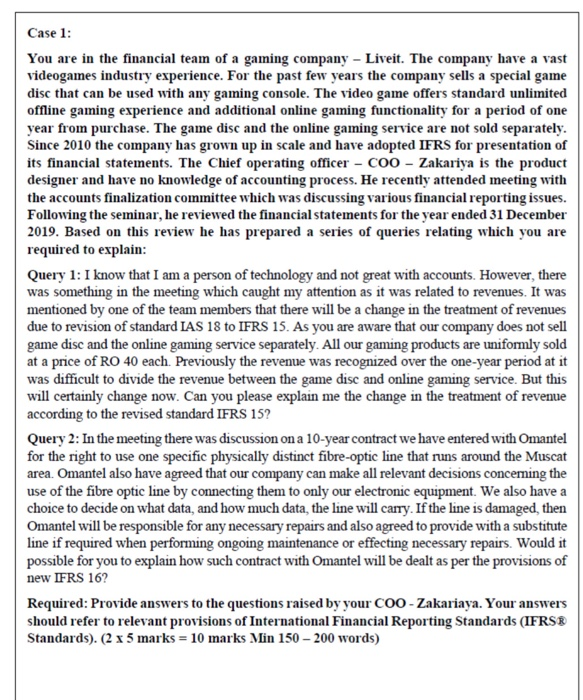

Case 1: You are in the financial team of a gaming company - Liveit. The company have a vast videogames industry experience. For the past few years the company sells a special game disc that can be used with any gaming console. The video game offers standard unlimited offline gaming experience and additional online gaming functionality for a period of one year from purchase. The game disc and the online gaming service are not sold separately. Since 2010 the company has grown up in scale and have adopted IFRS for presentation of its financial statements. The Chief operating officer - Coo - Zakariya is the product designer and have no knowledge of accounting process. He recently attended meeting with the accounts finalization committee which was discussing various financial reporting issues. Following the seminar, he reviewed the financial statements for the year ended 31 December 2019. Based on this review he has prepared a series of queries relating which you are required to explain: Query 1: I know that I am a person of technology and not great with accounts. However, there was something in the meeting which caught my attention as it was related to revenues. It was mentioned by one of the team members that there will be a change in the treatment of revenues due to revision of standard IAS 18 to IFRS 15. As you are aware that our company does not sell game disc and the online gaming service separately. All our gaming products are uniformly sold at a price of RO 40 each. Previously the revenue was recognized over the one-year period at it was difficult to divide the revenue between the game disc and online gaming service. But this will certainly change now. Can you please explain me the change in the treatment of revenue according to the revised standard IFRS 15? Query 2: In the meeting there was discussion on a 10-year contract we have entered with Omantel for the right to use one specific physically distinct fibre-optic line that runs around the Muscat area. Omantel also have agreed that our company can make all relevant decisions concerning the use of the fibre optic line by connecting them to only our electronic equipment. We also have a choice to decide on what data, and how much data, the line will carry. If the line is damaged, then Omantel will be responsible for any necessary repairs and also agreed to provide with a substitute line if required when performing ongoing maintenance or effecting necessary repairs. Would it possible for you to explain how such contract with Omantel will be dealt as per the provisions of new IFRS 16? Required: Provide answers to the questions raised by your COO - Zakariaya. Your answers should refer to relevant provisions of International Financial Reporting Standards (IFRS Standards). (2 x 5 marks = 10 marks Min 150 - 200 words)