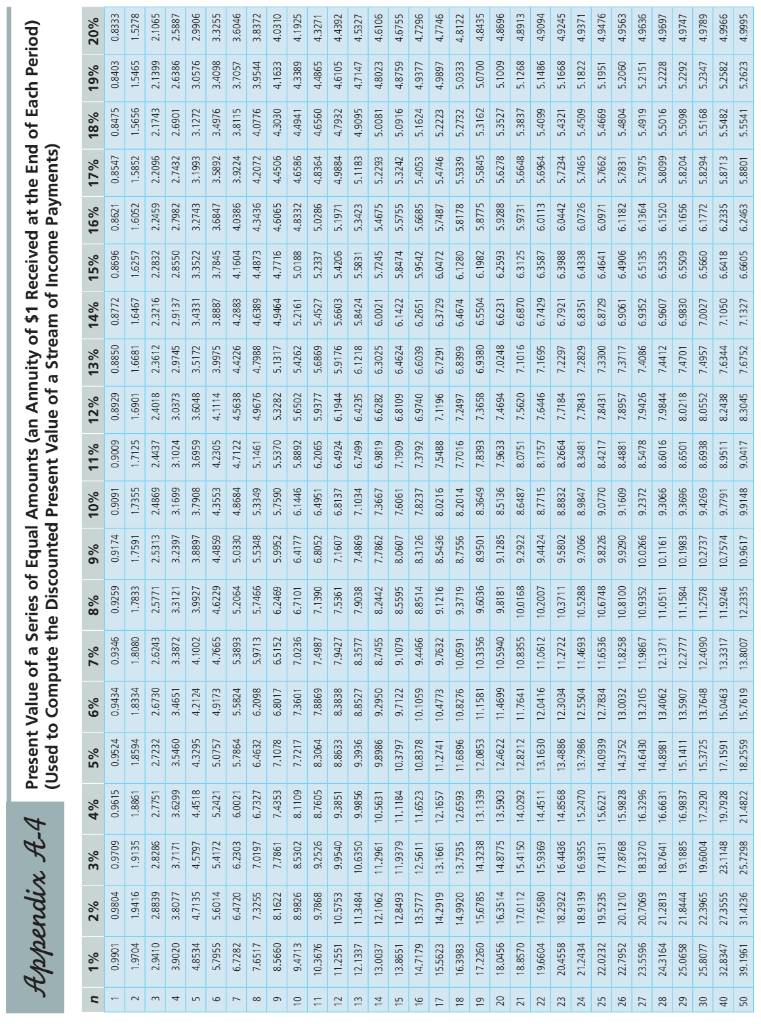

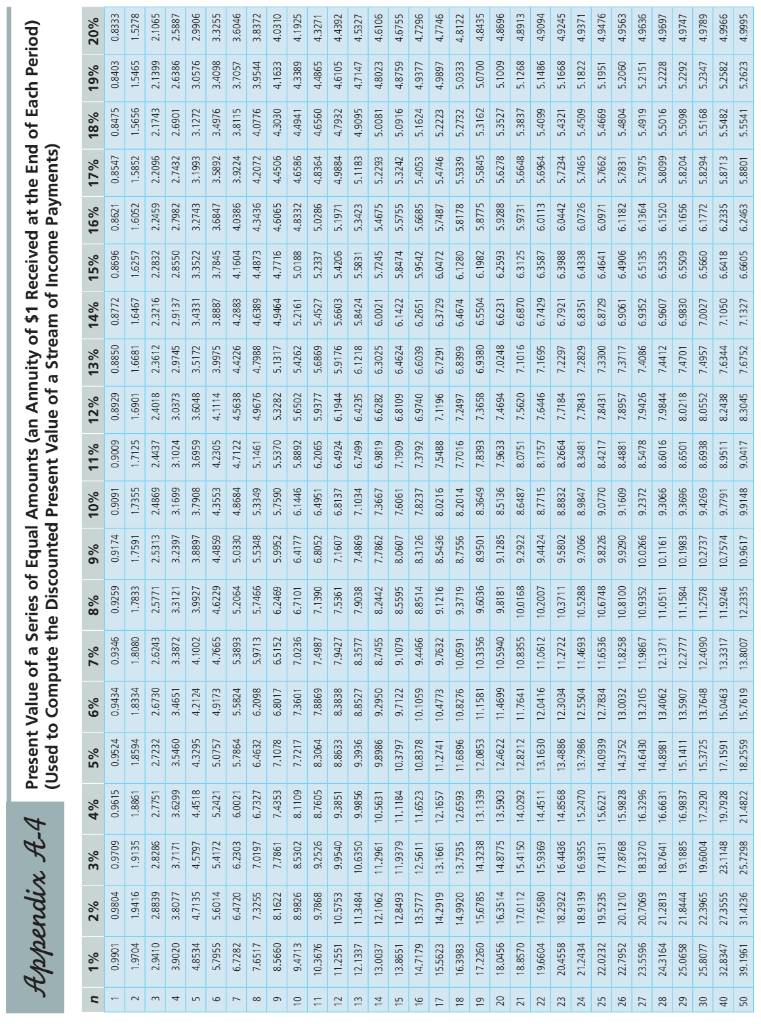

CASE 1 The Johnsons Consider Retirement Planning Harry Johnson's father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unantici- pated retirement, William's financial situation is poor be- cause he had not planned adequately for retirement. His situation has inspired Harry and Belinda to take a look at their own retirement planning. Together they now make about $200,000 per year ($110,000 for Belinda and $90,000 for Harry) and would like to have a sim- ilar level of living when they retire. Harry and Belinda are both are in their early 40s and they recently received their annual Social Security Benefits Statements indicat- ing that they each could expect about $22,000 per year in today's dollars as retirement benefits in 25 years at age 67. Although their retirement is a long way off, they know that the sooner they put a plan in place, the larger their retirement nest egg will be. (a) Belinda believes that the couple could maintain their current level of living if their retirement income rep- resented 90 percent of their current annual income after adjusting for inflation. Assuming a 4 percent inflation rate, what would Harry and Belindas's annual income need to be over and above their Social Security benefits when they retire at age 67? (Hint: Use Appendix A-l or visit the DO IT IN CLASS Garman/Forgue companion website.) Page 19 (b) Both Harry and Belinda are covered by defined- contribution retirement plans at work. Harry con- tributes $5,400 to his plan and his employer puts in $2,700. Belinda contributes $6,600 and her em- ployer puts in $3,300. Assuming a 7 percent rate of return, what would their combined retirement nest egg (now valued at $400,000) total 25 years from now if they keep contributing? (Hint: Use Appendix A-3 or visit the Garman/Forgue companion website.) (c) For how many years would the retire- ment nest egg provide the amount of in- come indicated in Question (a)? Assume a 4 percent return after taxes and infla- tion. (Hint: Use Appendix A-4 or visit DO IT IN CLASS Page 548 the Garman/Forgue companion website.) Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to compute the Discounted Present Value of a Stream of Income Payments) n 1 1% 0.9901 1.9704 2% 0.9804 1.9416 3% 0.9709 1.9135 4% 0.9615 1.8861 5% 0.9524 1.8594 6% 0.9434 1.8334 7% 0.9346 1.8080 8% 0.9259 1.7833 9% 0.9174 1.7591 2.5313 10% 0.9091 1.7355 2.4869 11% 12% 0.90090.8929 1.7125 1.6901 2.4437 2.4018 13% 14% 0.8850 0.8772 1.6681 1.6467 2.36122.3216 15% 0.8696 1.6257 2.2832 16% 0.8621 1.6052 18% 0.8475 1.5656 19% 0.8403 1.5465 3 2.94102.8839 2.8285 2.7751 2.72322.6730 2.62432.5771 2.1743 2.1399 3.9020 3.8077 3.7171 3 .6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 5 4.8534 4.7135 4.5797 4.4518 4.3295 4.21 24 4.1002 6 7 8 9 10 11 12 5.7955 6.7282 7.6517 .5660 9.4713 10.3676 11.2551 5.6014 6.4720 7.3255 8.1622 8.9826 9.7868 10.5753 11.3484 5.41725.2421 6.2303 6.0021 7.0197 6.7327 7.78617.4353 8.5302 8.1109 9.2526 8.7605 9.9540 9.3851 10.6350 9.9856 17% 0.8547 1.5852 2.2096 2.7432 3.1993 3.5892 3.9224 4.2072 4.4506 4.6586 4.8364 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 3.8897 3.7908 4.48594.3553 5.0330 4.8684 5.5348 5.3349 5.9952 5.7590 6.4177 6.1446 6.8052 6.4951 5.07574.9173 5.7864 5.5824 6.4632 6.2098 7.1078 6.8017 7.7217 7.3601 8.3064 7.8869 8.8633 83838 9.3936 8.8527 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 .2065 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.3271 3.6048 4.1114 45638 4.9676 5.3282 5.6502 5.9377 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 8 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 5.4527 3.35223.2743 3.7845 3.6847 4.1604 4.0386 4.4873 4.3436 4.7716 4.6065 5.0188 4.8332 5.2337 5.0286 2.6901 2.6386 3.1272 3.0576 3.4976 3.4098 3.81153.7057 4.0776 3.9544 4.30304.1633 4.4941 4.3389 4.6560 4.4865 6 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.4206 5.1971 4.9884 4.7932 4.6105 4.4392 13 12.1337 8.3577 7.4869 7.1034 6.7499 6.4235 6.1218 5.8424 5.5831 5.3423 5.1183 4.9095 4.7147 4.5327 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.78627.3667 6.9819 6.6282 6.3025 6.00215.7245 5.4675 5.2293 5.0081 4.8023 4.6106 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 5.8474 5.5755 5.0916 4.8759 4.6755 4.7296 16 14.7179 13.5777 14.2919 15.5623 4.7746 18 16.3983 14.9920 19 20 21 22 23 24 25 26 27 28 29 30 40 50 17.2260 18.0456 18.8570 19.6604 20.4558 21.2434 22.0232 22.7952 23.5596 24.3164 25.0658 25.8077 32.8347 39.1961 15.6785 16.3514 17.0112 17.6580 18.2922 18.9139 