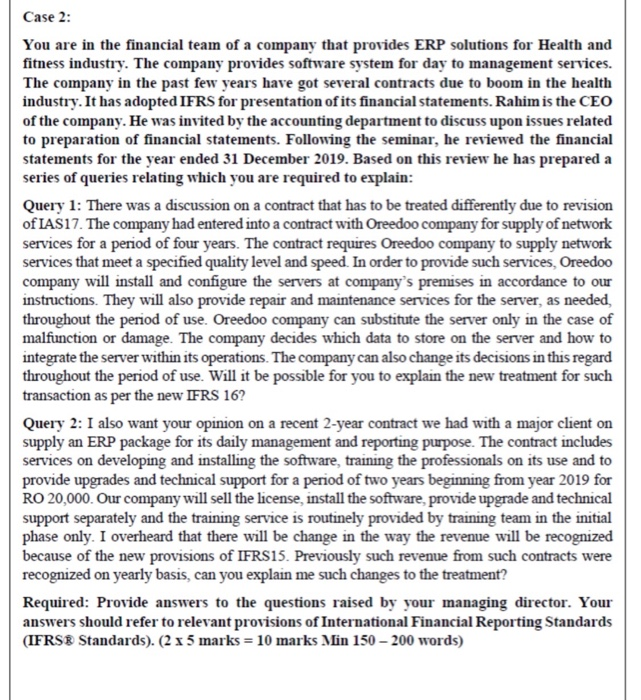

Case 2: You are in the financial team of a company that provides ERP solutions for Health and fitness industry. The company provides software system for day to management services. The company in the past few years have got several contracts due to boom in the health industry. It has adopted IFRS for presentation of its financial statements. Rahim is the CEO of the company. He was invited by the accounting department to discuss upon issues related to preparation of financial statements. Following the seminar, he reviewed the financial statements for the year ended 31 December 2019. Based on this review he has prepared a series of queries relating which you are required to explain: Query 1: There was a discussion on a contract that has to be treated differently due to revision of IAS17. The company had entered into a contract with Oreedoo company for supply of network services for a period of four years. The contract requires Oreedoo company to supply network services that meet a specified quality level and speed. In order to provide such services, Oreedoo company will install and configure the servers at company's premises in accordance to our instructions. They will also provide repair and maintenance services for the server, as needed, throughout the period of use. Oreedoo company can substitute the server only in the case of malfunction or damage. The company decides which data to store on the server and how to integrate the server within its operations. The company can also change its decisions in this regard throughout the period of use. Will it be possible for you to explain the new treatment for such transaction as per the new IFRS 16? Query 2: I also want your opinion on a recent 2-year contract we had with a major client on supply an ERP package for its daily management and reporting purpose. The contract includes services on developing and installing the software, training the professionals on its use and to provide upgrades and technical support for a period of two years beginning from year 2019 for RO 20,000. Our company will sell the license, install the software provide upgrade and technical support separately and the training service is routinely provided by training team in the initial phase only. I overheard that there will be change in the way the revenue will be recognized because of the new provisions of IFRS15. Previously such revenue from such contracts were recognized on yearly basis, can you explain me such changes to the treatment? Required: Provide answers to the questions raised by your managing director. Your answers should refer to relevant provisions of International Financial Reporting Standards (IFRS Standards). (2 x 5 marks = 10 marks Min 150 - 200 words) Case 2: You are in the financial team of a company that provides ERP solutions for Health and fitness industry. The company provides software system for day to management services. The company in the past few years have got several contracts due to boom in the health industry. It has adopted IFRS for presentation of its financial statements. Rahim is the CEO of the company. He was invited by the accounting department to discuss upon issues related to preparation of financial statements. Following the seminar, he reviewed the financial statements for the year ended 31 December 2019. Based on this review he has prepared a series of queries relating which you are required to explain: Query 1: There was a discussion on a contract that has to be treated differently due to revision of IAS17. The company had entered into a contract with Oreedoo company for supply of network services for a period of four years. The contract requires Oreedoo company to supply network services that meet a specified quality level and speed. In order to provide such services, Oreedoo company will install and configure the servers at company's premises in accordance to our instructions. They will also provide repair and maintenance services for the server, as needed, throughout the period of use. Oreedoo company can substitute the server only in the case of malfunction or damage. The company decides which data to store on the server and how to integrate the server within its operations. The company can also change its decisions in this regard throughout the period of use. Will it be possible for you to explain the new treatment for such transaction as per the new IFRS 16? Query 2: I also want your opinion on a recent 2-year contract we had with a major client on supply an ERP package for its daily management and reporting purpose. The contract includes services on developing and installing the software, training the professionals on its use and to provide upgrades and technical support for a period of two years beginning from year 2019 for RO 20,000. Our company will sell the license, install the software provide upgrade and technical support separately and the training service is routinely provided by training team in the initial phase only. I overheard that there will be change in the way the revenue will be recognized because of the new provisions of IFRS15. Previously such revenue from such contracts were recognized on yearly basis, can you explain me such changes to the treatment? Required: Provide answers to the questions raised by your managing director. Your answers should refer to relevant provisions of International Financial Reporting Standards (IFRS Standards). (2 x 5 marks = 10 marks Min 150 - 200 words)