Answered step by step

Verified Expert Solution

Question

1 Approved Answer

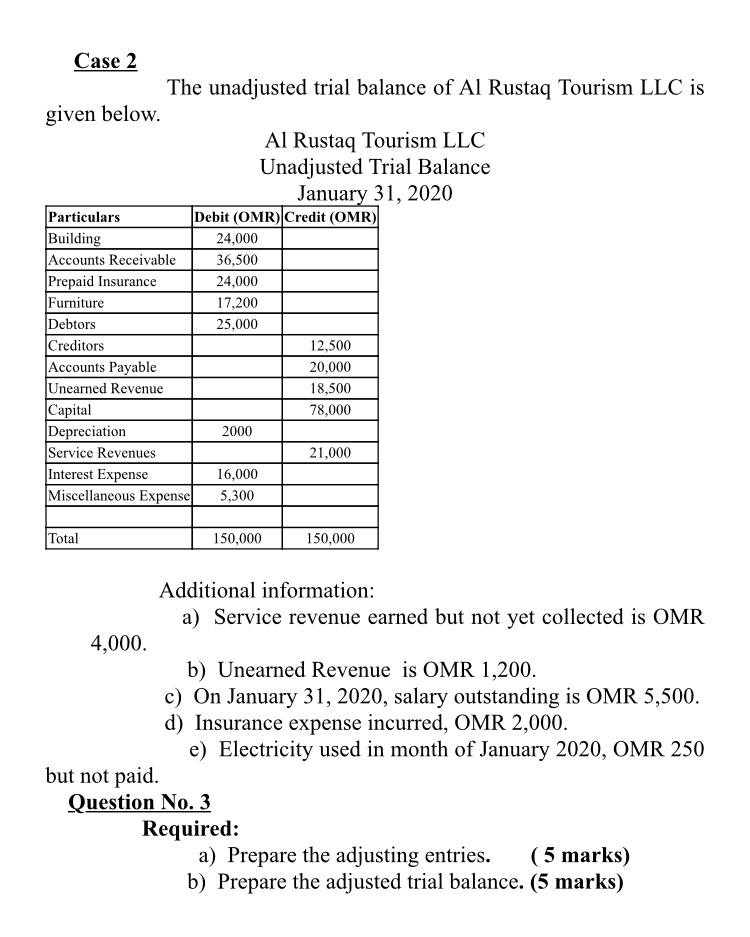

Case 2 The unadjusted trial balance of Al Rustaq Tourism LLC is given below. Case 2 The unadjusted trial balance of Al Rustaq Tourism LLC

Case 2 The unadjusted trial balance of Al Rustaq Tourism LLC is given below.

Case 2 The unadjusted trial balance of Al Rustaq Tourism LLC is given below. Al Rustaq Tourism LLC Unadjusted Trial Balance January 31, 2020 Particulars Debit (OMR) Credit (OMR) Building 24,000 Accounts Receivable 36,500 Prepaid Insurance 24,000 Furniture 17.200 Debtors 25,000 Creditors 12,500 Accounts Payable 20,000 Unearned Revenue 18,500 Capital 78,000 Depreciation 2000 Service Revenues 21,000 Interest Expense 16,000 Miscellaneous Expense 5,300 Total 150,000 150,000 Additional information: a) Service revenue earned but not yet collected is OMR 4,000. b) Unearned Revenue is OMR 1,200. c) On January 31, 2020, salary outstanding is OMR 5,500. d) Insurance expense incurred, OMR 2,000. e) Electricity used in month of January 2020, OMR 250 but not paid. Question No. 3 Required: a) Prepare the adjusting entries. (5 marks) b) Prepare the adjusted trial balance. (5 marks) Adjusting Entries Date Particulars L.F No Debit Credit b. ADJUSTED TRIAL BALANCE Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started