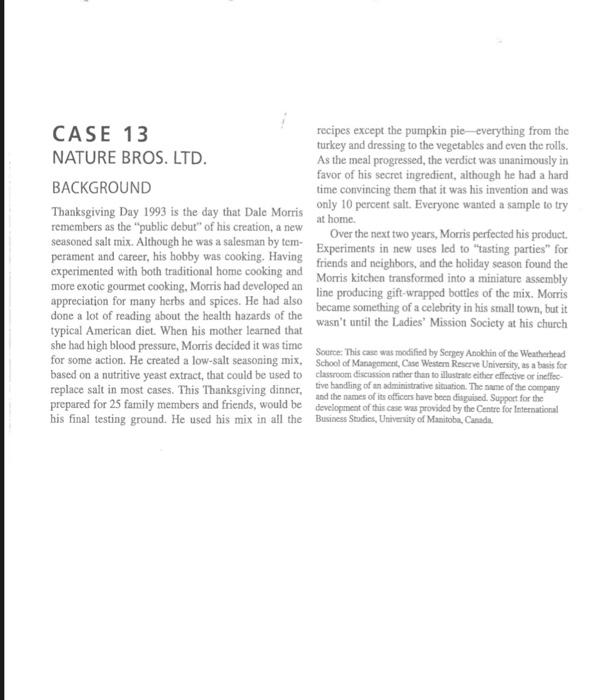

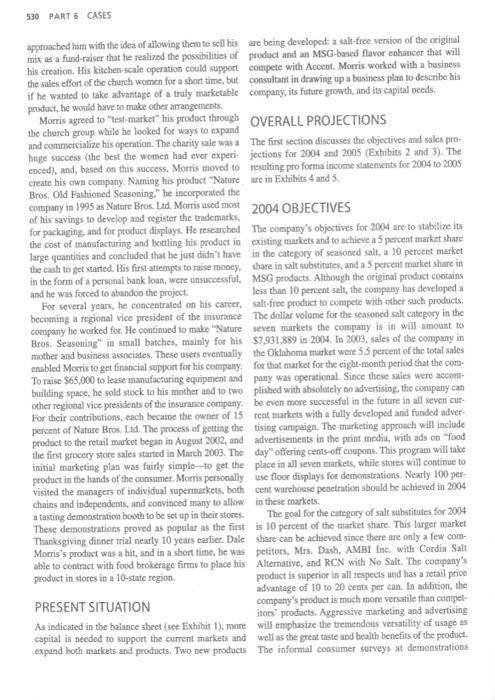

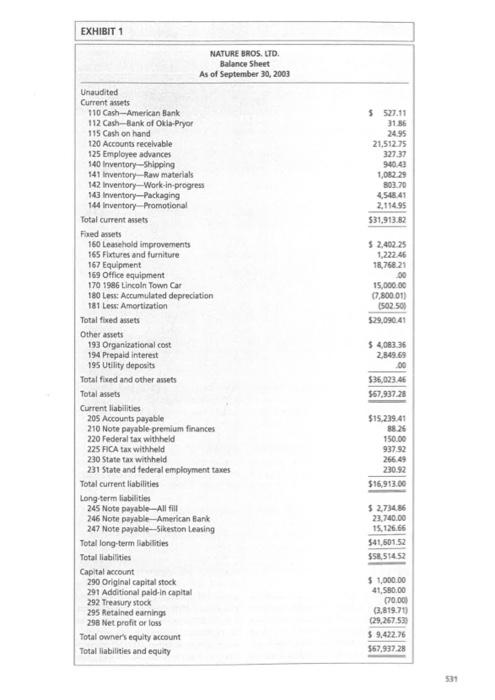

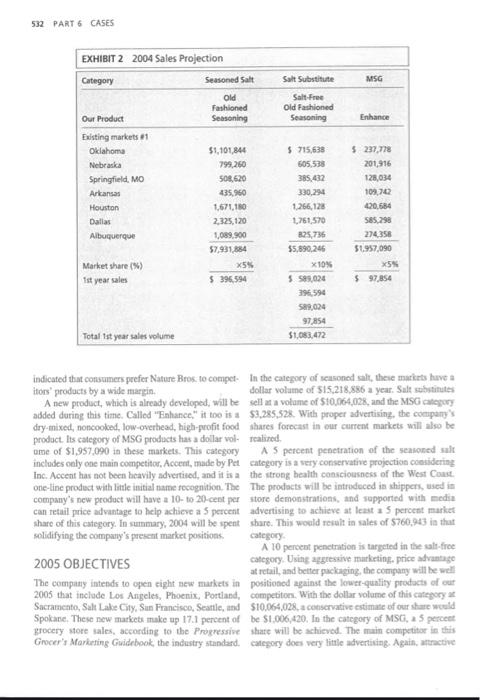

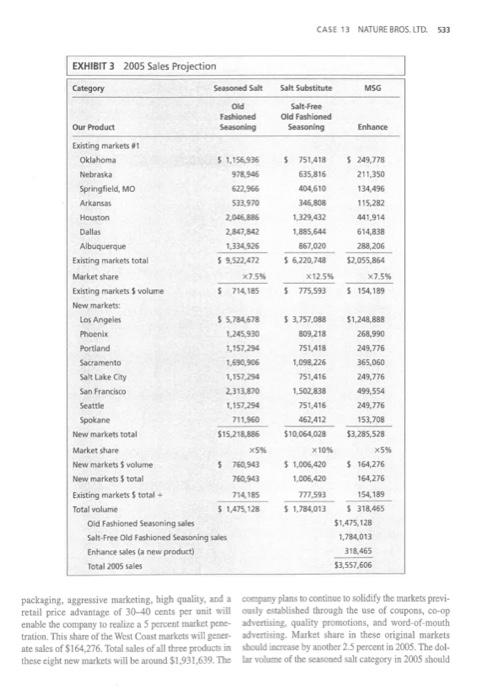

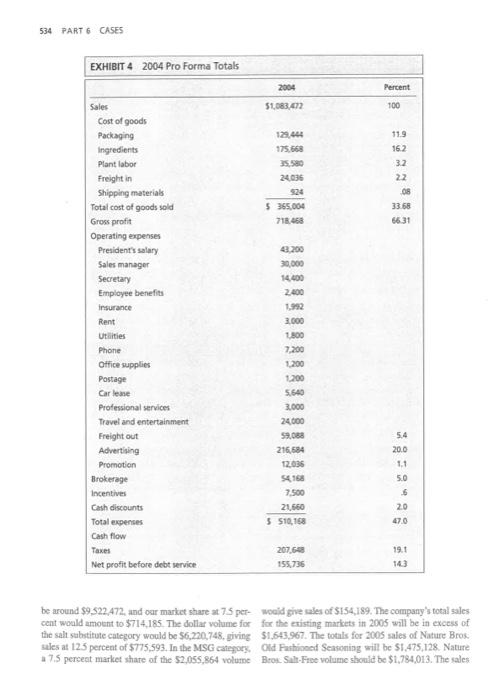

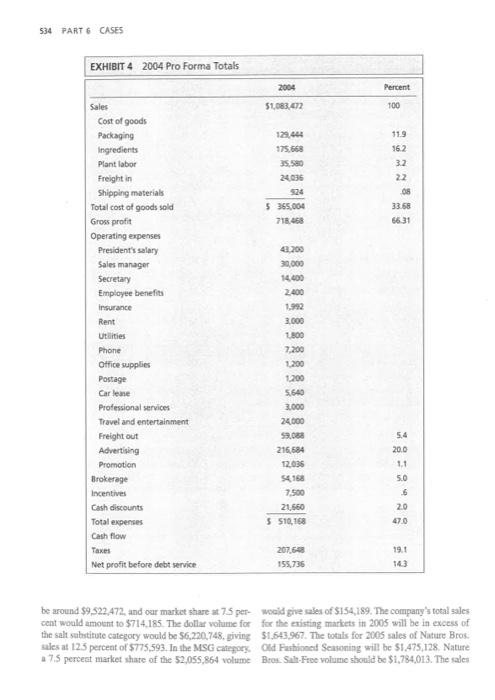

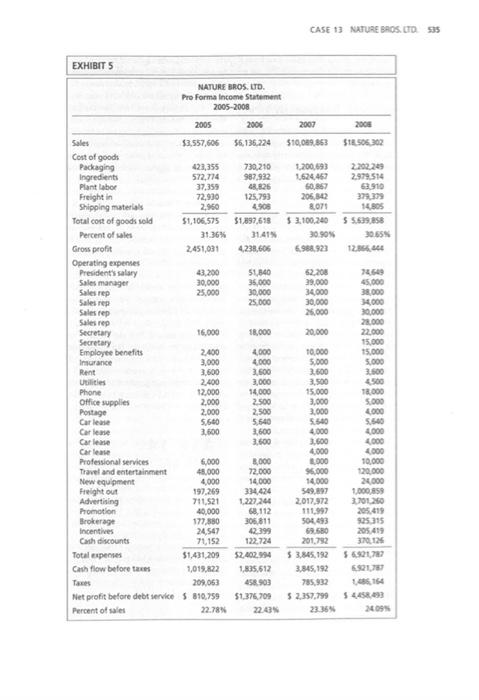

CASE 13 recipes except the pumpkin pie everything from the turkey and dressing to the vegetables and even the rolls. NATURE BROS. LTD. As the meal progressed, the verdict was unanimously in favor of his secret ingredient, although he had a hard BACKGROUND time convincing them that it was his invention and was Thanksgiving Day 1993 is the day that Dale Morris only 10 percent salt. Everyone wanted a sample to try at home remembers as the "public debut" of his creation, a new seasoned salt mix. Although he was a salesman by tem. Experiments in new uses led to "tasting parties" for Over the next two years, Morris perfected his product. perament and career, his hobby was cooking. Having friends and neighbors, and the holiday season found the experimented with both traditional home cooking and Morris kitchen transformed into a miniature assembly more exotic gourmet cooking, Morris had developed an line producing gift-wrapped bottles of the mix. Morris appreciation for many herbs and spices. He had also became something of a celebrity in his small town, but it done a lot of reading about the health hazards of the wasn't until the Ladies Mission Society at his church typical American diet. When his mother learned that she had high blood pressure, Morris decided it was time Source: This case was modified by Sergey Anokhin of the Weatherhead for some action. He created a low-salt seasoning mix. School of Management, Case Western Reserve University, as a basis for based on a nutritive yeast extract, that could be used to classroom discussion rather than to illustrate either effective or ineffec replace salt in most cases. This Thanksgiving dinner and the mess of its officers have been disguised Support for the prepared for 25 family members and friends, would be development of this case was provided by the Centre for International his final testing ground. He used his mix in all the Business Studies, University of Manitoba, Canada 530 PART 6 CASES approached him with the idea of allowing them to sell his are being developed a salt-free version of the original mit as a fund-raiser that he realized the possibilities of product and an MSG-based favor enhance that will his creation. His kitchen scale operation could support compete with Accent. Morris worked with a business the sales effort of the church women for a short time, but consultant in drawing up a business plan to describe his if he wanted to take advantage of a truly marketable company, its future growth and its capital needs. product, he would have to make other arrangements. Morris agreed to "test-market" his product through OVERALL PROJECTIONS the church group while he looked for ways to expand and commercialize his operation. The charity ale was a The first section discusses the objectives and sales pro- huge success (the best the women had ever experi jections for 2004 and 2005 (Exhibits 2 and 3). The enced), and, based on this success, Morris moved to resulting proforma income statements for 2004 to 2005 create his own company Naming his product "Nature are in Exhibits 4 and 5 Bros. Old Fashioned Seasoning," he incorporated the company in 1995 as Nature Bros. Ltd. Morris used most 2004 OBJECTIVES of his savings to develop and register the trademarks, for packaging, and for product displays. He researched The company's objectives for 2004 are to stabilize its the cost of manufacturing and bottling his product in existing markets and to achieve a 5 percent market share large quantities and concluded that he just didn't have in the category of seasoned salt, a 10 percent market the cash to get started. His first attempts to raise money, share in salt substitutes, and a 5 percent market share in in the form of a personal bank loan, were unsuccessful. MSG products. Although the original product contains and he was forced to abandon the project less than 10 percent salt, the company has developed a For several years, he concentrated on his career, saltfre product to compete with other such products, becoming a regional vice president of the insurance The dollar volume for the seasoned salt category in the company he worked for. He continued to make "Nature seven markets the company is in will amount to Bros. Seasoning" in small batches, mainly for his $7.931,889 in 2004. In 2003, sales of the company in mother and business associates. These users eventually the Oklahoma market were 5.5 percent of the total sales enabled Morris to get financial support for his company for that market for the cight-month period that the com To raise $65,000 to lease manufacturing equipment and pany was operational. Since these sales were accom building space, he sold stock to his mother and to two plished with absolutely no advertising, the company can other regional vice presidents of the insurance company be even more successful in the future in all seven cur For their contributions, each became the owner of 15 rent markets with a fully developed and funded adver percent of Nature Bros. Lad. The process of getting the tising campaign. The marketing approach will include product to the retail market began in August 2002, and advertisements in the print media, with ads on "food the first grocery store sales started in March 