Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 2 1 Sun Coast Savings Bank Long Term Financial Decisions Directed Sun Coast Savings Bank was founded in 1 9 7 1 in Safety

Case

Sun Coast Savings Bank

Long Term Financial Decisions

Directed

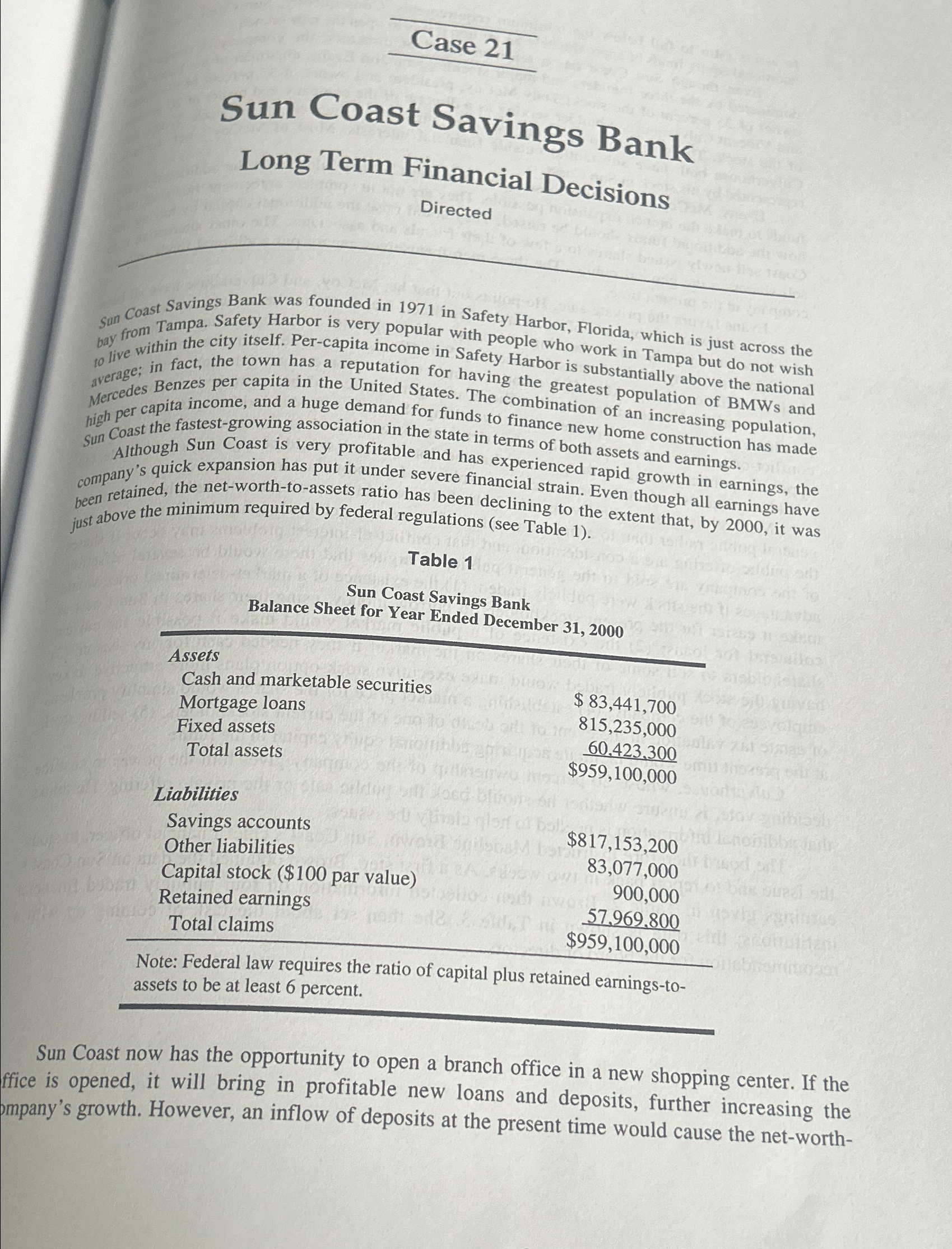

Sun Coast Savings Bank was founded in in Safety Harbor, Florida, which is just across the to live within the city itself. Percapita income in Safety people who work in Tampa but do not wish average; in fact, the town has a reputation for having ther is substantially above the national Mercedes Benzes per capita in the United States. The comb greatest population of BMWs and high per capita income, and a huge demand for funds to finance new of an increasing population, Sun Coast the fastestgrowing association in the state in terms of new home construction has made Although Sun Coast is very profitable and has experienced assets and earnings. company's quick expansion has put it under severe financial strain rapid growth in earnings, the been retained, the networthtoassets ratio has been declining to then though all earnings have just above the minimum required by federal regulations see Table

Table

Sun Coast Savings Bank

Balance Sheet for Year Ended December

Assets

Cash and marketable securities

Mortgage loans

Fixed assets

Total assets

Liabilities

Savings accounts

Other liabilities

$

Capital stock $ par value

table$

Table presents Sun Coast's balance sheet at the end of Using information contained in the balance sheet, calculate Sun Coast's networthtoassets ratio, the number of shares of stock outstanding, and the book value per share of common stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started