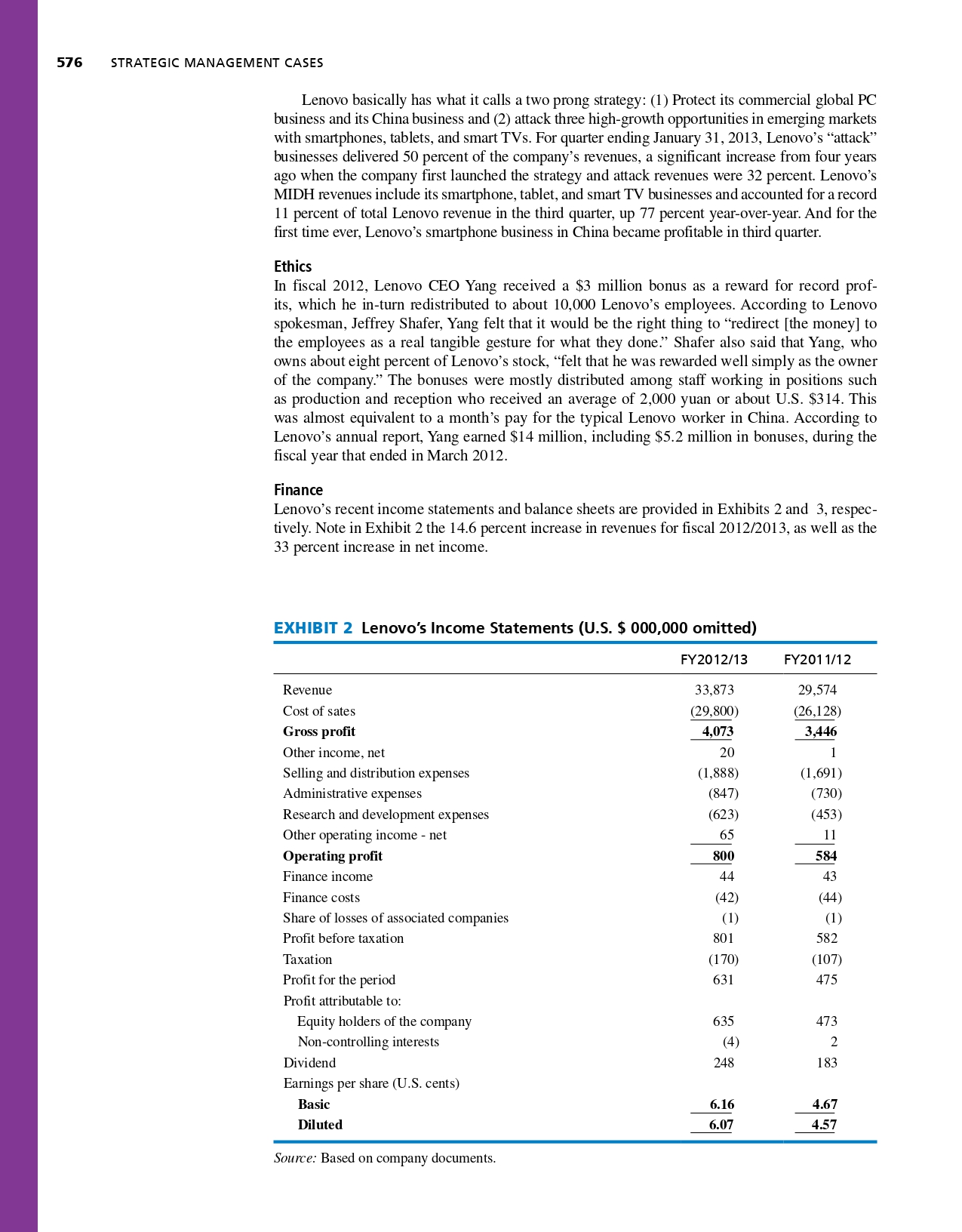

CASE 20 . LENOVO GROUP LIMITED, 2013 575 new geographic based structure became effective in April 2012 with the creation of new report- ing business units as follows: (1) China, (2) Asia-Pacific/Latin America (APLA), (3) Europe- Middle East-Africa (EMEA), and (4) North America. The new geographical structure, according to Lenovo, enables the firm to stay as close to its customers as possible. Strategy Lenovo is still primarily a PC company, but demand for PCs is falling; however, demand for smartphones is rapidly growing, so Lenovo is shifting gears. In smartphones, Lenovo is compet- ing with Chinese rivals, such as Huawei Technologies Co Lid. and ZTE Corp., that are already among the top-five smartphone companies globally. Although the second-biggest smartphone vendor in China, Lenovo has begun selling smartphones in Russia, Indonesia, the Philippines, and Vietnam, but the company faces stiff competition globally from Samsung Electronics Co. Ltd. and Apple Inc. Lenovo's manufacturing operations are a departure from the usual industry practice of out- sourcing to contract manufacturers. Lenovo instead focuses on vertical integration to avoid ex- cessive reliance on suppliers and to keep down costs. Speaking on this topic, Yuanqing said, "Selling PCs is like selling fresh fruit. The speed of innovation is very fast, so you must know how to keep up with the pace, control inventory, to match supply with demand and handle very fast turnover." Lenovo benefited from its vertical integration after flooding affected hard-drive manufacturers in Thailand in 2011 because the company could continue manufacturing opera- tions by shifting production toward products for which hard drives were still available. Lenovo began to accentuate vertical integration after a meeting in 2009 in which Yuanqing, and the head of Lenovo's supply chain, analyzed the costs versus the benefits of in-house manu- facturing and decided to make at least 50 percent of Lenovo's manufacturing in-house. Lenovo Chief Technology Officer George He said that vertical integration has an important role in prod- uct development. He stated, "If you look at the industry trends, most innovations for PCs, smart- phones, tablets and smart TVs are related to innovation of key components-display, battery and storage. Differentiation of key parts is so important. So we started investing more ... and work- ng very closely with key parts suppliers." Lenovo has partially moved production of its Think Pad line of computers to Japan. ThinkPads are produced by NEC in Yamagata Prefecture. Akaemi Watanabe, president of Lenovo Japan, said, "As a Japanese, I am glad to see the return to domestic production and the goal is to real- ize full-scale production as this will improve our image and make the products more acceptable o Japanese customers." Lenovo recently started manufacturing computers in Whitsett, North Carolina. For Lenovo's third quarter of 2012 that ending December 2012, the company reported a quarterly profit of $200.0 million, up 30 percent from a year previously. That amount exceeded its previous record of $163 million, on strong sales of smartphones and tablet computers. For the third quarter, Lenovo's revenue grew 12 percent from a year previously to $9.4 billion, but the bulk of that still came from its PC business. Lenovo shipped 9.4 million smartphones in the third quarter, all but about 400,000 of them however in China. CEO Yang says "the smartphone business outside China is 'still in the first stage' and Lenovo needs to invest to gain market share before focusing on profitability." The company's third-quarter revenues in the bigger but slower- growing PC market rose 7 percent to $7.9 billion. Lenovo's global market share in PC's increased