19.5235 20.1210 20.7069 21.2813 21.8444 22.3965 27.3555 31.4236 12.5611 11.6523 13.1661 12.1657 13.7535 12.6593 14.3238 13.1339 14.8775 13.5903 15.4150 14.0292 15.9369 14.4511 16.4436 14.8568 16.9355 15.2470 17.4131 15.6221 17.8768 15.9828 18.3270 16.3296 18.764116.6631 19.1885 16.9837 19.6004 17.2920 23.1148 19.7928 25.7298 21.4822 10.8378 11.2741 11.6896 12.0853 124622 12.8212 13.1630 13.4836 13.79B6 14.0939 14.3752 14.6430 14.8981 15.1411 15.3725 17.1591 18.2559 10.1059 10.4773 10.8276 11.1581 11.4699 11.7641 12.0416 12.3034 12.5504 12.7834 13.0032 13.2105 13.4062 13.5907 13.7648 15.0463 15.7619 9.4466 9.7632 10.0591 10.3356 10.5940 10.8355 11.0612 11.2722 11.4693 11.6536 11.8258 11.9867 12.1371 12.2777 12.4090 13.3317 13.8007 8.5595 8.8514 9.1216 9.3719 9.6036 9.8181 10.0168 10.2007 10.3711 10.5288 10.6748 10.8100 10.9352 11.0511 11.1584 11.2578 11.9246 12.2335 8.3126 7.8237 7.3792 8.5436 8.0216 7.5488 8.7556 8.2014 7.7016 8.9501 8.3649 7.8393 9.1285 8.5136 7.9633 9.2922 8.6487 8.0751 9.4424 8.7715 8.1757 9.5802 8.8832 8.2664 9.7066 8.9847 83481 9.8226 9.07708 .4217 9.92909.16098.4881 10.0266 9.2372 8.5478 10.11619.3066 8.6016 10.1983 9.3696 8.6501 10.2737 9.42698.6938 10.7574 9.7791 8.9511 10.9617 9.9148 9.0417 6.9740 6.6039 6.2651 5.9542 5.6685 7.11966.7291 6.37296.0472 5.7487 7.2497 6.8399 6.4674 6.12805.8178 7.3658 6.9380 6.5504 6.1982 5.8775 7.4694 7.0248 6.6231 6.25935,9288 7.5620 7.10166.6870 6.3125 5.9731 7.6446 7.1695 6.7429 6.3587 6.0113 7.7184 7.2297 6.7921 6.3988 6.0442 7.7843 7.2829 6.8351 6.4338 6.0726 7.8431 7.3300 6.8729 6.4641 6.0971 7.8957 7.3717 6.9061 6.4906 6.1182 7.9426 7.4036 6.9352 6.5135 6.1364 7.9844 7.4412 6.9607 6.5335 6.1520 8.0218 7.4701 6.9830 6.55096.1656 8.0552 7.4957 7.0027 6.56606.1772 8.2438 7.6344 7.1050 6.6418 6.2335 8.3045 7.6752 7.1327 6.6605 6.2463 5.3242 5.4053 5.4746 5.5339 5.5845 5.6278 5.6648 5.6954 5.7234 5.7465 5.7662 5.7831 5.7975 5.8099 5.8204 5.8294 5.8713 5.8801 5.1624 4.9377 5.2223 4.9897 5.27325.0333 5.3162 5.0700 5.35275.1009 5.38375.1268 5.4099 5.1486 5.4321 5.1668 5.45095.1822 5.4669 5.1951 5.4804 5.2060 5.4919 5.2151 5.5016 5.2228 5.5098 5.2292 5.5168 5.2347 5.5482 5.2582 5.5541 5.2623 4.8122 4.8435 4.8696 4.8913 4.9094 4.9245 4.9371 4.9476 4.9563 4.9636 4.9697 4.9747 4.9789 4.9966 4.9995 CASE 1 The Johnsons