2003. The day offering cents-off coupons. This program will take initial marketing plan was fairly simple--to get the place in all seven markets, while stores will continue to product in the hands of the consumer. Morris personally use floor displays for demonstrations. Nearly 100 per- visited the managers of individual supermarkets, both cent warehouse penetration should be achieved in 2004 chains and independents, and convinced many to allow in these markets. a tasting demonstration booth to be set up in their stores The goal for the category of salt substitutes for 2004 These demonstrations proved as popular as the first is 10 percent of the market share. This larger market Thanksgiving dinner trial nearly 10 years earlier. Dale share can be achieved since there are only a few com- Morris's product was a hit, and in a short time, he was petitors, Mrs. Dash, AMBI Inc. with Cordia Salt able to contract with food brokerage firms to place his Alternative, and RCN with No Salt. The company's product in stores in a 10-state region. product is superior in all respects and has a retail price advantage of 10 to 20 cents per can. In addition, the PRESENT SITUATION company's product is much more versatile than compet itors' products. Aggressive marketing and advertising As indicated in the balance sheet (see Exhibit 1), more will emphasize the tremendous versatility of usage as capital is needed to support the current markets and well as the great taste and health benefits of the product expand both markets and products. Two new products. The informal consumer surveys at demonstrations EXHIBIT 1 NATURE BROS. LTD. Balance Sheet As of September 30, 2003 5527.11 3186 24.95 21,512.75 327.37 940.43 1,082.29 303.70 4.548.41 2,114.95 531,913.82 $ 2,402.25 1.222.46 18,76821 00 15,000.00 0,800.011 1502.50) $29,090.41 Unaudited Current sets 110 Cash-American Bank 112 Cash-Bank of Okla-Pryor 115 Cash on hand 120 Accounts receivable 125 Employee advances 140 Inventory Shipping 141 levventory-Raw materials 142 Inventory-Work-in-progress 143 Inventory-Packaging 144 Inventory - Promotional Total current assets Fored assets 160 Leasehold improvements 165 Fixtures and furniture 167 Equipment 169 office equipment 170 1986 Lincoln Town Car 180 Less: Accumulated depreciation 181 Less: Amortization Totalfixed assets Other assets 193 Organizational cost 194 Prepaid interest 195 Utility deposits Total fixed and other assets Total assets Current liabilities 205 Accounts payable 210 Note payable premium finances 220 Federal tax withheld 225 FICA tax withheld 230 State tax withheld 231 State and federal employment taxes Total current liabilities Long-term liabilities 245 Note payable-All fill 246 Note payable American Bank 247 Note payable-Sikeston Leasing Total long-term liabilities Total liabilities Capital account 290 Original capital stock 291 Additional paid-in capital 292 Treasury stock 295 Retained earnings 298 Net profit or loss Total owner's equity account Total liabilities and equity $ 4,08336 2.849.69 00 $36,023.46 567,937.28 $15.239.41 150.00 937.92 266.49 230.92 $16,913.00 $ 2.734.86 23.740.00 15.126.66 $41,50152 $5851452 $1,000.00 41.550.00 70.000 2.819.79 (29,267.530 $ 9,422.76 $67,937.28 531 532 PART 6 CASES Salt Substitute MSG Salt Free Old Fashioned Seasoning Enhance EXHIBIT 2 2004 Sales Projection Category Seasoned Salt Old Fashioned Our Product Seasoning Existing markets Oklahoma $1,101,844 Nebraska 799,260 Springfield, MO 508,620 Arkansas 135.950 Houston 1,671,180 Dallas 2.325, 120 Albuquerque 1,089.900 57,937,854 Market share (%) X5% 1st year sales $ 396,594 $ 715,638 605,538 385.432 330.294 1.266,128 1761,570 825,736 $5,890.246 X10N $ 58,024 396,594 589,024 97,854 $1,083,472 $ 237,778 201,916 128,034 109.12 020684 585,298 274.358 51957,090 X5 $ 97,854 Total 1st year sales volume indicated that consumers prefer Nature Bros to compet in the category of stoned salt, these markets have a itors' products by a wide margin dollar volume of $15,218,886 a year. Sult substitutes A new product , which is already developed, will be sell at a volume of 510,064,028, and the MSG category added during this time. Called "Enhance," it too is a $3,285,528. With proper advertising, the company dry mixed, noncooked, low overhead, high-profit food shares forecast in our current markets will also be product. Its category of MSG products has a dollar vol- Talired, ome of $1,957,090 in these markets. This category AS percent penetration of the seasoned salt includes only one main competitor, Accent, made by Per category is a very conservative projection considering Inc. Accent has not been heavily advertised, and it is the strong health consciousness of the West Coast one-line product with little initial time recognition. The The products will be introduced in shippers, used in company's new product will have a 10-to 20-cent per store demonstrations, and supported with media can retail price advantage to help achieve a 5 percent advertising to achieve at least a 5 percent market share of this category. In summary, 2004 will be spent share. This would result in sales of $760,943 in that solidifying the company's present market positions. category A 10 percent penetration is targeted in the saltfree 2005 OBJECTIVES Category Using aggressive marketing price advantage at retail, and better packaging, the company will be well The company intends to open eight new markets in positioned against the lower-quality products of out 2005 that include Los Angeles, Phoenix, Portland, competiton. With the dollar volume of this category