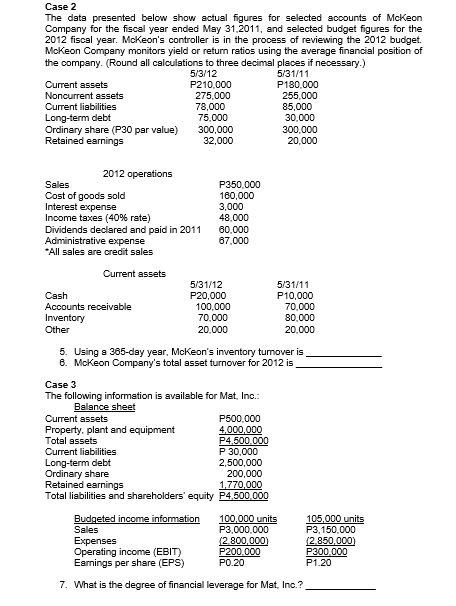

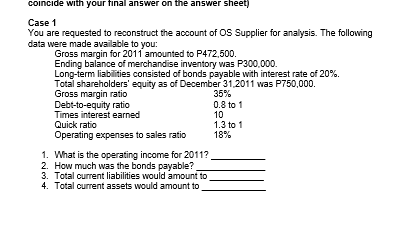

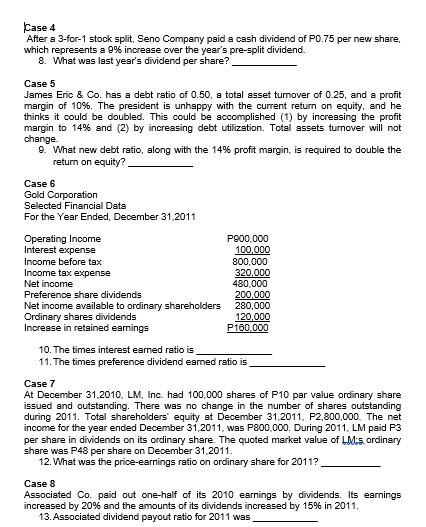

Case 2 The data presented below show actual figures for selected accounts of Mckeon Company for the fiscal year ended May 31.2011, and selected budget figures for the 2012 fiscal year. Mckeon's controller is in the process of reviewing the 2012 budget. Mckeon Company monitors yield or return ratios using the average financial position of the company. (Round all calculations to three decimal places if necessary.) 5/3/12 5/31/11 Current assets P210.000 P180.000 Noncurrent assets 275,000 255,000 Current liabilities 78,000 85,000 Long-term debt 75.000 30 000 Ordinary share (P30 par value) 300,000 300,000 Retained earnings 32,000 20,000 2012 operations Sales P350,000 Cost of goods sold 180,000 Interest expense 3,000 Income taxes (40% rate) 48 000 Dividends declared and paid in 2011 60.000 Administrative expense 37,000 *All sales are credit sales Current assets 5/31/12 5/31/11 Cash P20,000 P10,000 Accounts receivable 100,000 70,000 Inventory 70 000 80 000 Other 20.000 20.000 5. Using a 365-day year, Mckeon's inventory tumover is 6. Mckeon Company's total asset turnover for 2012 is Case 3 The following information is available for Mat, Inc.: Balance sheet Current assets P500,000 Property, plant and equipment 4,000,000 Total assets P4.500.000 Current liabilities P 30,000 Long-term debt 2,500,000 Ordinary share 200,000 Retained earnings 1,770,000 Total liabilities and shareholders' equity P4.500.000 Budgeted income information 100,000 units 105,000 units Sales P3,000,000 P3.150,000 Expenses (2.800,000) (2 850,000) Operating income (EBIT) P200.000 P300.000 Earnings per share (EPS) PO.20 P1.20 7. What is the degree of financial leverage for Mat, Inc.?coincide with your final answer on the answer sheet Case 1 You are requested to reconstruct the account of OS Supplier for anslysis. The following data were made ave able to you: Gross margin for 2011 amounted to P472,500. Ending balance of merchandise inventory was P300,000. Long-term liabilities consisted of bonds payable with interest rate of 20%. Total shareholders' equity as of December 31,2011 was P750,000. Gross margin ratio 35% Debt-to-equity ratio 0.8 to 1 Times interest earned 10 Quick ratio 1.3 to 1 Operating expenses to sales ratio 18% 1. What is the operating income for 2011? 2. How much was the bonds payable? 3. Total current liabilities would amount to 4. Total current assets would amount toCase 4 After a 3-for-1 stock split, Seno Company paid a cash dividend of P0.75 per new share, which represents a 9% increase over the year's pre-split dividend. 8. What was last year's dividend per share? Case 5 James Eric & Co. has a debt ratio of 0.50, a total asset turnover of 0.25, and a profit margin of 10%. The president is unhappy with the current return on equity, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 14% and (2) by increasing debt utilization. Total assets turnover will not change 9. What new debt ratio, along with the 14% profit margin, is required to double the return on equity? Case 6 Gold Corporation Selected Financial Data For the Year Ended, December 31.2011 Operating Income P800.000 Interest expense 100,000 Income before tax 800,000 Income tax expense 320,000 Net income 480,000 Preference share dividends 200,000 Net income available to ordinary shareholders 280,000 Ordinary shares dividends 120,000 Increase in retained eamings P160.000 10. The times interest earned ratio is 11. The times preference dividend earned ratio is Case 7 At December 31,2010. LM, Inc. had 100,000 shares of P10 par value ordinary share issued and outstanding. There was no change in the number of shares outstanding during 2011. Total shareholders' equity at December 31,2011, P2,800,000. The net income for the year ended December 31,2011, was P800,000. During 2011. LM paid F3 per share in dividends on its ordinary share. The quoted market value of LM;s ordinary share was P48 per share on December 31 2011. 12. What was the price-earnings ratio on ordinary share for 2011? Case 8 Associated Co. paid out one-half of its 2010 earnings by dividends. Its earnings increased by 20% and the amounts of its dividends increased by 15% in 2011. 13. Associated dividend payout ratio for 2011 was