to 15.9 percent in the third quarter, trailing HP's 17.0 percent, but well ahead of both Dell and Acer. Lenovo's 15.9 percent was the aver- age of their 1 1.1 percent market share in EMEA, 9 percent in North America, and 36.7 percent in China. Lenovo has rapidly gained market share in the PC sector and in early 2013 trails HP only by a slim margin in PC shipments. However, as PC demand growth slows, Lenovo has been diversifying into the mobile device sector to tap robust demand for smartphones and tablets, par- ticularly at home in China, the world's biggest market for mobile phones and PCs. About a one-tenth of Lenovo's third-quarter revenues in 2012 came from its mobile Internet and digital home (MIDH) business-mainly consisting of its smartphone sales in China, which jumped 77 percent to $998 million, although that was only 11 percent of total revenue. The com- pany's third-quarter shipments of media tablets rose 77 percent to 800,000 units. MIDH now con- tributes 1 1 percent of Lenovo's overall revenue. At the end of the third quarter in 2012, Lenovo is number-three worldwide in Smart Connected Devices (PC's, tablets, and smartphones).576 STRATEGIC MANAGEMENT CASES Lenovo basically has what it calls a two prong strategy: (1) Protect its commercial global PC business and its China business and (2) attack three high-growth opportunities in emerging markets with smartphones, tablets, and smart TVs. For quarter ending January 31, 2013, Lenovo's \"attack\" businesses delivered 50 percent of the company's revenues, a signicant increase from four years ago when the company first launched the strategy and attack revenues were 32 percent. Lenovo's MJDH revenues include its smartphone, tablet, and smart TV businesses and accounted for a record 11 percent of total Lenovo revenue in the third quarter, up 77 percent year-over-year. And for the rst time ever, Lenovo's smartphone business in China became protable in third quarter. Ethics In fiscal 2012, Lenovo CEO Yang received a $3 million bonus as a reward for record prof- its, which he in-turn redistributed to about 10,000 Lenovo's employees. According to Lenovo spokesman, Jeffrey Shafer, Yang felt that it would be the right thing to \"redirect [the money] to the employees as a real tangible gesture for what they done.\" Shafer also said that Yang, who owns about eight percent of Lenovo's stock, \"felt that he was rewarded well simply as the owner of the company.\" The bonuses were mostly distributed among staff working in positions such as production and reception who received an average of 2,000 yuan or about U.S. $314. This was almost equivalent to a month's pay for the typical Lenovo worker in China. According to Lenovo's annual report, Yang earned $14 million, including $5.2 million in bonuses, during the scal year that ended in March 2012. Finance Lenovo's recent income statements and balance sheets are provided in Exhibits 2 and 3, respec- tively. Note in Exhibit 2 the 14.6 percent increase in revenues for scal 2012f2013, as well as the 33 percent increase in net income. EXHIBIT 2 Lenovo's Income Statements (U.S. 5 000.000 omitted) FYZOIZIIE FY2011112 Revenue 3 3,873 29,574 Cost of sates (29,800) M) Gm prot 4,073 Other income, net 20 1 Selling and distribution expenses (1,888) (1 ,691) Administrative expenses (34?) (730) Research and development expenses (623) (453) Other operating income 7 net 65 1] Operating prot 800 $4 Finance income 44 43 Finance costs (42) (44) Share of losses of associated companies (1) (1) Prot before taxation 801 582 Taxation (170) [107) Prot for the period 631 475 Prot attributable to: Equity holders of the company 635 473 Noncontrolling interests (4) 2 Dividend 248 1 83 Earnings per share (U.S. cents) Basic 6.16 j Diluted 6.0? Source: Based on company documents