Sacramento, Salt Lake City, Sun Francisco, Seattle, and 510,064,028. a conservative estimate of our she would Spokane. These new markets make up 17.1 percent of be $1,006,420. In the category of MSG, 25 percent grocery store sales, according to the Progressive share will be achieved. The main competitor in this Grocer's Marketing Guidebook, the industry standard. category does very little advertising. Again, attractive CASE 13 NATURE BROS. UD. 533 MSG Salt Substitute Salt Free Old Fashioned Seasoning Enhance 5 751418 535,816 104.510 346,808 1.329,432 1,885,644 667,020 $ 6.220,740 x12.55 5 775,593 $ 249,778 211,350 134,496 115.282 441.914 614,838 288,206 52,055,864 X7.5% 5 154,189 EXHIBIT 3 2005 Sales Projection Category Seasoned Salt Old Fashioned Our Product Seasoning Existing markets Oklahoma 5 2.15 936 Nebraska 97854 Springfield, MO 622.966 Arkansas 533970 Houston 2.00 Dallas 2.847,542 Albuquerque 1,334 925 Existing markets total 59.522.472 Market share Existing markets volume 5 714 185 New markets: Los Angeles $ 5.784678 Phoenix L245.930 Portland 1.157.294 Sacramento 1.590,906 Salt Lake City 1.152.250 San Francisco 2313870 Seattle 1.157.254 Spokane 711.GO New markets total $15.218.886 Market share XS New markets 5 volume $760,543 New markets Stotal 260 Existing markets total 714 15 Total volume 5 1.47 128 Old Fashioned Seasoning sales Salt-Free Old Fashioned Seasoning sales Enhance sales a new product Total 2005 sales 5 3.757,088 $1.248,888 309,218 268,990 751.418 249,776 1.098.226 365,060 751,416 249,776 1.502.838 199,554 751,416 249.776 462,412 153,708 $10.064,028 $3,285,528 X10N X5% $ 1,004,420 $164,276 1.006,420 164,276 777.593 154, 189 51.784013 $318.455 51.475,128 1,784013 318.465 $3,557,606 packaging, aggressive marketing, high quality, and a company plans to continue to solidity the markets provi retail price advantage of 30-40 cents per unit will cutly established through the use of coupons, co-op enable the company to realize a 5 percent market pene advertising quality promotions, and word-of-mouth tration. This share of the West Coast markets will genes advertising. Market share in these original markets ate sales of $164.276. Total sales of all three products in should increase by another 25 percent in 2005. The dol. these eight new markets will be around 51.931.639. The tar volume of the seasoned alt category in 2005 should 534 PART 6 CASES EXHIBIT 4 2004 Pro Forma Totals 2004 Percent 51,083.472 100 11.9 162 123,447 175,668 35.580 24.036 3.2 22 08 33.58 66.31 5 365,004 718.458 Sales Cost of goods Packaging Ingredients Plant labor Freight in Shipping materials Total cost of goods sold Gross profit Operating expenses President's salary Sales manager Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Professional services Travel and entertainment Freight out Advertising Promotion Brokerage Incentives Cash discounts Total expenses Cash flow Taxes Net profit before debt service 4,200 30,000 14.400 2.400 1992 3.000 1500 7,200 1200 5.4 5.640 3.000 24.000 59.08 216.584 12.036 54168 7.500 21,660 5 $10,158 20.0 1.1 5.0 6 20 207.66 155,736 19.1 143 be around $9.522,472, and our market share at 75 per would give sales of $154,189. The company's total sales cent would amount to $714.185. The dollar volume for for the existing markets in 2005 will be in excess of the salt substitute cutegory would be 56.220,748, giving $1,543.967. The totals for 2005 sales of Nature Bros sales at 125 percent of $775,593. In the MSG category, Old Fashioned Seasoning will be $1,475,128. Nature a 7.5 percent market share of the 52,055,864 volume Brok Sal-Fre volume should be $1,784,013. The sales 534 PART 6 CASES EXHIBIT 4 2004 Pro Forma Totals 2004 Percent 51,083.472 100 120.444 175,668 119 16.2 3.2 24.036 524 5 365.000 718.458 08 33.58 6631 Sales Cost of goods Packaging Ingredients Plant labor Freight in Shipping materials Total cost of goods sold Gross profit Operating expenses President's salary Sales manager Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Professional services Travel and entertainment Freight out Advertising Promotion Brokerage Incentives Cash discounts Total expenses Cash flow Taxes Net profit before debt service 2,200 30.000 14.400 2.400 1992 3.000 1800 7.200 1200 1200 5.640 3,000 24.000 59,088 216.584 12.035 54168 7.500 21,560 $ $10,158 5.4 20.0 1.1 5.0 6 20 470 207.65 155,736 19.1 143 be around $9,522,472, and our market share at 75 per would give sales of $154,189. The company's total sales cent would amount to $714.185. The dollar volume for for the existing markets in 2005 will be in excess of the salt substitute Category would be 56.220.748, giving $1,543.967. The totals for 2005 sales of Nature Bros. sales at 12.5 percent of $775593. In the MSG category, Old Fashioned Seasoning will be 51,475,128. Nature a 75 percent market share of the 52,055,864 volume Bros Salt Fre volume should be $1,784,013. The sales CASE 13 NATURE BROS. UD EXHIBIT 5 NATURE BROS. UTD Pro Forma Income Statement 2005-2008 2005 2008 2007 2008 56,136.224 $10,089.863 $12.506302 730,210 987,932 48,826 125,793 1,200,693 1624457 2.202.249 2.979.514 63.910 37.32 14.805 55.699,058 30.65 12.366.64 206,542 8.071 $ 2.100,240 30.90% 6.988.923 51.897,618 31.41 4,238,606 52,200 29,000 51.840 36.000 30,000 25.000 34.000 30,000 26.000 45.000 38000 14.000 30.000 28.000 22.000 15,000 15.000 5,000 3,500 18,000 Sales $3,557,605 Cost of goods Packaging 423,355 Ingredients 572,774 Plant labor 37,359 Freight in 72,930 Shipping materials 2.960 Total cost of goods sold $1,106,575 Percent of sales 31.36% Gross profit 2,451,031 