Question

Case 2: Given the following owners income and expense estimates for an apartment property, formulate a reconstructed operating statement. The building consists of 10 units

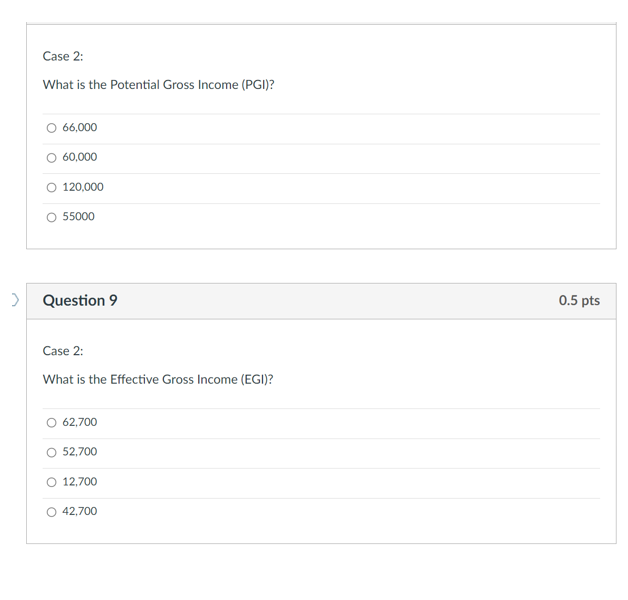

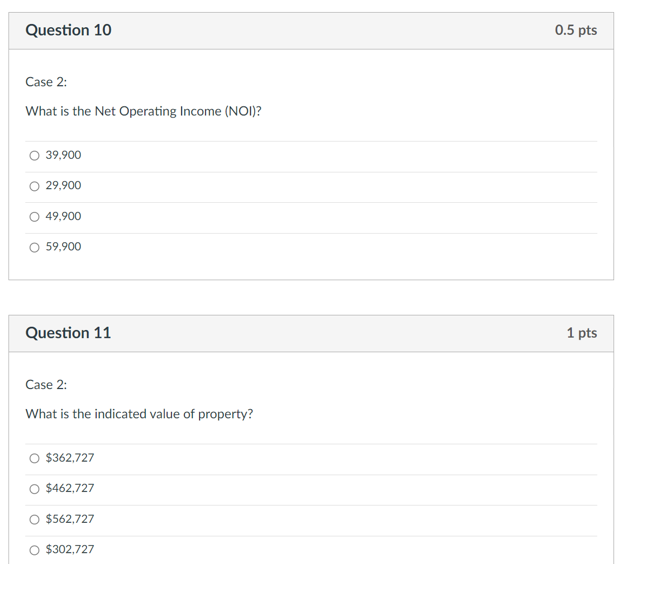

Case 2: Given the following owners income and expense estimates for an apartment property, formulate a reconstructed operating statement. The building consists of 10 units that could rent for $550 per month each. Owners Annual Income Statement Rental income (last year) $60,600 Less: Operating & capital expenses Power $2,200 Heat 1,700 Janitor 4,600 Water 3,700 Maintenance 4,800 Reserve for capital expenditures 2,800 Management 3,000 Tax depreciation 5,000 Mortgage payments 6,300 Estimating vacancy and collection losses at 5 percent of potential gross income, reconstruct the operating statement to obtain an estimate of NOI. Assume an above-line treatment of CAPX. Remember, there may be items in the owners statement that should not be included in the reconstructed operating statement.

Questions: 1. Using the NOI and a Ro of 11.0 percent, calculate the propertys indicated market value. Round your answer to the nearest $1,000.

Case 2: What is the Net Operating Income (NOI)? \begin{tabular}{|l|} \hline 39,900 \\ \hline 29,900 \\ \hline 49,900 \\ \hline 59,900 \\ \hline \end{tabular} Question 11 Case 2: What is the indicated value of property? $362,727 $462,727 $562,727 $302,727 Case 2: What is the Net Operating Income (NOI)? \begin{tabular}{|l|} \hline 39,900 \\ \hline 29,900 \\ \hline 49,900 \\ \hline 59,900 \\ \hline \end{tabular} Question 11 Case 2: What is the indicated value of property? $362,727 $462,727 $562,727 $302,727

Case 2: What is the Net Operating Income (NOI)? \begin{tabular}{|l|} \hline 39,900 \\ \hline 29,900 \\ \hline 49,900 \\ \hline 59,900 \\ \hline \end{tabular} Question 11 Case 2: What is the indicated value of property? $362,727 $462,727 $562,727 $302,727 Case 2: What is the Net Operating Income (NOI)? \begin{tabular}{|l|} \hline 39,900 \\ \hline 29,900 \\ \hline 49,900 \\ \hline 59,900 \\ \hline \end{tabular} Question 11 Case 2: What is the indicated value of property? $362,727 $462,727 $562,727 $302,727 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started