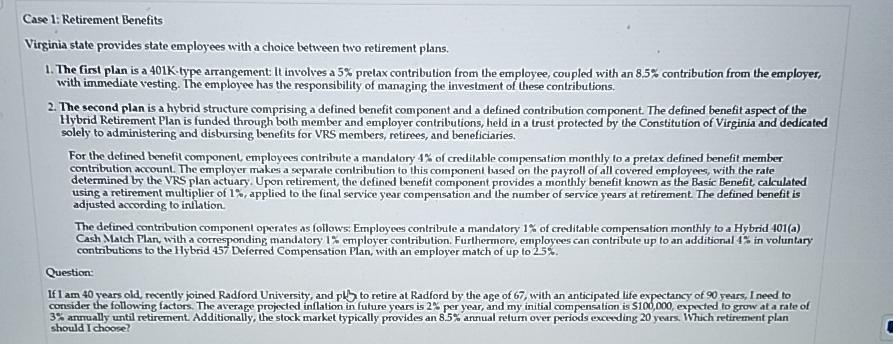

Case : Retirement Benefits

Virginia state provides state employees with a choice between two retirement plans.

The first plan is a Ktype arrangement: It involves a prelax contribution from the employee, coupled with an contribution from the employes, with immediate vesting. The employee has the responsibility of managing the investment of these contributions.

The second plan is a hybrid structure comprising a defined benefit component and a defined contribution component. The defined benefit aspect of the Hybrid Retirement Plan is funded through both member and employer contributions, held in a trust protected by the Constitution of Virginia and dedicated solely to administering and disbursing benefits for VRS members, retirees, and beneficiaries.

For the defined benefit component, employees contribute a mandalory of credilable compensation monthly to a pretax defined benefit member contribution account. The employer makes a separale conlribution to this component lused on the payroll of all covered employees, with the rate determined by the VRS plan actuary. Upon retirement, the defined benefit component provides a monthly benefit known as the Basic Benefit, calculated using a retirement multiplier of applied to the final service year compensation and the number of service years at retirement. The defined benefit is adjusted according to intlation.

The defined contribution componenl operates as follows. Employees contribule a mandatory of creditable compensation monthly to a Hybrid a Cash Malch Plan, with a corresponding mandatory employer contribution. Furthermore, employees can contribute up to an additional in voluntary contributions to the Hybrid Deferred Compensation Plan, with an employer match of up to

Question:

If am years old, recently joined Radford University, and p b to retire at Radford by the age of with an anticipated life expectancy of years, I need to consider the following factors. The average projected inflation in future years is per year, and my initial compensation is $ expected to grow at a rate of annually until retirement. Additionally, the stock market typically provides an annual return over periods exceding years. Which retirement plan should I choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started