Operating expenses President's salary 43,200 Sales manager 30,000 Sales rep 25.000 Salese Sales rep Salese Secretary 16.000 Secretary Employee benefits 2.400 3,000 Rent 3.600 Utilities 2.400 Phone 12.000 Office supplies 2.000 Postage 2.000 Car lease S60 Carcase 3.600 Carles Car lease Professional services 6,000 Travel and entertainment 48.000 New equipment 4.000 Freight out 197,269 Advertising 711.521 Promotion 40.000 Brokerage 177.880 Incentives 24547 Cash discounts 71152 Total expenses 51.431,209 Cash flow before taxes 1,019,822 Taxes 209.063 Net profit before debt service 5 310.759 Percent of sales 22.78% 4.000 4.000 2600 3,000 14.000 2.500 2.500 5,540 2,600 3.600 12.000 5.000 4000 5.540 8,000 72.000 14.000 334 424 1.227.244 68,112 306.811 42.399 122.724 52.402.994 1,835,612 458 903 $1376.709 10.000 5.000 2.600 3,500 15.000 3,000 3.000 5.500 4.000 3.600 4.000 8.000 $6.000 14.000 549,897 2017,972 111.997 504493 69.680 201.792 $ 3.845,192 3,845,192 785,932 5 2.357.799 23:36 4.000 4000 4000 10.000 120.000 24.000 1000059 1260 205.419 925 315 205.419 370125 5.6.2172 6.521.7 136164 2009 536 PART 6 CASES of Finance, our MSG product, should be $318,465. capability of producing about 300,000 units a month with This will give us a total sales volume of 53.557.606 for additional $15.000 investment for an automatic con- all three products in 2005 veyar system and a bigger product mixer. This production level would require two additional plant personnel , work FINANCIAL NEEDS AND PROJECTIONS ne shit with no overtime. The company could do He this production of needed with the addition of her In this plan, Morris indicated a need for $100,000 shift One of the main advantages of the company's besi equity infusion to expand sales, increase markets, and res is the very small overhead required to produce the add new products. The money would be used to secure products. The company can generate enough product to warehouse stocking space, do cooperative print adversach sales of approximately 54 million year while tising, give point-of-purchase display allowances, and maintaining production pwyroll of only $37.000 a year, pay operating expenses To meet the previously outlined production goals, the company will nood to purchase another filling machine NEW PRODUCT DEVELOPMENT in 2005. This machine will be capable of filling two ce with an overall speed of 75 cans per min The company plans to continue an ongoing research and which would increase capacity to 720,000 units a development program to introduce now and winning month. A higher speed scaming machine will also need products. Pour products are already developed that will to be purchased. The filling machine would cost approx be highly marketable and easily produced. Persoanele imately $22,000, a rebut came would cost $25,000, dedicated to building a large and profitable company while a new one would cost $50,000. With the addition und attracting quality brokers. The next new product of these two machines, the company would have a gets a different market segment but can be brought capacity of 1,000,000 units per month on one shift Goline for about $25,000 by using our existing machin By 2006, the company will have to decide whether to ery, types of containers, and display pieces. A highly contine the lease or buy the property where located respected broker felt that the product would be a big and expand the facilities. The property has plenty of success. The broker previously represented the only and for expansion for the next five years. The company major producer of a similar product, Pet Inc., which had has the sexibility to produce other types of products sales of $4.36 million in 1985. The company can achieve with the same equipment and can react quickly to at least a 5 percent market share with this product in the changes in customer preferences and modify its produc first year. The company's product will be at least equal to lie to meet sich demands as needed in quality and offer a 17 percent price advantage to the consumer, while still making an ccellent profit, Another new product would require slightly different cquipment. This product would be initially produced by a private label manufacturer. The product would be established before any major machinery was purchased Many large companies use private-label manufacturers or co-packers, as they are called in the trade Consumer tests at demonstrations and food shows have indicated that each of these products will be strong PLANT AND EQUIPMENT The company's plant is located in a nearly new metal building in Rose, Oklahoma. The case on the building limits payments to no more than $300 per month for the next seven years. The new computer-controlled filing equipment will be paid off in two months, and the sam ing equipment is leased from the company's container manufacture for only 51 per year. The company has the Additional Case discussion Questions: Nature Brothers Ltd. 1. Summarize the information presented regarding the present and proposed products. Briefly describe the company's 2004 and 2005 objectives. 2. After reviewing this material, make a list of additional information which should be supplied to support the sales projections. 3. Comment on objectives: Are they reasonable, optimistic, or conservative? What marketing mix would best support this growth rate? 4. Evaluate the information supplied regarding a new product development and physical assets in light of the pro forma income statements Morris developed. 5. Is the capital sought appropriate for the circumstances? If more information is needed, state what it is and how it could be obtained. 