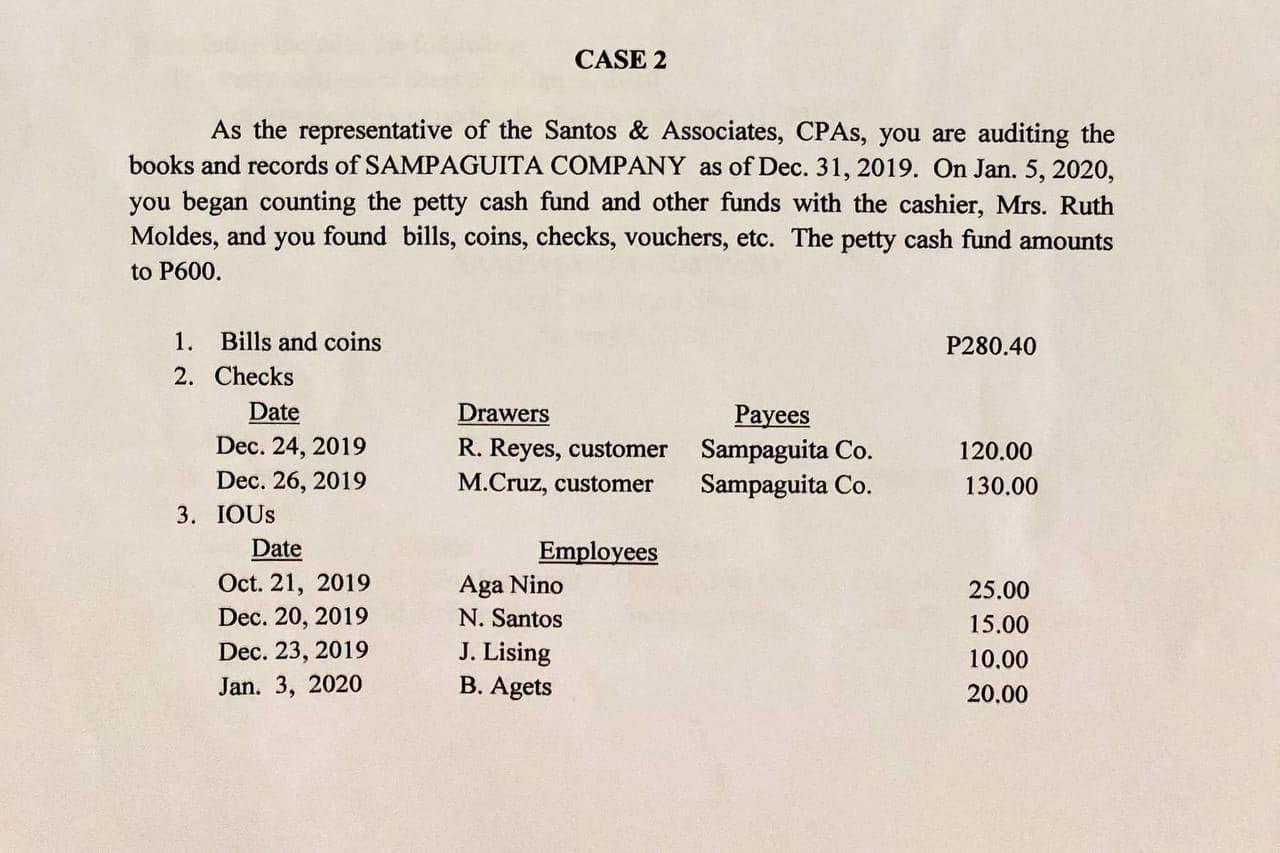

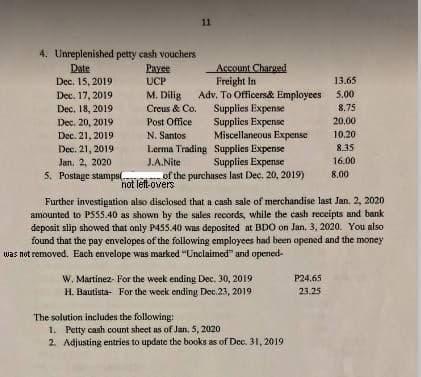

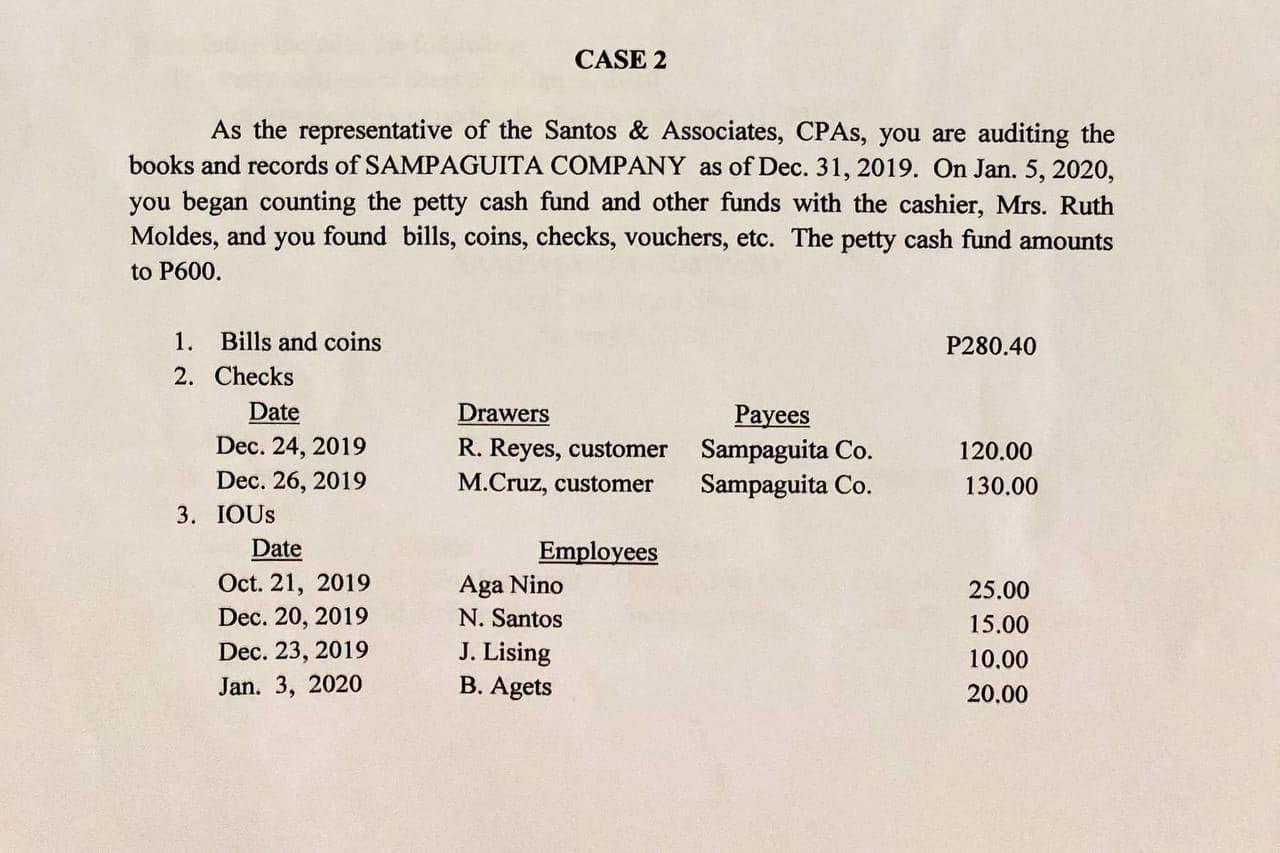

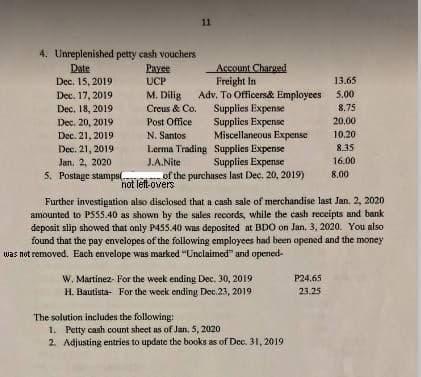

CASE 2 As the representative of the Santos & Associates, CPAs, you are auditing the books and records of SAMPAGUITA COMPANY as of Dec. 31, 2019. On Jan. 5, 2020, you began counting the petty cash fund and other funds with the cashier, Mrs. Ruth Moldes, and you found bills, coins, checks, vouchers, etc. The petty cash fund amounts to P600. P280.40 Drawers Payees R. Reyes, customer Sampaguita Co. M.Cruz, customer Sampaguita Co. 120.00 130.00 1. Bills and coins 2. Checks Date Dec. 24, 2019 Dec. 26, 2019 3. IOUS Date Oct. 21, 2019 Dec. 20, 2019 Dec. 23, 2019 Jan. 3, 2020 Employees Aga Nino N. Santos J. Lising B. Agets 25.00 15.00 10.00 20.00 11 4. Unreplenished petty cash vouchers Date Payee Account Charged Dec. 15, 2019 UCP Freight in 13.65 Dec. 17, 2019 M.Dilig Adv. To Officers Employees 5.00 Dec. 18, 2019 Creus & Co. Supplies Expense 8.75 Dec. 20, 2019 Post Office Supplies Expense 20,00 Dec. 21. 