Answered step by step

Verified Expert Solution

Question

1 Approved Answer

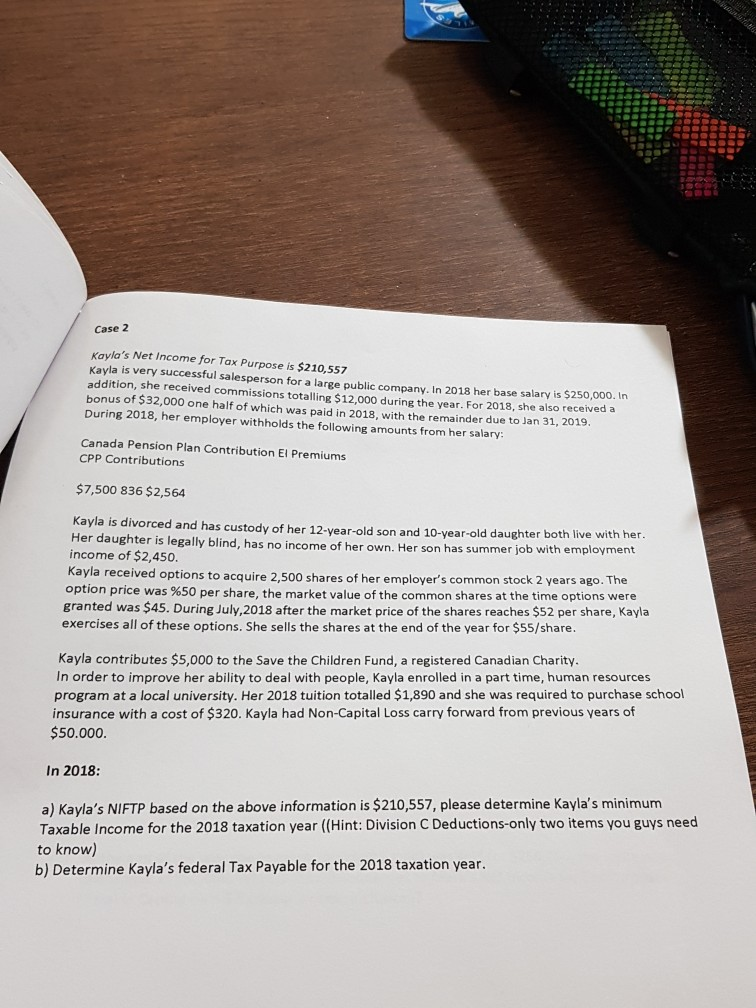

Case 2 Kayla's Net Income for Tax Purpose is $210,557 Kayla is very successful salesperson for a large public company. In 2018 her base salary

Case 2 Kayla's Net Income for Tax Purpose is $210,557 Kayla is very successful salesperson for a large public company. In 2018 her base salary is $250,000. In addition, she received commissions totalling $12,000 during the year. For 2018, she also received a bonus of $32,000 one half of which was paid in 2018, with the remainder due to Jan 31, 2019. During 2018, her employer withholds the following amounts from her salary Canada Pension Plan Contribution El Premiums CPP Contributions $7,500 836 $2,564 Kayla is divorced and has custody of her 12-year-old son and 10-year-old daughter both live with her Her daughter is legally blind, has no income of her own. Her son has summer job with emp income of $2,450. Kayla received options to acquire 2,500 shares of her employer's common stock 2 years ago. The option price was %50 per share, the market value of the common shares at the time options were granted was $45. During July,2018 after the market price of the shares reaches $52 per share, Kayla exercises all of these options. She sells the shares at the end of the year for $55/share. loyment Kayla contributes $5,000 to the Save the Children Fund, a registered Canadian Charity In order to improve her ability to deal with people, Kayla enrolled in a part time, human resources program at a local university. Her 2018 tuition totalled $1,890 and she was required to purchase school insurance with a cost of $320. Kayla had Non-Capital Loss carry forward from previous years of $50.000. In 2018: a) Kayla's NIFTP based on the above information is $210,557, please determine Kayla's minimum Taxable Income for the 2018 taxation year ((Hint: Division C Deductions-only two items you guys need to know) b) Determine Kayla's federal Tax Payable for the 2018 taxation year. Case 2 Kayla's Net Income for Tax Purpose is $210,557 Kayla is very successful salesperson for a large public company. In 2018 her base salary is $250,000. In addition, she received commissions totalling $12,000 during the year. For 2018, she also received a bonus of $32,000 one half of which was paid in 2018, with the remainder due to Jan 31, 2019. During 2018, her employer withholds the following amounts from her salary Canada Pension Plan Contribution El Premiums CPP Contributions $7,500 836 $2,564 Kayla is divorced and has custody of her 12-year-old son and 10-year-old daughter both live with her Her daughter is legally blind, has no income of her own. Her son has summer job with emp income of $2,450. Kayla received options to acquire 2,500 shares of her employer's common stock 2 years ago. The option price was %50 per share, the market value of the common shares at the time options were granted was $45. During July,2018 after the market price of the shares reaches $52 per share, Kayla exercises all of these options. She sells the shares at the end of the year for $55/share. loyment Kayla contributes $5,000 to the Save the Children Fund, a registered Canadian Charity In order to improve her ability to deal with people, Kayla enrolled in a part time, human resources program at a local university. Her 2018 tuition totalled $1,890 and she was required to purchase school insurance with a cost of $320. Kayla had Non-Capital Loss carry forward from previous years of $50.000. In 2018: a) Kayla's NIFTP based on the above information is $210,557, please determine Kayla's minimum Taxable Income for the 2018 taxation year ((Hint: Division C Deductions-only two items you guys need to know) b) Determine Kayla's federal Tax Payable for the 2018 taxation year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started