6. Based on the current balance sheet, how much equity should he give up for the investment? CASE 13 recipes except the pumpkin pie everything from the turkey and dressing to the vegetables and even the rolls. NATURE BROS. LTD. As the meal progressed, the verdict was unanimously in favor of his secret ingredient, although he had a hard BACKGROUND time convincing them that it was his invention and was Thanksgiving Day 1993 is the day that Dale Morris only 10 percent salt. Everyone wanted a sample to try at home remembers as the "public debut" of his creation, a new seasoned salt mix. Although he was a salesman by tem. Experiments in new uses led to "tasting parties" for Over the next two years, Morris perfected his product. perament and career, his hobby was cooking. Having friends and neighbors, and the holiday season found the experimented with both traditional home cooking and Morris kitchen transformed into a miniature assembly more exotic gourmet cooking, Morris had developed an line producing gift-wrapped bottles of the mix. Morris appreciation for many herbs and spices. He had also became something of a celebrity in his small town, but it done a lot of reading about the health hazards of the wasn't until the Ladies Mission Society at his church typical American diet. When his mother learned that she had high blood pressure, Morris decided it was time Source: This case was modified by Sergey Anokhin of the Weatherhead for some action. He created a low-salt seasoning mix. School of Management, Case Western Reserve University, as a basis for based on a nutritive yeast extract, that could be used to classroom discussion rather than to illustrate either effective or ineffec replace salt in most cases. This Thanksgiving dinner and the mess of its officers have been disguised Support for the prepared for 25 family members and friends, would be development of this case was provided by the Centre for International his final testing ground. He used his mix in all the Business Studies, University of Manitoba, Canada 530 PART 6 CASES approached him with the idea of allowing them to sell his are being developed a salt-free version of the original mit as a fund-raiser that he realized the possibilities of product and an MSG-based favor enhance that will his creation. His kitchen scale operation could support compete with Accent. Morris worked with a business the sales effort of the church women for a short time, but consultant in drawing up a business plan to describe his if he wanted to take advantage of a truly marketable company, its future growth and its capital needs. product, he would have to make other arrangements. Morris agreed to "test-market" his product through OVERALL PROJECTIONS the church group while he looked for ways to expand and commercialize his operation. The charity ale was a The first section discusses the objectives and sales pro- huge success (the best the women had ever experi jections for 2004 and 2005 (Exhibits 2 and 3). The enced), and, based on this success, Morris moved to resulting proforma income statements for 2004 to 2005 create his own company Naming his product "Nature are in Exhibits 4 and 5 Bros. Old Fashioned Seasoning," he incorporated the company in 1995 as Nature Bros. Ltd. Morris used most 2004 OBJECTIVES of his savings to develop and register the trademarks, for packaging, and for product displays. He researched The company's objectives for 2004 are to stabilize its the cost of manufacturing and bottling his product in existing markets and to achieve a 5 percent market share large quantities and concluded that he just didn't have in the category of seasoned salt, a 10 percent market the cash to get started. His first attempts to raise money, share in salt substitutes, and a 5 percent market share in in the form of a personal bank loan, were unsuccessful. MSG products. Although the original product contains and he was forced to abandon the project less than 10 percent salt, the company has developed a For several years, he concentrated on his career, saltfre product to compete with other such products, becoming a regional vice president of the insurance The dollar volume for the seasoned salt category in the company he worked for. He continued to make "Nature seven markets the company is in will amount to Bros. Seasoning" in small batches, mainly for his $7.931,889 in 2004. In 2003, sales of the company in mother and business associates. These users eventually the Oklahoma market were 5.5 percent of the total sales enabled Morris to get financial support for his company for that market for the cight-month period that the com To raise $65,000 to lease manufacturing equipment and pany was operational. Since these sales were accom building space, he sold stock to his mother and to two plished with absolutely no advertising, the company can other regional vice presidents of the insurance company be even more successful in the future in all seven cur For their contributions, each became the owner of 15 rent markets with a fully developed and funded adver percent of Nature Bros. Lad. The process of getting the tising campaign. The marketing approach will include product to the retail market began in August 2002, and advertisements in the print media, with ads on "food the first grocery store sales started in March 2003. The day offering cents-off coupons. This program will take initial marketing plan was fairly simple--to get the place in all seven markets, while stores will continue to product in the