2019 N. Santos Miscellaneous Expense 10.20 Dec. 21, 2019 Lerma Trading Supplies Expense 8.35 Jan 2, 2020 J.A.Nite Supplies Expense 16.00 5. Postage stampa of the purchases last Dec. 20, 2019) 8.00 not left-overs Further investigation also disclosed that a cash sale of merchandise last Jan 2, 2020 amounted to P555.40 as shown by the sales records, while the cash receipts and bank deposit slip showed that only P455.40 was deposited at BDO on Jan. 3. 2020. You also found that the pay envelopes of the following employees had been opened and the money was not removed. Each cuvelope was marked "Unclaimed and opened W. Martinez. For the week ending Dec. 30, 2019 H. Bautista For the week ending Dec 23, 2019 P24.65 23.35 The solution includes the following: 1. Petty cash count sheet as of Jan 5, 2020 2 Adjusting entries to update the books as of Dec 31, 2019 CASE 2 As the representative of the Santos & Associates, CPAs, you are auditing the books and records of SAMPAGUITA COMPANY as of Dec. 31, 2019. On Jan. 5, 2020, you began counting the petty cash fund and other funds with the cashier, Mrs. Ruth Moldes, and you found bills, coins, checks, vouchers, etc. The petty cash fund amounts to P600. P280.40 Drawers Payees R. Reyes, customer Sampaguita Co. M.Cruz, customer Sampaguita Co. 120.00 130.00 1. Bills and coins 2. Checks Date Dec. 24, 2019 Dec. 26, 2019 3. IOUS Date Oct. 21, 2019 