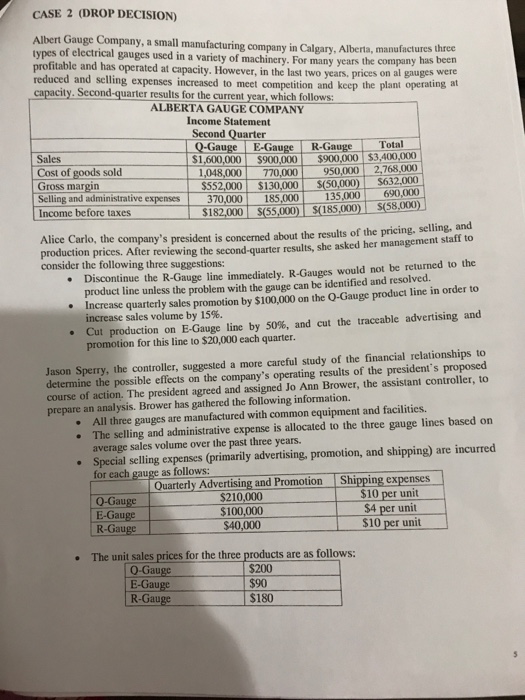

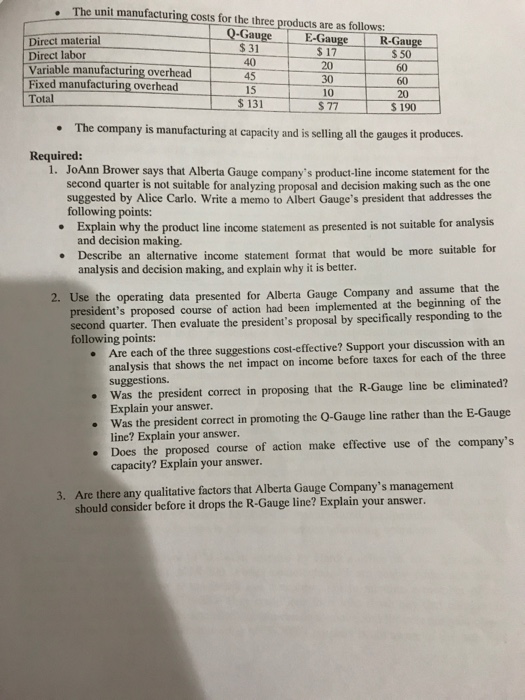

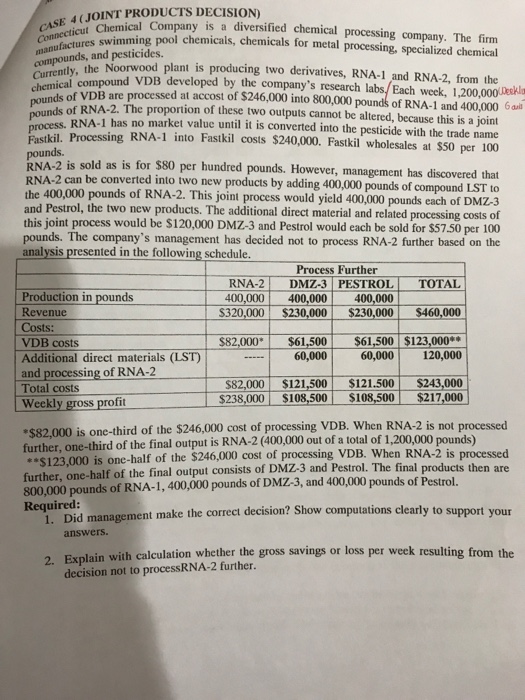

CASE 2 (DROP DECISION) Albert Gauge Company, a small manufacturing company in Calgary, Alberta, types of electrical gauges used in a variety of machinery. For many years the company profitable and has operated at capacity. However, in the last two years, prices on al gauges reduced and selling ex manufactures three has been were at meet competition and keep the plant ity. Second-quarter results for the current year, which follows: ALBERTA GAUGE COMPANY Income Statement Second Quarter Q-Gauge E-GaugeR-GaugeTotal 1,600,000 $900,000 $900,000 $3,400,000 Sales Cost of goods sold Gross margin 048,000770,000 950,000 2,768,000 SSS2,000-$130,000-S(50,000)-$632.000, Selling and administrative expenses 370,000 185,000 135,000 Income before taxes s182,000Ls(55,00)(185,00)| $(58000) production prices. After reviewing the second-quarter results, she asked her management staff to consider the following three suggestions Alice Carlo, th e company's president is concerned about the results of the pricing, selling, and Discontinue the R-Gauge line immediately. R-Gauges would not be returned to the product line unless the problem with the gauge can be identified and resolved. Increase quarterly sales promotion by $100,000 on the O-Gauge product line in order to increase sales volume by i596. Cut production on E-Gauge line by 50%, and cut the traceable advertising and promotion for this line to $20,000 each quarter. e Jason Sperry, the controller, suggested a more careful study of the financial relationships to determine the possible effects on the company's operating results of the president's proposed course of action. The president agreed and assigned Jo Ann Brower, the assistant controller, to prepare an analysis. Brower has gathered the following information. The selling and administrative expense is allocated to the three gauge lines based on . Special selling expenses (primarily advertising, promotion, and shipping) are incurred Quarterly Advertising and PromotionShipping expenses All three gauges are manufactured with common equipment and facilities. average sales volume over the past three years. for each gauge as follows: O-Gau . 10 per unit $4 per unit $10 per unit $210,000 E-Gau $40,000 The unit sales prices for the three products are as follows: $200 $90 $180 O-Gau E-Gauge R-Gau CASE 2 (DROP DECISION) Albert Gauge Company, a small manufacturing company in Calgary, Alberta, types of electrical gauges used in a variety of machinery. For many years the company profitable and has operated at capacity. However, in the last two years, prices on al gauges reduced and selling ex manufactures three has been were at meet competition and keep the plant ity. Second-quarter results for the current year, which follows: ALBERTA GAUGE COMPANY Income Statement Second Quarter Q-Gauge E-GaugeR-GaugeTotal 1,600,000 $900,000 $900,000 $3,400,000 Sales Cost of goods sold Gross margin 048,000770,000 950,000 2,768,000 SSS2,000-$130,000-S(50,000)-$632.000, Selling and administrative expenses 370,000 185,000 135,000 Income before taxes s182,000Ls(55,00)(185,00)| $(58000) production prices. After reviewing the second-quarter results, she asked her management staff to consider the following three suggestions Alice Carlo, th e company's president is concerned about the results of the pricing, selling, and Discontinue the R-Gauge line immediately. R-Gauges would not be returned to the product line unless the problem with the gauge can be identified and resolved. Increase quarterly sales promotion by $100,000 on the O-Gauge product line in order to increase sales volume by i596. Cut production on E-Gauge line by 50%, and cut the traceable advertising and promotion for this line to $20,000 each quarter. e Jason Sperry, the controller, suggested a more careful study of the financial relationships to determine the possible effects on the company's operating results of the president's proposed course of action. The president agreed and assigned Jo Ann Brower, the assistant controller, to prepare an analysis. Brower has gathered the following information. The selling and administrative expense is allocated to the three gauge lines based on . Special selling expenses (primarily advertising, promotion, and shipping) are incurred Quarterly Advertising and PromotionShipping expenses All three gauges are manufactured with common equipment and facilities. average sales volume over the past three years. for each gauge as follows: O-Gau . 10 per unit $4 per unit $10 per unit $210,000 E-Gau $40,000 The unit sales prices for the three products are as follows: $200 $90 $180 O-Gau E-Gauge R-Gau