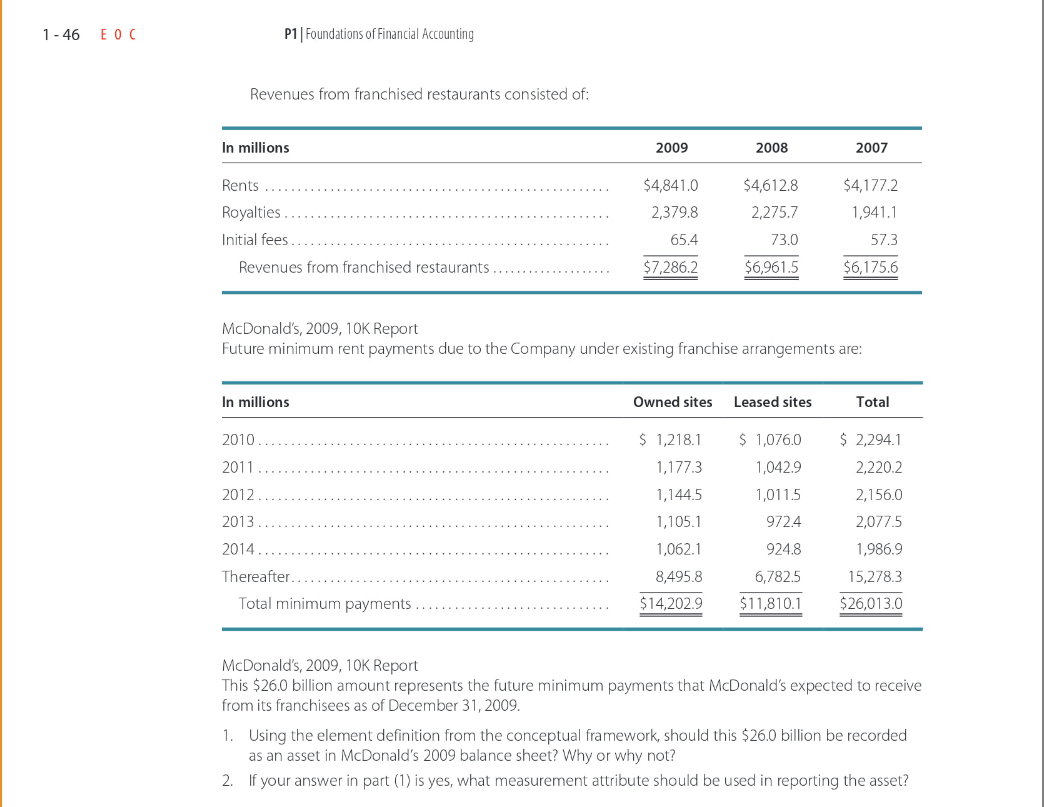

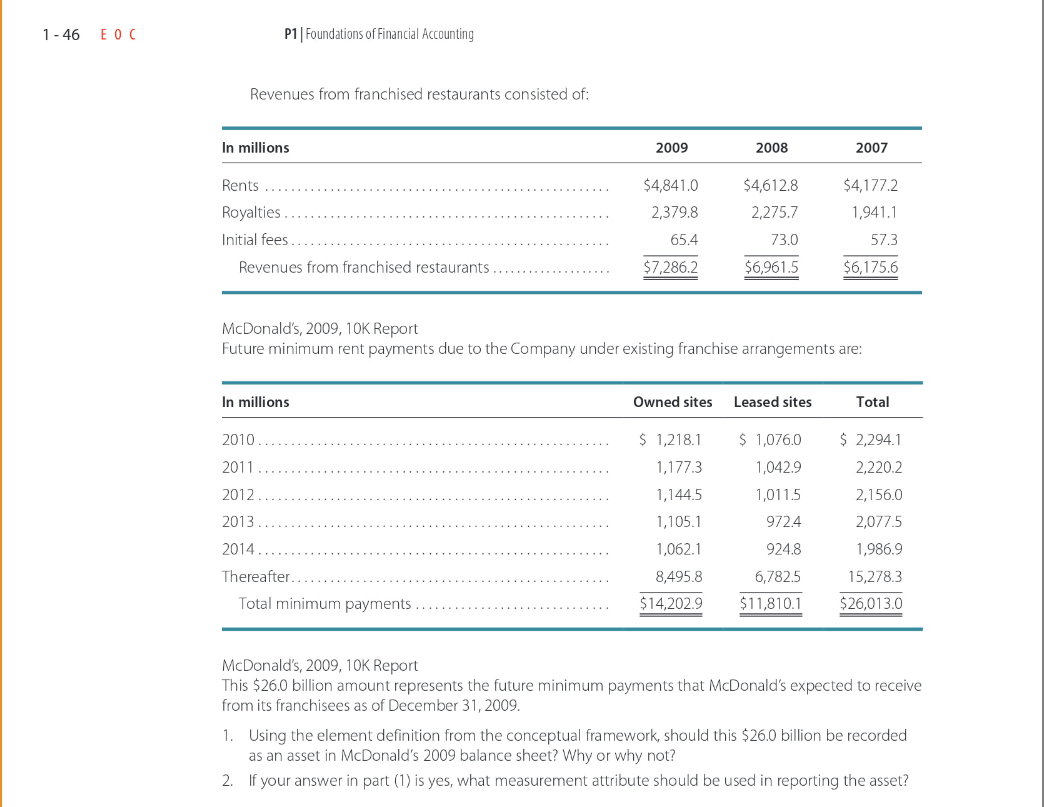

Case 1-24 Deciphering Financial Statements (McDonald's Corporation) The following information comes from the 2009 financial statements of McDonald's Corporation. Conventional franchise arrangements generally include a lease and a license and provide for payment of initial fees, as well as continuing rent and royalties to the Company based upon a percent of sales with minimum rent payments that parallel the Company's underlying leases and escalations (on properties that are leased). Under this arrangement, franchisees are granted the right to operate a restaurant using the McDonald's System and, in most cases, the use of a restaurant facility, generally for a period of 20 years. These franchisees pay related occupancy costs including property taxes, insurance and maintenance. Affiliates and developmental licensees operating under license agreements pay a royalty to the Company based upon a percent of sales, and may pay initial fees. The results of operations of restaurant businesses purchased and sold in transactions with franchisees were not material to the consolidated financial statements for periods prior to purchase and sale. 1 - 46 EOC P1 | Foundations of Financial Accounting Revenues from franchised restaurants consisted of: In millions 2009 2008 2007 Rents $4,841.0 2,379.8 $4,612.8 2,275.7 Royalties. Initial fees $4,177.2 1,941.1 57.3 $6,175.6 65.4 73.0 Revenues from franchised restaurants $7,286.2 $6,961.5 McDonald's, 2009, 10K Report Future minimum rent payments due to the Company under existing franchise arrangements are: In millions Owned sites Leased sites Total $ 1,218.1 2010 2011 $ 1,076.0 1,042.9 1,1773 $ 2,294.1 2,220.2 2,156.0 2,0775 1,011.5 972.4 2012 2013 2014 Thereafter. Total minimum payments 1,144.5 1,105.1 1,062.1 8,495.8 $14,202.9 924.8 6,782.5 $11,810.1 1,986.9 15,278.3 $26,013.0 McDonald's, 2009, 10K Report This $26.0 billion amount represents the future minimum payments that McDonald's expected to receive from its franchisees as of December 31, 2009. 1. Using the element definition from the conceptual framework, should this $26.0 billion be recorded as an asset in McDonald's 2009 balance sheet? Why or why not? 2. If your answer in part (1) is yes, what measurement attribute should be used in reporting the asset