Case 1.1 (j-l)

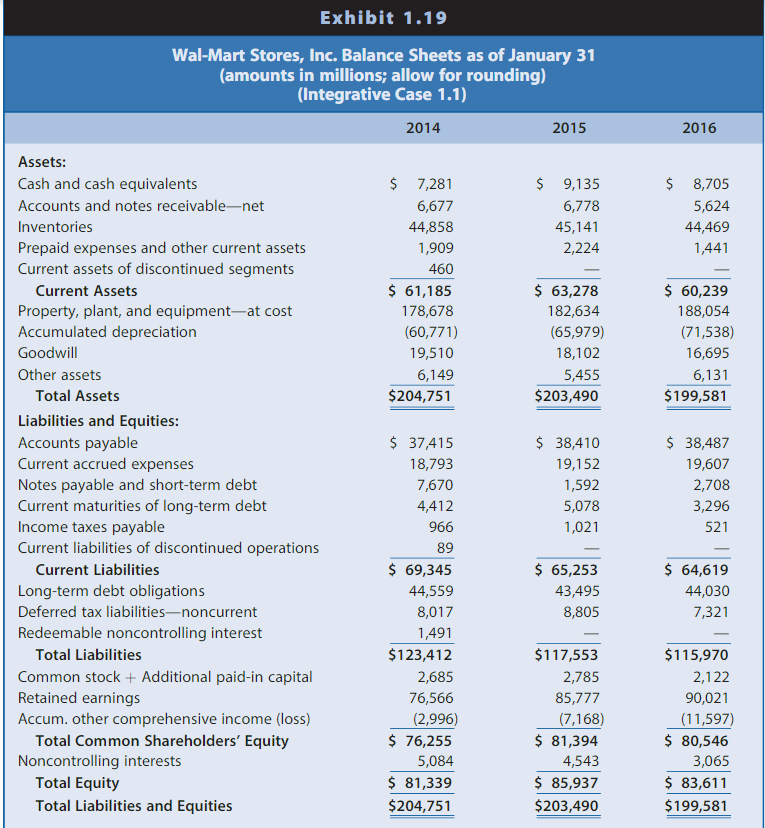

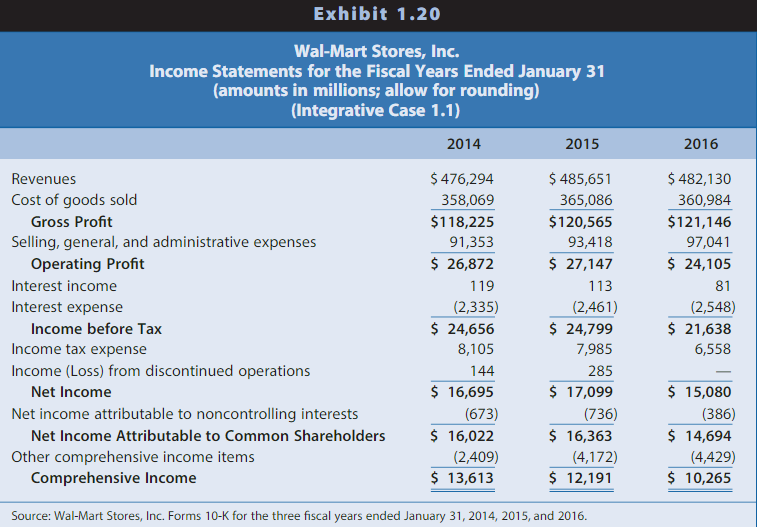

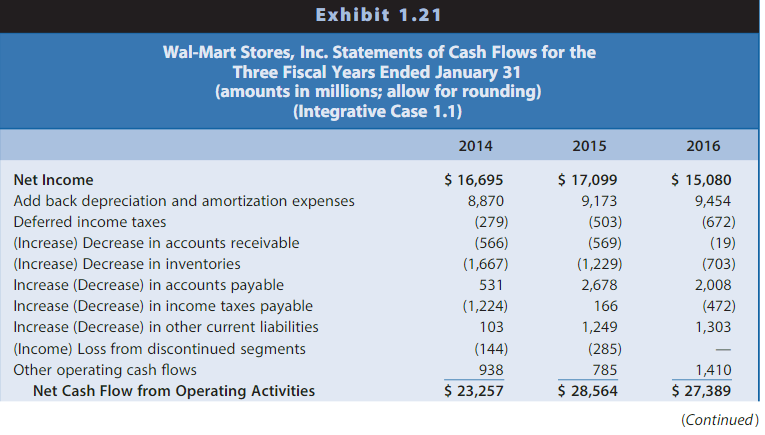

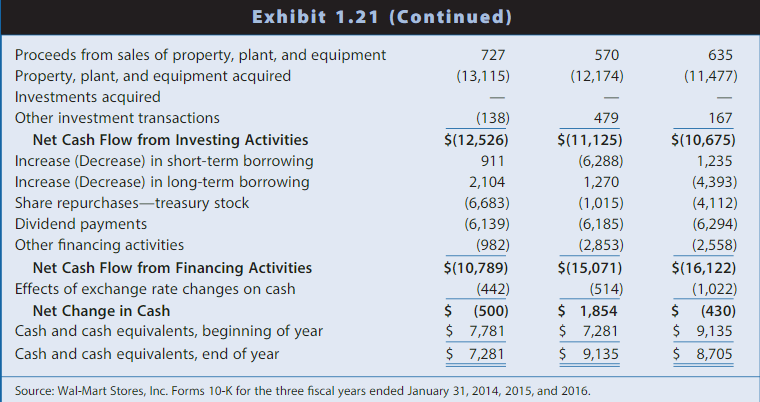

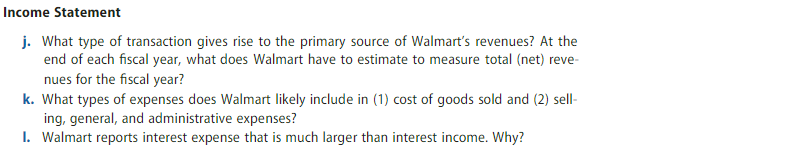

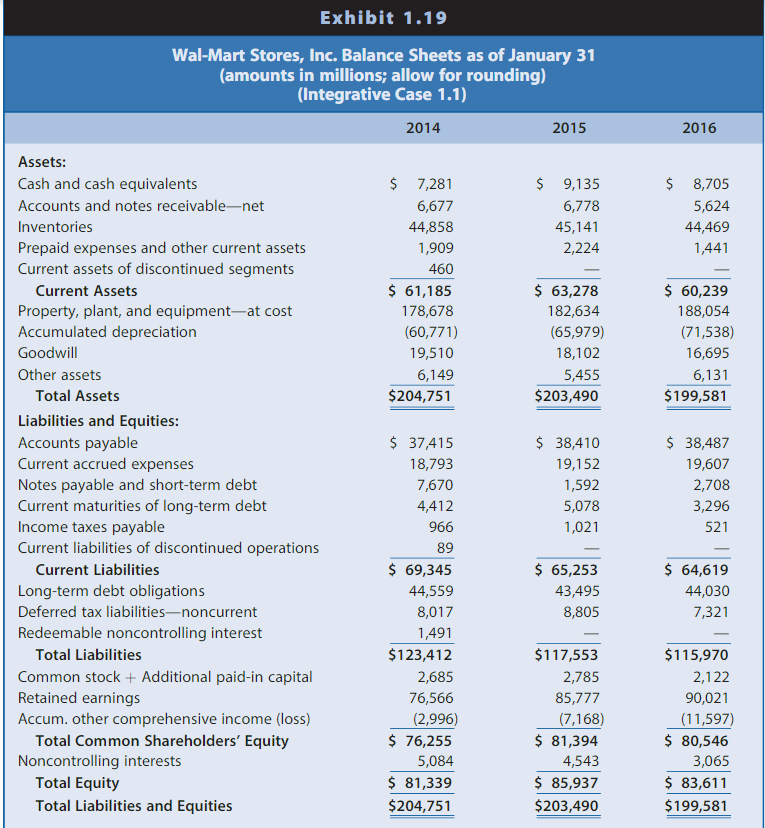

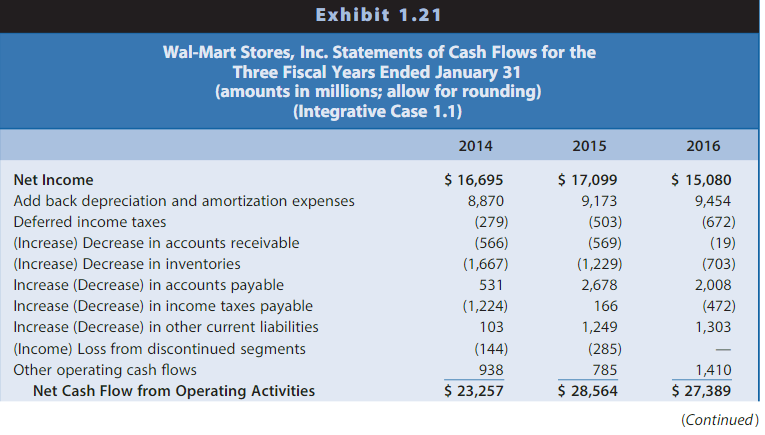

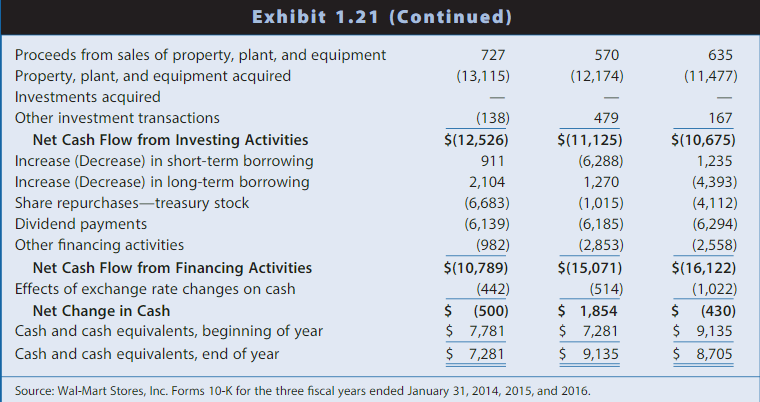

The first case at the end of this chapter and numerous subsequent chapters is a series of integrative cases involving Wal-Mart Stores, Inc. (Walmart). The series of cases applies the concepts and analytical tools discussed in each chapter to Walmart's financial statements and notes. The preparation of responses to the questions in these cases results in an integrated illustration of the six sequential steps in financial statement analysis discussed in this chapter and throughout the book. Introduction Walmart is a very large chain of retail stores selling consumer goods. As it states in its Form 10K for fiscal 2015: Wal-Mart Stores, Inc. ("Walmart," the "Company" or "we") helps people around the world save money and live better-anytime and anywhere-in retail stores or through our e-commerce and mobile capabilities. Through innovation, we are striving to create a customer-centric