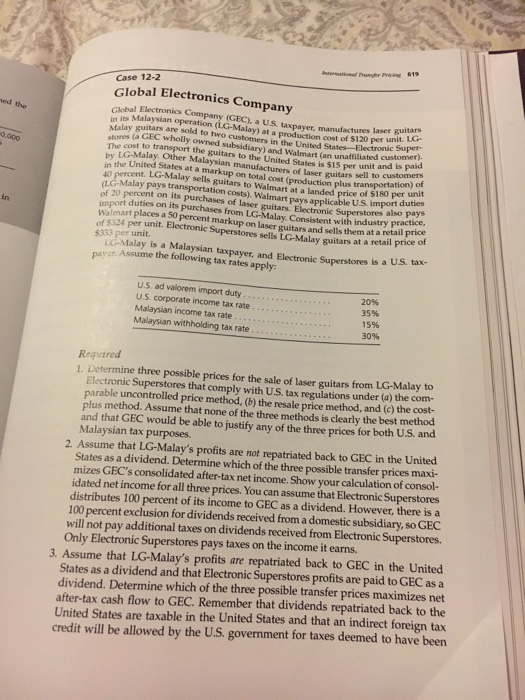

Case 12-2 Global Electronics pany in its Malaysia Company (GEC), a US taxpayer manufactures laser guitars Malay are sold to two cost of s120 per unit. The (a GEC owned subsidiary) and Walmart (an unaffiliated customer by cost to transport in other Malaysian manufacturers of per unit and is paid States at mark laser 40 percent. toal (production plus transportation) (LG-Malay pays guitars to Walmart of 20 percent on transportation costs). unit import duties on its purchases of pays applicable import duties laser guitars. also Walmart places a 50 percent Malay pays of $324 per unit. ectronic with industry practice, $333 per unit. El Superstores guitars and sells them at retai sells payer lay is a Malaysian taxpayer at a retail price of Assume the following and Electronic Superstores is a US. tax tax rates apply: U.S. ad valorem import duty income tax rate Malaysian income tax rate Malaysian withholding tax rate 15% 30% l. Determine three possible prices for sale of laser from LG-Malay to parable uncontrolled price comply with regulations plus method. Assume the resale and (c) the cost and that GEC would that none of the three methods is clearly the best method Malaysian tax be able to justify any of the three prices for both US and purposes. 2. Assume that LG-Malay's profits are not repatriated back to GEC in the United States as a dividend. Determine which of the three possible transfer mizes GEC's consolidated after-tax net income. Show your calculation of consol- idated net income for all three prices. You can assume that Electronic Superstores distributes 100 percent of its income to GEC as a dividend. However, there is a 100 exclusion for dividends received from a domestic subsidiary, so GEC percent will not pay additional taxes on dividends received from Electronic Superstores. Only Electronic Superstores pays taxes on the income it earns. 3. Assume that LG-Malay's profits are repatriated back to GEC in the United States as a dividend and that Electronic Superstores profits are paid to GEC as a dividend. Determine which of the three possible transfer prices maximizes net after-tax cash flow to GEC. Remember that dividends repatriated back to the United States are taxable in the United States and that an indirect foreign tax credit will be allowed by the US. government for taxes deemed to have been