Consider Retirement Planning Harry Johnson's father, William, was recently forced into early retirement at age 63 because of poor health. In addition to the psychological drawbacks of the unantici- pated retirement, William's financial situation is poor be- cause he had not planned adequately for retirement. His situation has inspired Harry and Belinda to take a look at their own retirement planning. Together they now make about $200,000 per year ($110,000 for Belinda and $90,000 for Harry) and would like to have a sim- ilar level of living when they retire. Harry and Belinda are both are in their early 40s and they recently received their annual Social Security Benefits Statements indicat- ing that they each could expect about $22,000 per year in today's dollars as retirement benefits in 25 years at age 67. Although their retirement is a long way off, they know that the sooner they put a plan in place, the larger their retirement nest egg will be. (a) Belinda believes that the couple could maintain their current level of living if their retirement income rep- resented 90 percent of their current annual income after adjusting for inflation. Assuming a 4 percent inflation rate, what would Harry and Belindas's annual income need to be over and above their Social Security benefits when they retire at age 67? (Hint: Use Appendix A-l or visit the DO IT IN CLASS Garman/Forgue companion website.) Page 19 (b) Both Harry and Belinda are covered by defined- contribution retirement plans at work. Harry con- tributes $5,400 to his plan and his employer puts in $2,700. Belinda contributes $6,600 and her em- ployer puts in $3,300. Assuming a 7 percent rate of return, what would their combined retirement nest egg (now valued at $400,000) total 25 years from now if they keep contributing? (Hint: Use Appendix A-3 or visit the Garman/Forgue companion website.) (c) For how many years would the retire- ment nest egg provide the amount of in- come indicated in Question (a)? Assume a 4 percent return after taxes and infla- tion. (Hint: Use Appendix A-4 or visit DO IT IN CLASS Page 548 the Garman/Forgue companion website.) Present Value of a Series of Equal Amounts (an Annuity of $1 Received at the End of Each Period) (Used to compute the Discounted Present Value of a Stream of Income