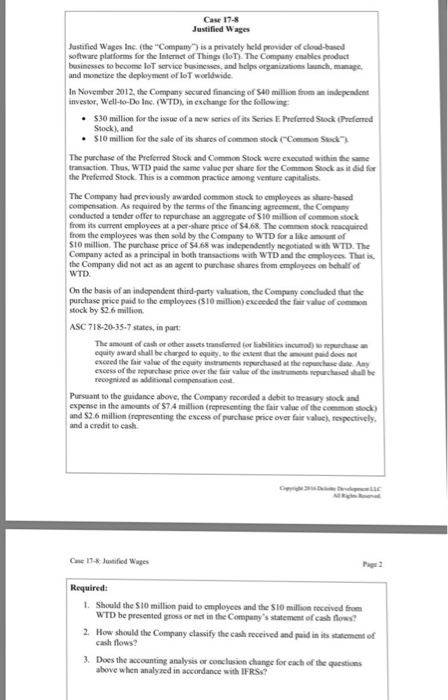

Case 17-8 Justified Wages Justified Wages Inc. (the "Company) is a privatcly held provider of cloud-based software platforms for the Internet of Things (loT). The Company enables product basinesses to become loT service businesses, and helps organizations launch, manage and monetize the deployment of loT worldwide In November 2012, the Company sacured financing of $40 million from an independent investor, Well-to-Do Ine. (WTD), in exchange for the following $30 maillion for the issue of a new series of its Series E Preforred Stock (Prefared Stock), and $10 mallion for the sale of its shares of common stock (Common Sock The purchase of the Preferred Stock and Common Stock were executed within the same transaction. Thus, WTD paid the same value per share for the Common Stock as it did for the Preferred Stock This is a common practice among venture capitalists The Company had previoasly awarded common stock to employees as share-based compensation. As required by the terms of the financing agreement the Company conducted a tender offer to repurchase an aggregate of $10 million of common stock from its current employees at a per-share price of $4.68. The common stock reacquired from the employees was then sold by the Company to WTD for a like amount of 10 million. The parchase price of S4.68 was independently negotiatod with WTD The Company acted as a principal in both transactions with WTD and the employces. That is the Company did not act as an agent to parchase shares from employees on bchalf of WTD On the basis of an indapendent third-party valuation, the Company concladed that the purchase price paid to the employees ($10 million) esceeded the fair valuc of common stock by $2 6 million. ASC 718-20-35-7 states, in part The amount of cash or other assets transfmedior babilties incamad) Nprdlie equity award shall be chargod to equity, to the extent that the amount paid des ot exceed the Eair value of the equity instruments ropurchased at the rse date Amy excess of the repurchase price over the fair value ofthe amtrummts repudiod all be Pursuant to the guidance above, the Company recorded a debit to treasury stock and expense in the amounts of $7.4 million (representing the fair value of the common stock and $2.6 million (representing the excess of purchase price over fair valac), respectively, and a credit to cash Case 17-8: Justified Wages Page 2 Required: I. Should the S10 million paid to employees and the $10 million roccived from WTD be presented gross or net in the Company's statement of cash flows? How should the Company classify the cash received and paid in its statment of cash flows? 2. 3. Does the accounting analysis or conclusion change for each of the question above when analyzed in accordance with IFRSs? Case 17-8 Justified Wages Justified Wages Inc. (the "Company) is a privatcly held provider of cloud-based software platforms for the Internet of Things (loT). The Company enables product basinesses to become loT service businesses, and helps organizations launch, manage and monetize the deployment of loT worldwide In November 2012, the Company sacured financing of $40 million from an independent investor, Well-to-Do Ine. (WTD), in exchange for the following $30 maillion for the issue of a new series of its Series E Preforred Stock (Prefared Stock), and $10 mallion for the sale of its shares of common stock (Common Sock The purchase of the Preferred Stock and Common Stock were executed within the same transaction. Thus, WTD paid the same value per share for the Common Stock as it did for the Preferred Stock This is a common practice among venture capitalists The Company had previoasly awarded common stock to employees as share-based compensation. As required by the terms of the financing agreement the Company conducted a tender offer to repurchase an aggregate of $10 million of common stock from its current employees at a per-share price of $4.68. The common stock reacquired from the employees was then sold by the Company to WTD for a like amount of 10 million. The parchase price of S4.68 was independently negotiatod with WTD The Company acted as a principal in both transactions with WTD and the employces. That is the Company did not act as an agent to parchase shares from employees on bchalf of WTD On the basis of an indapendent third-party valuation, the Company concladed that the purchase price paid to the employees ($10 million) esceeded the fair valuc of common stock by $2 6 million. ASC 718-20-35-7 states, in part The amount of cash or other assets transfmedior babilties incamad) Nprdlie equity award shall be chargod to equity, to the extent that the amount paid des ot exceed the Eair value of the equity instruments ropurchased at the rse date Amy excess of the repurchase price over the fair value ofthe amtrummts repudiod all be Pursuant to the guidance above, the Company recorded a debit to treasury stock and expense in the amounts of $7.4 million (representing the fair value of the common stock and $2.6 million (representing the excess of purchase price over fair valac), respectively, and a credit to cash Case 17-8: Justified Wages Page 2 Required: I. Should the S10 million paid to employees and the $10 million roccived from WTD be presented gross or net in the Company's statement of cash flows? How should the Company classify the cash received and paid in its statment of cash flows? 2. 3. Does the accounting analysis or conclusion change for each of the question above when analyzed in accordance with IFRSs