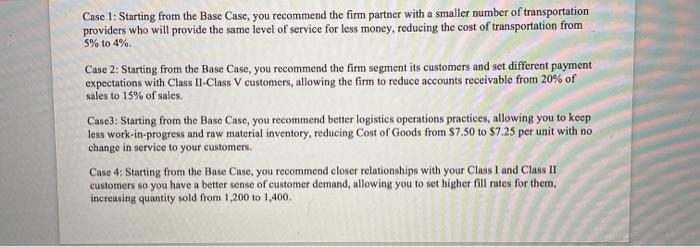

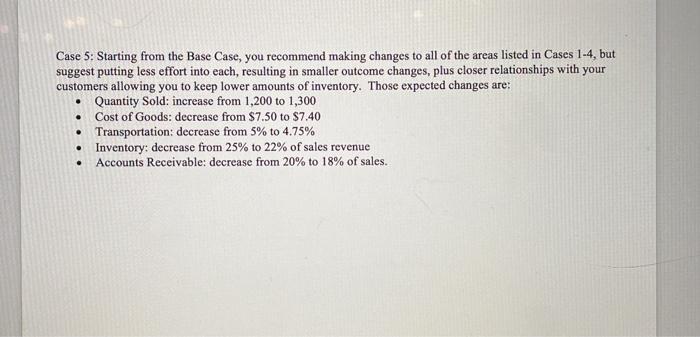

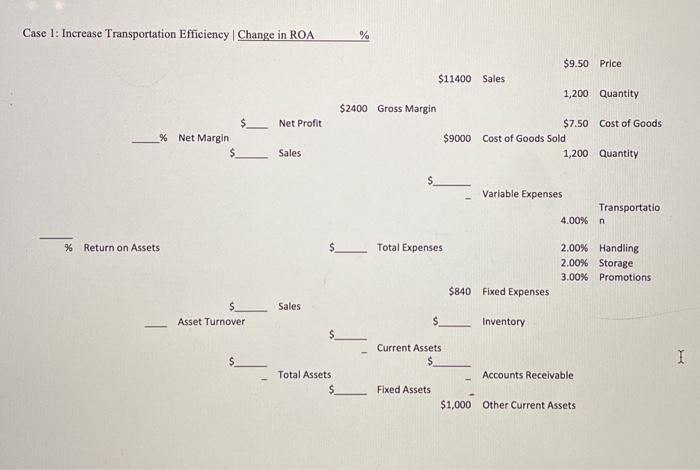

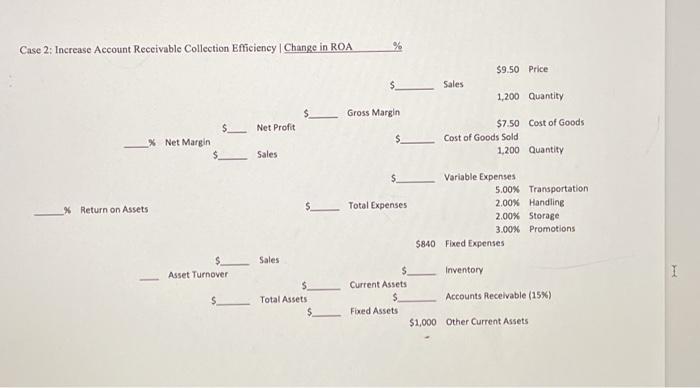

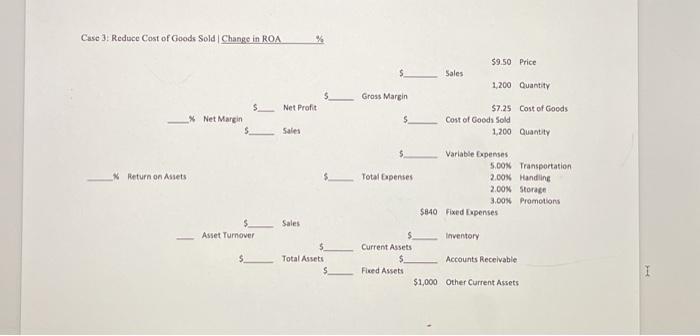

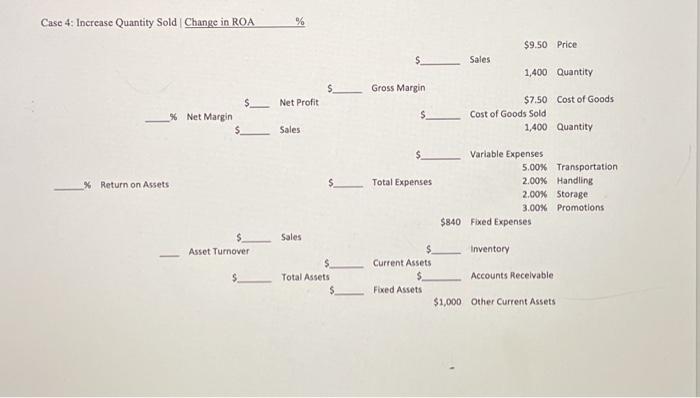

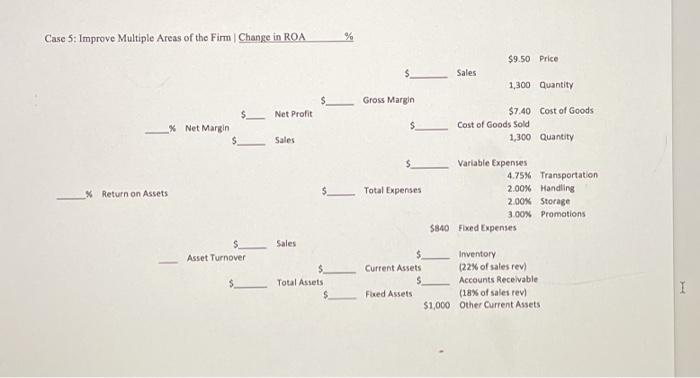

Case 1: Starting from the Base Casc, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Basc Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. . Case 1: Increase Transportation Efficiency Change in ROA % $9.50 Price $11400 Sales 1,200 Quantity $2400 Gross Margin Net Profit $ % Net Margin $ $7.50 Cost of Goods $9000 Cost of Goods Sold 1,200 Quantity Sales Variable Expenses Transportatio 4.00% % Return on Assets $_ Total Expenses 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Inventory Current Assets $ $ I Accounts Receivable Total Assets $ Fixed Assets $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency Change in ROA $9.50 Price $ Sales 1,200 Quantity Gross Margin Net Profit $ % Net Margin $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Sales $ % Return on Assets $ Total Expenses Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets $ Inventory Current Assets $ Accounts Receivable (15%) Fixed Assets $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold Change in ROA $9.50 Price Sales 1,200 Quantity Gross Margin $ Net Profit Net Margin $ $7.25 Cost of Goods Cost of Goods Sold 1,200 Quantity Sales 5 % Return on Assets Total penses Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover S Total Assets Inventory Current Assets $ Accounts Receivable Fixed Assets $1,000 Other Current Assets I Case 4: Increase Quantity Sold Change in ROA % $9.50 Price Sales 1,400 Quantity Gross Margin $ Net Profit % Net Margin $ $7.50 Cost of Goods Cost of Goods Sold 1,400 Quantity Sales $ % Return on Assets Total Expenses _ Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets $ Inventory Current Assets Accounts Recevable Fixed Assets $1,000 Other Current Assets Case 5: Improve Multiple Areas of the Firm Change in ROA $9.50 Price $ Sales 1,300 Quantity Gross Margin $ Net Profit Net Margin $ $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Sales % Return on Assets $ Total Expenses Variable Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets Inventory Current Assets (22% of sales revi 5 Accounts Receivable Fixed Assets (18% of sales rev) $1,000 Other Current Assets I Case 1: Starting from the Base Casc, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Basc Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. . Case 1: Increase Transportation Efficiency Change in ROA % $9.50 Price $11400 Sales 1,200 Quantity $2400 Gross Margin Net Profit $ % Net Margin $ $7.50 Cost of Goods $9000 Cost of Goods Sold 1,200 Quantity Sales Variable Expenses Transportatio 4.00% % Return on Assets $_ Total Expenses 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Inventory Current Assets $ $ I Accounts Receivable Total Assets $ Fixed Assets $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency Change in ROA $9.50 Price $ Sales 1,200 Quantity Gross Margin Net Profit $ % Net Margin $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Sales $ % Return on Assets $ Total Expenses Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets $ Inventory Current Assets $ Accounts Receivable (15%) Fixed Assets $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold Change in ROA $9.50 Price Sales 1,200 Quantity Gross Margin $ Net Profit Net Margin $ $7.25 Cost of Goods Cost of Goods Sold 1,200 Quantity Sales 5 % Return on Assets Total penses Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover S Total Assets Inventory Current Assets $ Accounts Receivable Fixed Assets $1,000 Other Current Assets I Case 4: Increase Quantity Sold Change in ROA % $9.50 Price Sales 1,400 Quantity Gross Margin $ Net Profit % Net Margin $ $7.50 Cost of Goods Cost of Goods Sold 1,400 Quantity Sales $ % Return on Assets Total Expenses _ Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets $ Inventory Current Assets Accounts Recevable Fixed Assets $1,000 Other Current Assets Case 5: Improve Multiple Areas of the Firm Change in ROA $9.50 Price $ Sales 1,300 Quantity Gross Margin $ Net Profit Net Margin $ $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Sales % Return on Assets $ Total Expenses Variable Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Sales Asset Turnover $ Total Assets Inventory Current Assets (22% of sales revi 5 Accounts Receivable Fixed Assets (18% of sales rev) $1,000 Other Current Assets