Payments) n 1 1% 0.9901 1.9704 2% 0.9804 1.9416 3% 0.9709 1.9135 4% 0.9615 1.8861 5% 0.9524 1.8594 6% 0.9434 1.8334 7% 0.9346 1.8080 8% 0.9259 1.7833 9% 0.9174 1.7591 2.5313 10% 0.9091 1.7355 2.4869 11% 12% 0.90090.8929 1.7125 1.6901 2.4437 2.4018 13% 14% 0.8850 0.8772 1.6681 1.6467 2.36122.3216 15% 0.8696 1.6257 2.2832 16% 0.8621 1.6052 18% 0.8475 1.5656 19% 0.8403 1.5465 3 2.94102.8839 2.8285 2.7751 2.72322.6730 2.62432.5771 2.1743 2.1399 3.9020 3.8077 3.7171 3 .6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 5 4.8534 4.7135 4.5797 4.4518 4.3295 4.21 24 4.1002 6 7 8 9 10 11 12 5.7955 6.7282 7.6517 .5660 9.4713 10.3676 11.2551 5.6014 6.4720 7.3255 8.1622 8.9826 9.7868 10.5753 11.3484 5.41725.2421 6.2303 6.0021 7.0197 6.7327 7.78617.4353 8.5302 8.1109 9.2526 8.7605 9.9540 9.3851 10.6350 9.9856 17% 0.8547 1.5852 2.2096 2.7432 3.1993 3.5892 3.9224 4.2072 4.4506 4.6586 4.8364 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 3.8897 3.7908 4.48594.3553 5.0330 4.8684 5.5348 5.3349 5.9952 5.7590 6.4177 6.1446 6.8052 6.4951 5.07574.9173 5.7864 5.5824 6.4632 6.2098 7.1078 6.8017 7.7217 7.3601 8.3064 7.8869 8.8633 83838 9.3936 8.8527 3.6959 4.2305 4.7122 5.1461 5.5370 5.8892 .2065 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 4.3271 3.6048 4.1114 45638 4.9676 5.3282 5.6502 5.9377 3.5172 3.9975 4.4226 4.7988 5.1317 5.4262 5.6869 8 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 5.4527 3.35223.2743 3.7845 3.6847 4.1604 4.0386 4.4873 4.3436 4.7716 4.6065 5.0188 4.8332 5.2337 5.0286 2.6901 2.6386 3.1272 3.0576 3.4976 3.4098 3.81153.7057 4.0776 3.9544 4.30304.1633 4.4941 4.3389 4.6560 4.4865 6 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.4206 5.1971 4.9884 4.7932 4.6105 4.4392 13 12.1337 8.3577 7.4869 7.1034 6.7499 6.4235 6.1218 5.8424 5.5831 5.3423 5.1183 4.9095 4.7147 4.5327 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.78627.3667 6.9819 6.6282 6.3025 6.00215.7245 5.4675 5.2293 5.0081 4.8023 4.6106 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 5.8474 5.5755 5.0916 4.8759 4.6755 4.7296 16 14.7179 13.5777 14.2919 15.5623 4.7746 18 16.3983 14.9920 19 20 21 22 23 24 25 26 27 28 29 30 40 50 17.2260 18.0456 18.8570 19.6604 20.4558 21.2434 22.0232 22.7952 23.5596 24.3164 25.0658 25.8077 32.8347 39.1961 15.6785 16.3514 17.0112 17.6580 