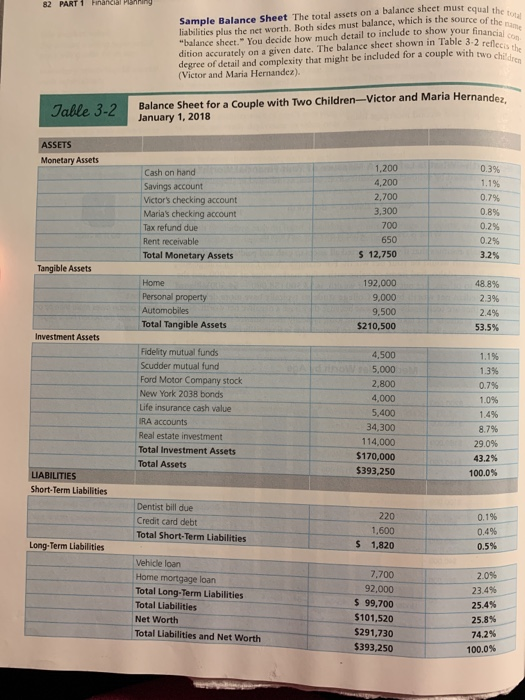

CASE 2 Victor and Maria Hernandez Victor and Maria, both in their late 30s, have two chil- dren: John, age 13, and Joseph, age 15. Victor has had a long sales career with a retail appliance store. Maria works part-time nandezes own two vehicles and their home, they have a mortgage. They will face many financial challenges go to college, and leave home and go out in the world on their own. Victor and Maria also recognize the need C to further prepare for their retirement and the challenges of aging. Victor and Maria spent some time making up their first balance sheet, which is shown in Table 3-2. Victor and Maria are a bit confused about how various financial activities can affect their net worth. as a medical records assistant. The Her- on which over the next 20 years, as their children drive, (a) Assume that their home is now appraised at $200,000 and the value of their automobile has dropped to $8,500. Calculate and characterize the effects of these changes their asset-to-debt ratio. on their net worth and on (b) If Victor and Maria take out a bank loan for $1,600 and pay off their credit card debts totaling $1,600, what effects would these changes have on their net worth? (c) If Victor and Maria sell their New York 2038 bond and put the cash into the savings account, what ef fects would this have on their net worth and liquid- ity ratio 82 PART 1 Fnancial PIaAHIng Sample Balance Sheet The total assets on a balance sheet must equal the total liabilitics plus the net worth. Both sides must balance, which is the source of the name "balance sheet." You decide how much detail to include to show your financial con dition accurately on a given date. The balance sheet shown in Table 3-2 reflecis the degree of detail and complexity that might be included for a couple with two children (Victor and Maria Hernandez) Balance Sheet for a Couple with Two Children-Victor and Maria Hernande January 1, 2018 Jable 3-2 ASSETS Monetary Assets 1,200 0.3% Cash on hand 4,200 1.1% Savings account Victor's checking account 2,700 0.7% 0.8 % 3,300 Maria's checking account 700 0.2% Tax refund due Rent receivable Total Monetary Assets 650 0.2% S 12,750 3.2 % Tangible Assets Home 192,000 48.8% Personal property Automobiles 9,000 2.3% 9,500 2.4% Total Tangible Assets $210,500 53.5% Investment Assets Fidelity mutual funds 4,500 1.1% Scudder mutual fund 5,000 1.3% Ford Motor Company stock 2,800 0.7 % New York 2038 bonds 4,000 1.0% Life insurance cash value 5,400 1.4% IRA accounts 34,300 8.7% Real estate investment 114,000 29.0% Total Investment Assets $170,000 43.2% Total Assets $393,250 100.0% LIABILITIES Short-Term Liabilities Dentist bill due 220 0.1%6 Credit card debt 1,600 0.4% Total Short-Term Liabilities $ 1,820 Long-Term Liabilities 0.5% Vehicle loan 7,700 Home mortgage loan Total Long-Term Liabilities Total Liabilities 2.0% 92,000 23.4 % $ 99,700 25.4% $101,520 Net Worth 25.8 % Total Liabilities and Net Worth $291,730 74.2% $393,250 100.0%