experience that seamlessly integrates digital and physical shopping. Physical retail encompasses our brick and mortar presence in each market where we operate. Digital retail is comprised of our e-commerce websites and mobile commerce applications. Each week, we serve nearly 260 million customers who visit our over 11,500 stores under 63 banners in 28 countries and e-commerce websites in 11 countries. Our strategy is to lead on price, differentiate on access, be competitive on assortment and deliver a great experience. Leading on price is designed to earn the trust of our customers every day by providing a broad assortment of quality merchandise and services at everyday low prices ("EDLP"). EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity. Price leadership is core to who we are. Everyday low cost ("EDLC") is our commitment to control expenses so those cost savings can be passed along to our customers. Our digital and physical presence provides customers access to our broad assortment anytime and anywhere. We strive to give our customers and members a great digital and physical shopping experience. For more detailed discussion of Walmart's stores, products, customers, and business model, visit the company's website: www.corporate.walmart.com. 13 Financial Statements Exhibit 1.19 presents comparative balance sheets, Exhibit 1.20 presents comparative income statements, and Exhibit 1.21 (pages 62-63) presents comparative statements of cash flows for Walmart for the three fiscal years ending January 31, 2014, 2015, and 2016. Walmart prepares its financial statements in accordance with U.S. GAAP. For more detail on Walmart financial statements, or to download the fiscal 2015 Form 10-K, you can visit Walmart's investor relations REQUIRED Respond to the following questions relating to Walmart. Income Statement j. What type of transaction gives rise to the primary source of Walmart's revenues? At the end of each fiscal year, what does Walmart have to estimate to measure total (net) revenues for the fiscal year? k. What types of expenses does Walmart likely include in (1) cost of goods sold and (2) selling, general, and administrative expenses? I. Walmart reports interest expense that is much larger than interest income. Why? Exhibit 1.20 Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31, 2014, 2015, and 2016. (LUmInIUEU) Source: Wal-Mart Stores, Inc. Forms 10-K for the three fiscal years ended January 31,2014,2015, and 2016