18.2922 18.9139 19.5235 20.1210 20.7069 21.2813 21.8444 22.3965 27.3555 31.4236 12.5611 11.6523 13.1661 12.1657 13.7535 12.6593 14.3238 13.1339 14.8775 13.5903 15.4150 14.0292 15.9369 14.4511 16.4436 14.8568 16.9355 15.2470 17.4131 15.6221 17.8768 15.9828 18.3270 16.3296 18.764116.6631 19.1885 16.9837 19.6004 17.2920 23.1148 19.7928 25.7298 21.4822 10.8378 11.2741 11.6896 12.0853 124622 12.8212 13.1630 13.4836 13.79B6 14.0939 14.3752 14.6430 14.8981 15.1411 15.3725 17.1591 18.2559 10.1059 10.4773 10.8276 11.1581 11.4699 11.7641 12.0416 12.3034 12.5504 12.7834 13.0032 13.2105 13.4062 13.5907 13.7648 15.0463 15.7619 9.4466 9.7632 10.0591 10.3356 10.5940 10.8355 11.0612 11.2722 11.4693 11.6536 11.8258 11.9867 12.1371 12.2777 12.4090 13.3317 13.8007 8.5595 8.8514 9.1216 9.3719 9.6036 9.8181 10.0168 10.2007 10.3711 10.5288 10.6748 10.8100 10.9352 11.0511 11.1584 11.2578 11.9246 12.2335 8.3126 7.8237 7.3792 8.5436 8.0216 7.5488 8.7556 8.2014 7.7016 8.9501 8.3649 7.8393 9.1285 8.5136 7.9633 9.2922 8.6487 8.0751 9.4424 8.7715 8.1757 9.5802 8.8832 8.2664 9.7066 8.9847 83481 9.8226 9.07708 .4217 9.92909.16098.4881 10.0266 9.2372 8.5478 10.11619.3066 8.6016 10.1983 9.3696 8.6501 10.2737 9.42698.6938 10.7574 9.7791 8.9511 10.9617 9.9148 9.0417 6.9740 6.6039 6.2651 5.9542 5.6685 7.11966.7291 6.37296.0472 5.7487 7.2497 6.8399 6.4674 6.12805.8178 7.3658 6.9380 6.5504 6.1982 5.8775 7.4694 7.0248 6.6231 6.25935,9288 7.5620 7.10166.6870 6.3125 5.9731 7.6446 7.1695 6.7429 6.3587 6.0113 7.7184 7.2297 6.7921 6.3988 6.0442 7.7843 7.2829 6.8351 6.4338 6.0726 7.8431 7.3300 6.8729 6.4641 6.0971 7.8957 7.3717 6.9061 6.4906 6.1182 7.9426 7.4036 6.9352 6.5135 6.1364 7.9844 7.4412 6.9607 6.5335 6.1520 8.0218 7.4701 6.9830 6.55096.1656 8.0552 7.4957 7.0027 6.56606.1772 8.2438 7.6344 7.1050 6.6418 6.2335 8.3045 7.6752 7.1327 6.6605 6.2463 5.3242 5.4053 5.4746 5.5339 5.5845 5.6278 5.6648 5.6954 5.7234 5.7465 5.7662 5.7831 5.7975 5.8099 5.8204 5.8294 5.8713 5.8801 5.1624 4.9377 5.2223 4.9897 5.27325.0333 5.3162 5.0700 5.35275.1009 5.38375.1268 5.4099 5.1486 5.4321 5.1668 5.45095.1822 5.4669 5.1951 5.4804 5.2060 5.4919 5.2151 5.5016 5.2228 5.5098 5.2292 5.5168 5.2347 5.5482 5.2582 5.5541 5.2623 4.8122 4.8435 4.8696 4.8913 4.9094 4.9245 4.9371 4.9476 4.9563 4.9636 4.9697 4.9747 4.9789 4.9966 4.9995