hands of the consumer. Morris personally use floor displays for demonstrations. Nearly 100 per- visited the managers of individual supermarkets, both cent warehouse penetration should be achieved in 2004 chains and independents, and convinced many to allow in these markets. a tasting demonstration booth to be set up in their stores The goal for the category of salt substitutes for 2004 These demonstrations proved as popular as the first is 10 percent of the market share. This larger market Thanksgiving dinner trial nearly 10 years earlier. Dale share can be achieved since there are only a few com- Morris's product was a hit, and in a short time, he was petitors, Mrs. Dash, AMBI Inc. with Cordia Salt able to contract with food brokerage firms to place his Alternative, and RCN with No Salt. The company's product in stores in a 10-state region. product is superior in all respects and has a retail price advantage of 10 to 20 cents per can. In addition, the PRESENT SITUATION company's product is much more versatile than compet itors' products. Aggressive marketing and advertising As indicated in the balance sheet (see Exhibit 1), more will emphasize the tremendous versatility of usage as capital is needed to support the current markets and well as the great taste and health benefits of the product expand both markets and products. Two new products. The informal consumer surveys at demonstrations EXHIBIT 1 NATURE BROS. LTD. Balance Sheet As of September 30, 2003 5527.11 3186 24.95 21,512.75 327.37 940.43 1,082.29 303.70 4.548.41 2,114.95 531,913.82 $ 2,402.25 1.222.46 18,76821 00 15,000.00 0,800.011 1502.50) $29,090.41 Unaudited Current sets 110 Cash-American Bank 112 Cash-Bank of Okla-Pryor 115 Cash on hand 120 Accounts receivable 125 Employee advances 140 Inventory Shipping 141 levventory-Raw materials 142 Inventory-Work-in-progress 143 Inventory-Packaging 144 Inventory - Promotional Total current assets Fored assets 160 Leasehold improvements 165 Fixtures and furniture 167 Equipment 169 office equipment 170 1986 Lincoln Town Car 180 Less: Accumulated depreciation 181 Less: Amortization Totalfixed assets Other assets 193 Organizational cost 194 Prepaid interest 195 Utility deposits Total fixed and other assets Total assets Current liabilities 205 Accounts payable 210 Note payable premium finances 220 Federal tax withheld 225 FICA tax withheld 230 State tax withheld 231 State and federal employment taxes Total current liabilities Long-term liabilities 245 Note payable-All fill 246 Note payable American Bank 247 Note payable-Sikeston Leasing Total long-term liabilities Total liabilities Capital account 290 Original capital stock 291 Additional paid-in capital 292 Treasury stock 295 Retained earnings 298 Net profit or loss Total owner's equity account Total liabilities and equity $ 4,08336 2.849.69 00 $36,023.46 567,937.28 $15.239.41 150.00 937.92 266.49 230.92 $16,913.00 $ 2.734.86 23.740.00 15.126.66 $41,50152 $5851452 $1,000.00 41.550.00 70.000 2.819.79 (29,267.530 $ 9,422.76 $67,937.28 531 532 PART 6 CASES Salt Substitute MSG Salt Free Old Fashioned Seasoning Enhance EXHIBIT 2 2004 Sales Projection Category Seasoned Salt Old Fashioned Our Product Seasoning Existing markets Oklahoma $1,101,844 Nebraska 799,260 Springfield, MO 508,620 Arkansas 135.950 Houston 1,671,180 Dallas 2.325, 120 Albuquerque 1,089.900 57,937,854 Market share (%) X5% 1st year sales $ 396,594 $ 715,638 605,538 385.432 330.294 1.266,128 1761,570 825,736 $5,890.246 X10N $ 58,024 396,594 589,024 97,854 $1,083,472 $ 237,778 201,916 128,034 109.12 020684 585,298 274.358 51957,090 X5 $ 97,854 Total 1st year sales volume indicated that consumers prefer Nature Bros to compet in the category of stoned salt, these markets have a itors' products by a wide margin dollar volume of $15,218,886 a year. Sult substitutes A new product , which is already developed, will be sell at a volume of 510,064,028, and the MSG category added during this time. Called "Enhance," it too is a $3,285,528. With proper advertising, the company dry mixed, noncooked, low overhead, high-profit food shares forecast in our current markets will also be product. Its category of MSG products has a dollar vol- Talired, ome of $1,957,090 in these markets. This category AS percent penetration of the seasoned salt includes only one main competitor, Accent, made by Per category is a very conservative projection considering Inc. Accent has not been heavily advertised, and it is the strong health consciousness of the West Coast one-line product with little initial time recognition. The The products will be introduced in shippers, used in company's new product will have a 10-to 20-cent per store demonstrations, and supported with media can retail price advantage to help achieve a 5 percent advertising to achieve at least a 5 percent market share of this category. In summary, 2004 will be spent share. This would result in sales of $760,943 in that solidifying the company's present market positions. category A 10 percent penetration is targeted in the saltfree 2005 OBJECTIVES Category Using aggressive marketing price advantage at retail, and better packaging, the company will be well The company intends to open eight new markets in positioned against the lower-quality products of out 2005 that include Los Angeles, Phoenix, Portland, competiton. With the dollar volume of this category Sacramento, Salt Lake City, Sun Francisco, Seattle, and 510,064,028. a conservative estimate of our she would Spokane. These new markets make up 17.1 percent of be $1,006,420. In the category