Dec. 20, 2019 Dec. 23, 2019 Jan. 3, 2020 Employees Aga Nino N. Santos J. Lising B. Agets 25.00 15.00 10.00 20.00 11 4. Unreplenished petty cash vouchers Date Payee Account Charged Dec. 15, 2019 UCP Freight in 13.65 Dec. 17, 2019 M.Dilig Adv. To Officers Employees 5.00 Dec. 18, 2019 Creus & Co. Supplies Expense 8.75 Dec. 20, 2019 Post Office Supplies Expense 20,00 Dec. 21. 2019 N. Santos Miscellaneous Expense 10.20 Dec. 21, 2019 Lerma Trading Supplies Expense 8.35 Jan 2, 2020 J.A.Nite Supplies Expense 16.00 5. Postage stampa of the purchases last Dec. 20, 2019) 8.00 not left-overs Further investigation also disclosed that a cash sale of merchandise last Jan 2, 2020 amounted to P555.40 as shown by the sales records, while the cash receipts and bank deposit slip showed that only P455.40 was deposited at BDO on Jan. 3. 2020. You also found that the pay envelopes of the following employees had been opened and the money was not removed. Each cuvelope was marked "Unclaimed and opened W. Martinez. For the week ending Dec. 30, 2019 H. Bautista For the week ending Dec 23, 2019 P24.65 23.35 The solution includes the following: 1. Petty cash count sheet as of Jan 5, 2020 2 Adjusting entries to update the books as of Dec 31, 2019