Answered step by step

Verified Expert Solution

Question

1 Approved Answer

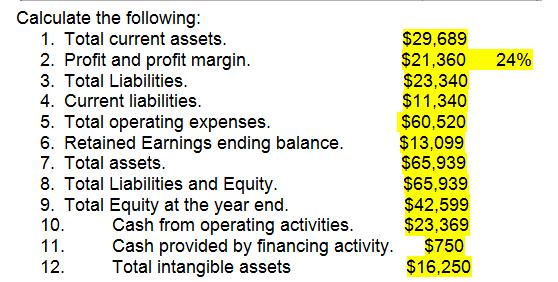

The following accounts have been provided: The results are shown in yellow, but I want to know how to calculate them, like what are current

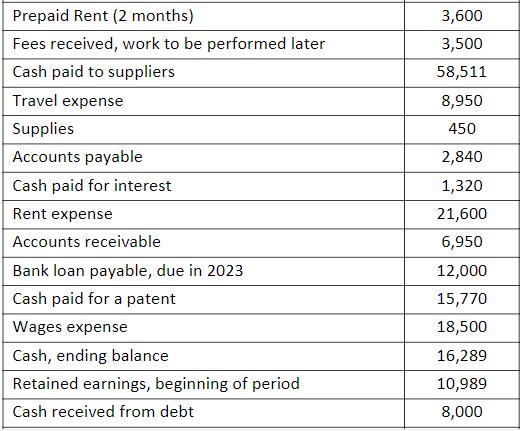

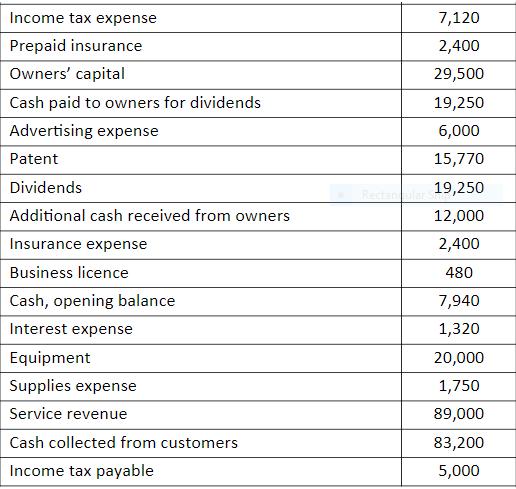

The following accounts have been provided:

The results are shown in yellow, but I want to know how to calculate them, like what are current assests in this example.

The results are shown in yellow, but I want to know how to calculate them, like what are current assests in this example.

Prepaid Rent (2 months) Fees received, work to be performed later Cash paid to suppliers Travel expense Supplies Accounts payable Cash paid for interest Rent expense Accounts receivable Bank loan payable, due in 2023 Cash paid for a patent Wages expense Cash, ending balance Retained earnings, beginning of period Cash received from debt 3,600 3,500 58,511 8,950 450 2,840 1,320 21,600 6,950 12,000 15,770 18,500 16,289 10,989 8,000 Income tax expense Prepaid insurance Owners capital Cash paid to owners for dividends Advertising expense Patent Dividends Additional cash received from owners Insurance expense Business licence Cash, opening balance Interest expense Equipment Supplies expense Service revenue Cash collected from customers Income tax payable 7,120 2,400 29,500 19,250 6,000 15,770 ar 19,250 12,000 2,400 480 7,940 1,320 20,000 1,750 89,000 83,200 5,000 Calculate the following: 1. Total current assets. 2. Profit and profit margin. 3. Total Liabilities. 4. Current liabilities. 5. Total operating expenses. 6. Retained Earnings ending balance. 7. Total assets. 8. Total Liabilities and Equity. 9. Total Equity at the year end. 10. 11. 12. Cash from operating activities. Cash provided by financing activity. Total intangible assets $29,689 $21,360 $23,340 $11,340 $60,520 $13,099 $65,939 $65,939 $42,599 $23,369 $750 $16,250 24%

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

2 Profit Margin Profit Service Revenue x 100 2136089000 x 100 24 W...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started