of MSG, 25 percent grocery store sales, according to the Progressive share will be achieved. The main competitor in this Grocer's Marketing Guidebook, the industry standard. category does very little advertising. Again, attractive CASE 13 NATURE BROS. UD. 533 MSG Salt Substitute Salt Free Old Fashioned Seasoning Enhance 5 751418 535,816 104.510 346,808 1.329,432 1,885,644 667,020 $ 6.220,740 x12.55 5 775,593 $ 249,778 211,350 134,496 115.282 441.914 614,838 288,206 52,055,864 X7.5% 5 154,189 EXHIBIT 3 2005 Sales Projection Category Seasoned Salt Old Fashioned Our Product Seasoning Existing markets Oklahoma 5 2.15 936 Nebraska 97854 Springfield, MO 622.966 Arkansas 533970 Houston 2.00 Dallas 2.847,542 Albuquerque 1,334 925 Existing markets total 59.522.472 Market share Existing markets volume 5 714 185 New markets: Los Angeles $ 5.784678 Phoenix L245.930 Portland 1.157.294 Sacramento 1.590,906 Salt Lake City 1.152.250 San Francisco 2313870 Seattle 1.157.254 Spokane 711.GO New markets total $15.218.886 Market share XS New markets 5 volume $760,543 New markets Stotal 260 Existing markets total 714 15 Total volume 5 1.47 128 Old Fashioned Seasoning sales Salt-Free Old Fashioned Seasoning sales Enhance sales a new product Total 2005 sales 5 3.757,088 $1.248,888 309,218 268,990 751.418 249,776 1.098.226 365,060 751,416 249,776 1.502.838 199,554 751,416 249.776 462,412 153,708 $10.064,028 $3,285,528 X10N X5% $ 1,004,420 $164,276 1.006,420 164,276 777.593 154, 189 51.784013 $318.455 51.475,128 1,784013 318.465 $3,557,606 packaging, aggressive marketing, high quality, and a company plans to continue to solidity the markets provi retail price advantage of 30-40 cents per unit will cutly established through the use of coupons, co-op enable the company to realize a 5 percent market pene advertising quality promotions, and word-of-mouth tration. This share of the West Coast markets will genes advertising. Market share in these original markets ate sales of $164.276. Total sales of all three products in should increase by another 25 percent in 2005. The dol. these eight new markets will be around 51.931.639. The tar volume of the seasoned alt category in 2005 should 534 PART 6 CASES EXHIBIT 4 2004 Pro Forma Totals 2004 Percent 51,083.472 100 11.9 162 123,447 175,668 35.580 24.036 3.2 22 08 33.58 66.31 5 365,004 718.458 Sales Cost of goods Packaging Ingredients Plant labor Freight in Shipping materials Total cost of goods sold Gross profit Operating expenses President's salary Sales manager Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Professional services Travel and entertainment Freight out Advertising Promotion Brokerage Incentives Cash discounts Total expenses Cash flow Taxes Net profit before debt service 4,200 30,000 14.400 2.400 1992 3.000 1500 7,200 1200 5.4 5.640 3.000 24.000 59.08 216.584 12.036 54168 7.500 21,660 5 $10,158 20.0 1.1 5.0 6 20 207.66 155,736 19.1 143 be around $9.522,472, and our market share at 75 per would give sales of $154,189. The company's total sales cent would amount to $714.185. The dollar volume for for the existing markets in 2005 will be in excess of the salt substitute cutegory would be 56.220,748, giving $1,543.967. The totals for 2005 sales of Nature Bros sales at 125 percent of $775,593. In the MSG category, Old Fashioned Seasoning will be $1,475,128. Nature a 7.5 percent market share of the 52,055,864 volume Brok Sal-Fre volume should be $1,784,013. The sales 534 PART 6 CASES EXHIBIT 4 2004 Pro Forma Totals 2004 Percent 51,083.472 100 120.444 175,668 119 16.2 3.2 24.036 524 5 365.000 718.458 08 33.58 6631 Sales Cost of goods Packaging Ingredients Plant labor Freight in Shipping materials Total cost of goods sold Gross profit Operating expenses President's salary Sales manager Secretary Employee benefits Insurance Rent Utilities Phone Office supplies Postage Car lease Professional services Travel and entertainment Freight out Advertising Promotion Brokerage Incentives Cash discounts Total expenses Cash flow Taxes Net profit before debt service 2,200 30.000 14.400 2.400 1992 3.000 1800 7.200 1200 1200 5.640 3,000 24.000 59,088 216.584 12.035 54168 7.500 21,560 $ $10,158 5.4 20.0 1.1 5.0 6 20 470 207.65 155,736 19.1 143 be around $9,522,472, and our market share at 75 per would give sales of $154,189. The company's total sales cent would amount to $714.185. The dollar volume for for the existing markets in 2005 will be in excess of the salt substitute Category would be 56.220.748, giving $1,543.967. The totals for 2005 sales of Nature Bros. sales at 12.5 percent of $775593. In the MSG category, Old Fashioned Seasoning will be 51,475,128. Nature a 75 percent market share of the 52,055,864 volume Bros Salt Fre volume should be $1,784,013. The sales CASE 13 NATURE BROS. UD EXHIBIT 5 NATURE BROS. UTD Pro Forma Income Statement 2005-2008 2005 2008 2007 2008 56,136.224 $10,089.863 $12.506302 730,210 987,932 48,826 125,793 1,200,693 1624457 2.202.249 2.979.514 63.910 37.32 14.805 55.699,058 30.65 12.366.64 206,542 8.071 $ 2.100,240 30.90% 6.988.923 51.897,618 31.41 4,238,606 52,200 29,000 51.840 36.000 30,000 25.000 34.000 30,000 26.000 45.000 38000 14.000 30.000 28.000 22.000 15,000 15.000 5,000 3,500 18,000 Sales $3,557,605 Cost of goods Packaging 423,355 Ingredients 572,774 Plant labor 37,359 Freight in 72,930 Shipping materials 2.960 Total cost of goods sold $1,106,575 Percent of sales 31.36% Gross profit 2,451,031 Operating expenses President's salary 43,200 Sales manager 30,000 Sales rep 25.000 Salese Sales rep Salese Secretary 16.000 Secretary Employee benefits 