Question

Case 1 The most recent financial statements for Marvel Corporation follow. Sales for year 2022 are projected to increase by 12 percent. Tax rate will

Case 1

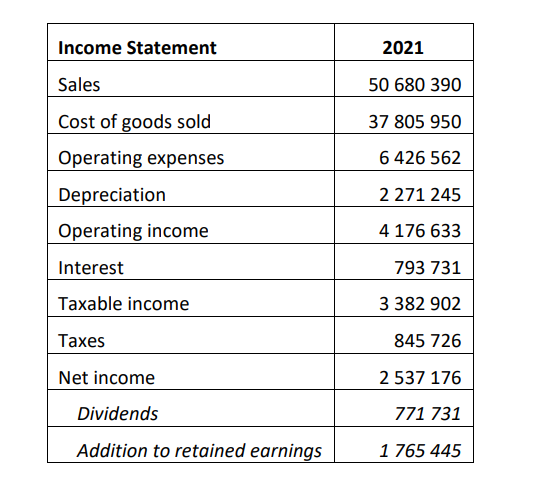

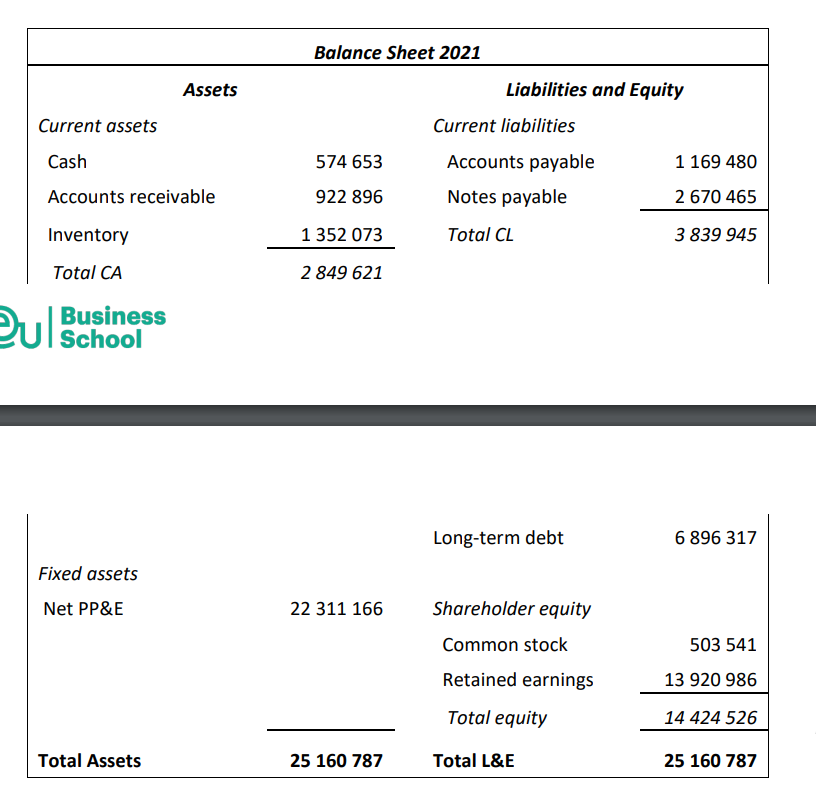

The most recent financial statements for Marvel Corporation follow. Sales for year 2022 are projected to increase by 12 percent. Tax rate will be 25% in year 2022. The company maintains a constant dividend payout ratio. The firm is operating at full capacity.

1.1 Calculate internal and sustainable growth rates. Explain what they mean

1.2 Using the percentage of sales approach, prepare proforma financial statements for year 2022

1.3 Calculate the amount of external financing needed in 2022. What financing options are available for the company?

1.4 Assuming that the company operated at 85% capacity in 2021, re-calculate the amount of external financing needed in 2022

1.5 Discuss the role of financial planning.

\begin{tabular}{|l|r|} \hline Income Statement & 2021 \\ \hline Sales & 50680390 \\ \hline Cost of goods sold & 37805950 \\ \hline Operating expenses & 6426562 \\ \hline Depreciation & 2271245 \\ \hline Operating income & 4176633 \\ \hline Interest & 793731 \\ \hline Taxable income & 3382902 \\ \hline Taxes & 845726 \\ \hline Net income & 2537176 \\ \hline Dividends & 771731 \\ \hline Addition to retained earnings & 1765445 \\ \hline \end{tabular} BusinessSchool \begin{tabular}{|l|r|} \hline Income Statement & 2021 \\ \hline Sales & 50680390 \\ \hline Cost of goods sold & 37805950 \\ \hline Operating expenses & 6426562 \\ \hline Depreciation & 2271245 \\ \hline Operating income & 4176633 \\ \hline Interest & 793731 \\ \hline Taxable income & 3382902 \\ \hline Taxes & 845726 \\ \hline Net income & 2537176 \\ \hline Dividends & 771731 \\ \hline Addition to retained earnings & 1765445 \\ \hline \end{tabular} BusinessSchoolStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started