2.400 3,000 Rent 3.600 Utilities 2.400 Phone 12.000 Office supplies 2.000 Postage 2.000 Car lease S60 Carcase 3.600 Carles Car lease Professional services 6,000 Travel and entertainment 48.000 New equipment 4.000 Freight out 197,269 Advertising 711.521 Promotion 40.000 Brokerage 177.880 Incentives 24547 Cash discounts 71152 Total expenses 51.431,209 Cash flow before taxes 1,019,822 Taxes 209.063 Net profit before debt service 5 310.759 Percent of sales 22.78% 4.000 4.000 2600 3,000 14.000 2.500 2.500 5,540 2,600 3.600 12.000 5.000 4000 5.540 8,000 72.000 14.000 334 424 1.227.244 68,112 306.811 42.399 122.724 52.402.994 1,835,612 458 903 $1376.709 10.000 5.000 2.600 3,500 15.000 3,000 3.000 5.500 4.000 3.600 4.000 8.000 $6.000 14.000 549,897 2017,972 111.997 504493 69.680 201.792 $ 3.845,192 3,845,192 785,932 5 2.357.799 23:36 4.000 4000 4000 10.000 120.000 24.000 1000059 1260 205.419 925 315 205.419 370125 5.6.2172 6.521.7 136164 2009 536 PART 6 CASES of Finance, our MSG product, should be $318,465. capability of producing about 300,000 units a month with This will give us a total sales volume of 53.557.606 for additional $15.000 investment for an automatic con- all three products in 2005 veyar system and a bigger product mixer. This production level would require two additional plant personnel , work FINANCIAL NEEDS AND PROJECTIONS ne shit with no overtime. The company could do He this production of needed with the addition of her In this plan, Morris indicated a need for $100,000 shift One of the main advantages of the company's besi equity infusion to expand sales, increase markets, and res is the very small overhead required to produce the add new products. The money would be used to secure products. The company can generate enough product to warehouse stocking space, do cooperative print adversach sales of approximately 54 million year while tising, give point-of-purchase display allowances, and maintaining production pwyroll of only $37.000 a year, pay operating expenses To meet the previously outlined production goals, the company will nood to purchase another filling machine NEW PRODUCT DEVELOPMENT in 2005. This machine will be capable of filling two ce with an overall speed of 75 cans per min The company plans to continue an ongoing research and which would increase capacity to 720,000 units a development program to introduce now and winning month. A higher speed scaming machine will also need products. Pour products are already developed that will to be purchased. The filling machine would cost approx be highly marketable and easily produced. Persoanele imately $22,000, a rebut came would cost $25,000, dedicated to building a large and profitable company while a new one would cost $50,000. With the addition und attracting quality brokers. The next new product of these two machines, the company would have a gets a different market segment but can be brought capacity of 1,000,000 units per month on one shift Goline for about $25,000 by using our existing machin By 2006, the company will have to decide whether to ery, types of containers, and display pieces. A highly contine the lease or buy the property where located respected broker felt that the product would be a big and expand the facilities. The property has plenty of success. The broker previously represented the only and for expansion for the next five years. The company major producer of a similar product, Pet Inc., which had has the sexibility to produce other types of products sales of $4.36 million in 1985. The company can achieve with the same equipment and can react quickly to at least a 5 percent market share with this product in the changes in customer preferences and modify its produc first year. The company's product will be at least equal to lie to meet sich demands as needed in quality and offer a 17 percent price advantage to the consumer, while still making an ccellent profit, Another new product would require slightly different cquipment. This product would be initially produced by a private label manufacturer. The product would be established before any major machinery was purchased Many large companies use private-label manufacturers or co-packers, as they are called in the trade Consumer tests at demonstrations and food shows have indicated that each of these products will be strong PLANT AND EQUIPMENT The company's plant is located in a nearly new metal building in Rose, Oklahoma. The case on the building limits payments to no more than $300 per month for the next seven years. The new computer-controlled filing equipment will be paid off in two months, and the sam ing equipment is leased from the company's container manufacture for only 51 per year. The company has the Additional Case discussion Questions: Nature Brothers Ltd. 1. Summarize the information presented regarding the present and proposed products. Briefly describe the company's 2004 and 2005 objectives. 2. After reviewing this material, make a list of additional information which should be supplied to support the sales projections. 3. Comment on objectives: Are they reasonable, optimistic, or conservative? What marketing mix would best support this growth rate? 4. Evaluate the information supplied regarding a new product development and physical assets in light of the pro forma income statements Morris developed. 5. Is the capital sought appropriate for the circumstances? If more information is needed, state what it is and how it could be obtained. 6. Based on the current balance sheet, how much equity should he give up for the investment